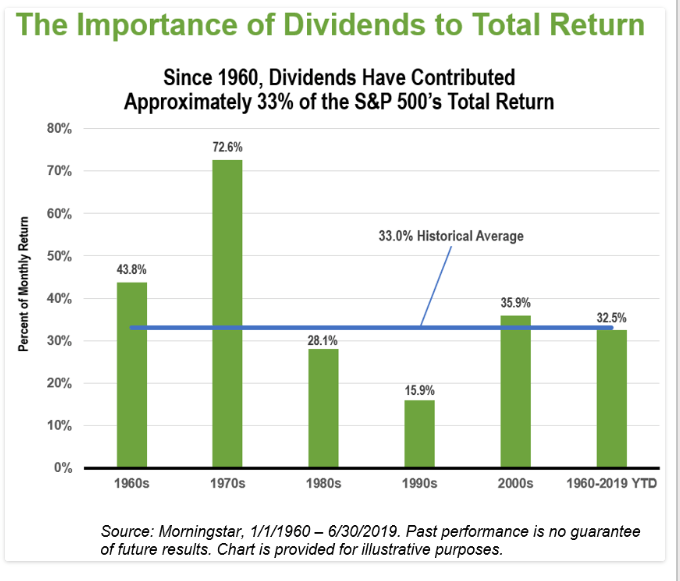

The importance of dividends to a well-diversified portfolio cannot be understated. In fact, dividends account for a significant portion of the overall total return of the S&P over the long term. Though the current yield on the S&P is around 2%, the power of compounding and divided growth over time leads to a higher contribution to the total return.

According to an article at S&P by Kieran Kirwan dividends accounted for 33% of the total return of S&P 500 since 1960 as shown in the chart below:

Click to enlarge

Source: The Rising Importance of Dividends When Earnings Slow, S&P

The contribution of dividends to total return varies over different periods. For instance, during the 1970s dividends amounted to nearly 73% of the total return but during the dot com era of the 1990s it declined to 16%.

Key Takeaway:

Investors should not ignore dividends even if they are low such as the current 2% or so. Unlike price appreciation, dividends are usually stable and predictable for well established firms and many of them also increase dividend payments year after year. So investors can identify and own some of these dividend paying and dividend growing leaders.

You may also like:

- Dividends: How Much Do They Contribute to Total Returns ?

- Why Dividend Reinvestment is Important Even When the Yield is Low

- How Much Did Dividends Contribute To Australian Stocks’ Total Return Since 1900

- On The Importance of Dividends in the Long-Term Returns of Canadian Stocks

- Dividend Payers and Growers Outperform over the Long-Term

- Comparing the Contribution of Dividends and Share Price Gains to Total Returns Across Regions

- Contribution of Dividends to Total Return in S&P 500 1990-2015

- Dividend Contribution to Total Returns: A Look at Three Regions

- Australian Stocks: Dividend Contribution to Total Returns Since 1900

- Why Foreign Stocks May Be Better For A Dividend Growth Strategy Than US Stocks

- Dividend Yield, Dividend Growth and Multiple Expansion of Select Developed Countries

- Multiple Expansion or Dividend Growth: Which is the Main Driver of Long-Term Equity Returns ?

- On The Importance Of Dividend Growth To Long-Term Returns

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

- iShares Select Dividend ETF (DVY)

- Vanguard High Dividend Yield ETF (VYM)

- Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions