One of the investment strategies followed by some investors is the Dividend Growth Investment (DGI) strategy. With this philosophy, they identify and own stocks that consistently not pay dividends but also increase their dividend payouts every year. Hence a rising dividend payments received year after year would compound the overall returns of a portfolio when those dividends are reinvested.

Some DGI investors may own stocks that are called as the S&P Dividend Aristocrats. The companies in the S&P 500® Dividend Aristocrats Index can be considered as the blue-chips of dividend stocks in the US equity market. These Aristocrats are selected from the 500 constituents of the benchmark S&P 500 Index. In order for an S&P 500 company to be designated an aristocrat, it must have increased dividends every year for the last 25 consecutive years. Increasing dividends every years for such a long period of time is not easy for most companies. So only 50 companies out of 500 have the enviable title of a Dividend Aristocrat.

The 50 S&P Dividend Aristocrats are listed in the table below:

Source: S&P

Download: The complete list of the 50 S&P Dividend Aristocrats (in Excel format)

The above list includes popular names like Exxon Mobil Corp (XOM), Procter & Gamble Co (PG) and Johnson & Johnson (JNJ), etc. but also lesser-known names like Cincinnati Financial Corporation(CINF), Dover Corp (DOV) and Ecolab Inc (ECL).

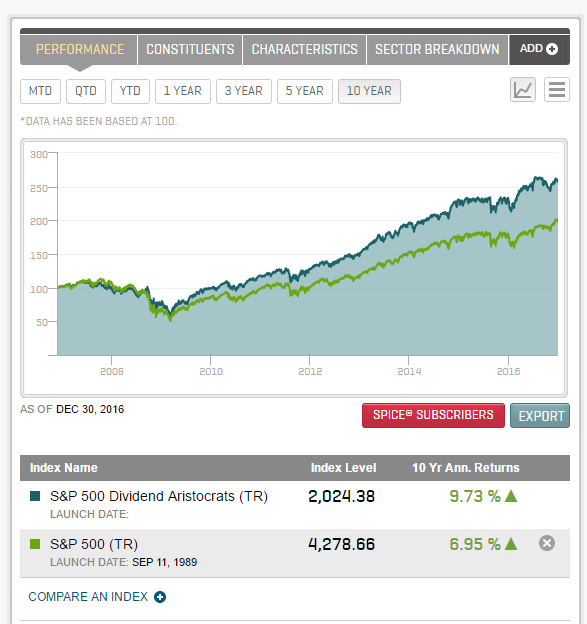

In terms of total-returns Dividend Aristocrats easily beat the overall S&P 500 Index in the 5 and 10 year periods as shown in the charts below.

S&P 500 Dividend Aristocrats vs S&P 500 Returns in 5 Years:

Click to enlarge

S&P 500 Dividend Aristocrats vs S&P 500 Returns in 10 Years:

Source: S&P

While the difference in returns between the aristocrats and S&P 500 is small over 5 years, the difference at 2.78% over the 10 year period is significant.

Though investors can earn higher returns with the aristocrats. one study suggests that DGI investors may be able to earn much higher returns with foreign stocks. From the study:

A dividend growth strategy could potentially work even better overseas than in the U.S. Our research shows that foreign dividend-paying stocks generally offer higher yields, higher dividend growth, and outperformance in the long run.

