Dividend-paying stocks beat non-dividend payers in terms of total return over many years. Among the stocks that pay dividends, it is even better to go with stocks that not only pay dividends but also increase them year after year consistently. Slow and steady rise in dividends compounds the return especially when a stocks is owned for years or decades. I written many articles in the past on the importance of dividends for success in equity investing. Below are some of those posts:

- How Much Dividends Contribute to S&P 500’s Total Return

- On The Importance Of Dividend Growth To Long-Term Returns

- How Much Dividends Contribute To Stock Returns Over The Long Run?

- Multiple Expansion or Dividend Growth: Which is the Main Driver of Long-Term Equity Returns ?

- When the Dividend Grows the Stock Price Follows: A Case Study

- Dividend Growers Beat Dividend Payers And Non-Dividend Payers Over The Long Term

- Why Foreign Stocks May Be Better For A Dividend Growth Strategy Than US Stocks

- Contribution of Dividends to Total Return in S&P 500 1990-2015

- Dividend Payers and Growers Outperform “the Market”

- Dividends: How Much Do They Contribute to Total Returns ?

That said, a recent article in The Wall Street Journal noted that dividend stocks may have their moment of glory again. From the article:

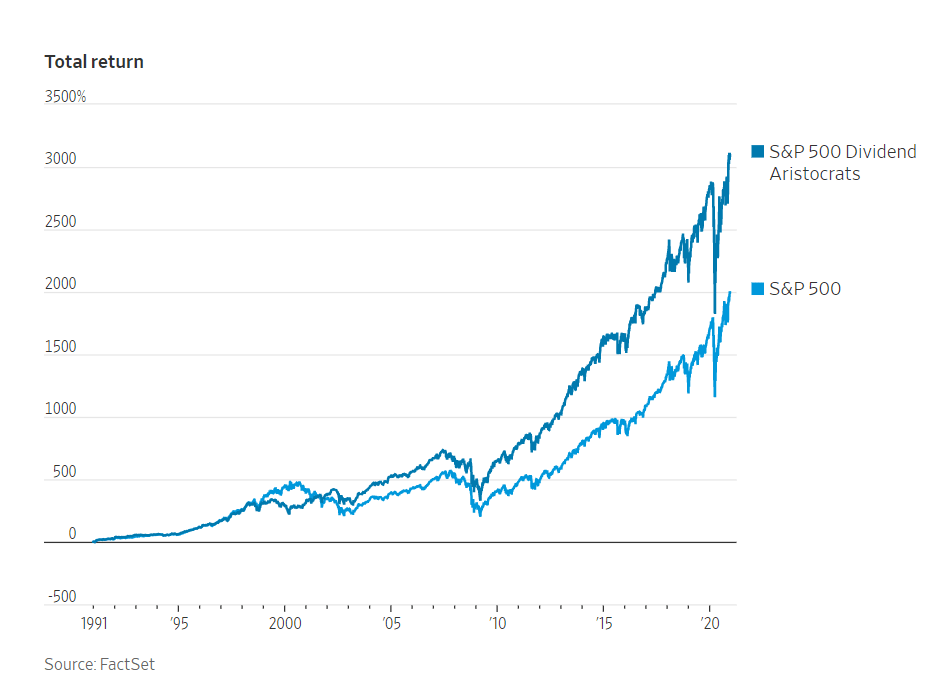

Yet for something that theoretically shouldn’t matter, dividend-paying stocks have done swimmingly. The key seems to be focusing on those with high but sustainable payouts. Slicing large U.S. companies into quintiles by dividend yield found that the second-highest-yielding group beat the market most consistently each year over many decades. Measured from 1928 through 2019, a basket of dividend payers in that quintile saw a $1 investment turn into $25,395, according to Dartmouth College professor Kenneth French. A basket of nonpayers would have been worth just $2,139.

That result is all the more remarkable because dividends were a relatively small part of investors’ returns during the market’s most-rewarding decades. In the 1990s and 2010s they produced 16% and 17% of the S&P 500’s return, according to data from Morningstar and Hartford Funds. But they more than made up for it during less-exciting periods like the 1940s and 1970s, when they made up 67% and 73% of the return, respectively.

Part of the answer for why dividends mattered is that reinvesting them during those bleak times paid off—easier said than done when investors get discouraged. But another is what sort of company pays them in the first place. A dividend payer is more likely to be a value stock. In June, the average price-to-book ratio of Dividend Aristocrats such as AbbVie, ABBV -2.01% 3M MMM -0.54% and Colgate-Palmolive, CL -0.58% with at least a quarter century of rising payouts, was less than half that of the S&P Growth Index, according to ProShares. Value is out of fashion now, like it was in the 1990s and other bullish periods, but cheap stocks shine when the party ends. The same might not be true for companies that mostly reward shareholders through buybacks since they are much quicker to slash them just as stocks plunge.

Source: Dividends Will Have Their Day Again, WSJ

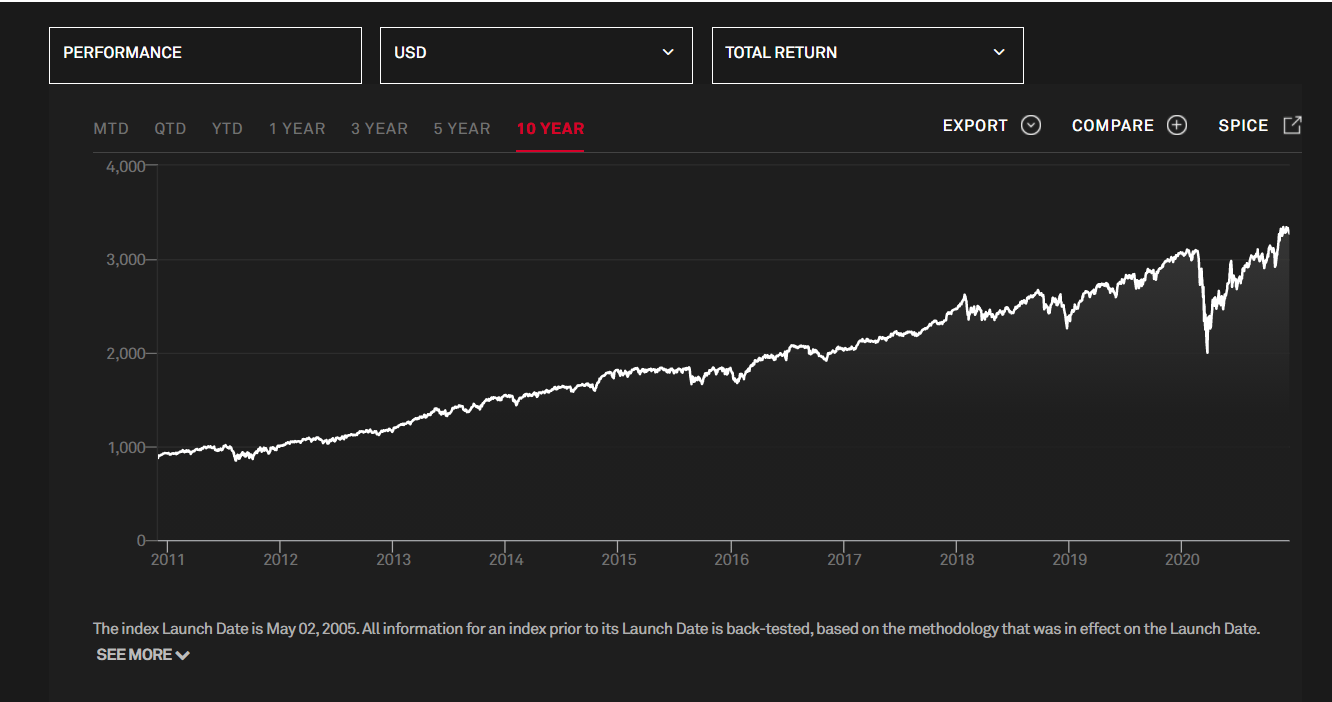

The importance of dividends cannot be understated as evidenced by the stats mentioned in the article above. The following chart shows the nice growth of the S&P 500 Dividend Aristocrats Index in the past 10 years:

Click to enlarge

Source: S&P Global

Ten constituents of the S&P 500 Dividend Aristocrats Index are listed below:

- Colgate-Palmolive Co (CL)

- Johnson & Johnson (JNJ)

- Chevron Corp (CVX)

- Emerson Electric Co (EMR)

- Raytheon Technologies Corporation (RTX)

- General Dynamics Corp (GD)

- Caterpillar Inc (CAT)

- AT&T Inc (T)

- T. Rowe Price Group Inc (TROW)

- Abbott Laboratories(ABT)

Disclosure: No Positions