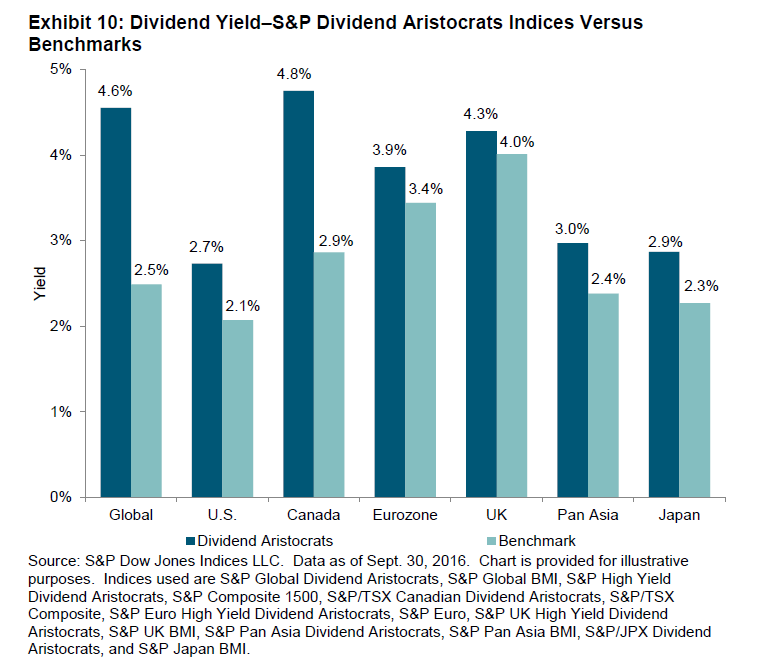

Yield

Market participants that are willing to accept the potential risk associated with investing in international equities could find higher dividend yields outside the U.S. As Exhibit 10 illustrates, the yields in Pan Asia and Japan were slightly higher than in the U.S., while the yields in the UK and eurozone were almost twice as high as in the U.S.The yield spreads between the Dividend Aristocrats strategies and the broad market benchmarks range from 25 bps to 70 bps for the U.S., eurozone, UK, Pan Asia, and Japan. The spreads are higher for global markets and Canada, at 2.1% and 1.9%, respectively. For the S&P/TSX Canadian Dividend Aristocrats, this may be due to the five-year hurdle, a less stringent requirement than other regions. For the S&P Global Dividend Aristocrats, this is mainly due to a country allocation that is driven by yield and deviates from market cap. The index significantly underweights the U.S. and overweights Canada.

Source: A Case for Dividend Growth Strategies, S&P Global

Compared to the current yield of 2.7% for S&P Dividend Aristocrats, other aristocrats of markets offer substantially higher yields. For example, Canadian aristocrats offer 4.8% and the UK aristocrats offer 4.3%. The overall Global aristocrats have a yield of 4.6% which is 2.1% higher than the yield of their US peers.

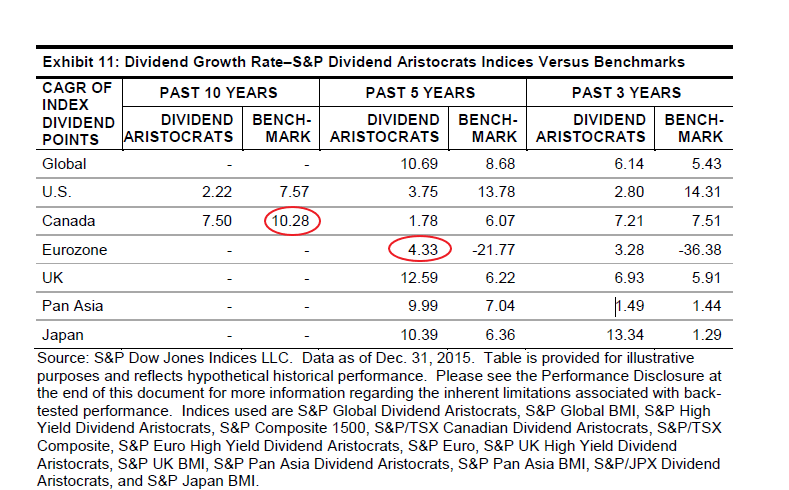

Foreign aristocrats not only have higher yields but also higher dividend growth rates which is more important for the compounding effect. From the above study:

DPS Growth Rate

The S&P High Yield Dividend Aristocrats had a dividend growth rate of 2.22% and 3.75% per year over the past 10 and 5 years, respectively. In international markets, the growth rates were much higher, especially in the UK, Pan Asia, and Japan (see Exhibit 11).

So a dividend strategy may work better with foreign stocks than US stocks. However there are some caveats which investors should be aware of. These include:

- For US investors, dividend withholding taxes on foreign stocks can take a chunk of the yields. Some countries such as Switzerland have high withholding tax rates.

- Many foreign firms pay dividends not quarterly but only once or twice per year.

- In addition to taxes, ADR fees may be deducted from dividend payments further reducing the net amounts received by an investor.

Despite these disadvantages, DGI investors may want to consider owing foreign dividend aristocrats for the following reasons:

- The base dividend yields of some foreign markets are much higher than that of the US S&P 500.

- Dividend growth rate over the years may also be higher in some markets. Even when the rate is lower sometimes, the high base dividend yield will more than compensate and can lead out-performance of US peers.

- While dividend withholding taxes are a pain, there are countries that do not charge this taxes to Americans. For example, Canada does not charge this tax on Canadian stocks held in qualified retirement accounts such as 401K. Other countries like Singapore have no withholding taxes at all.

Disclosure: No Positions