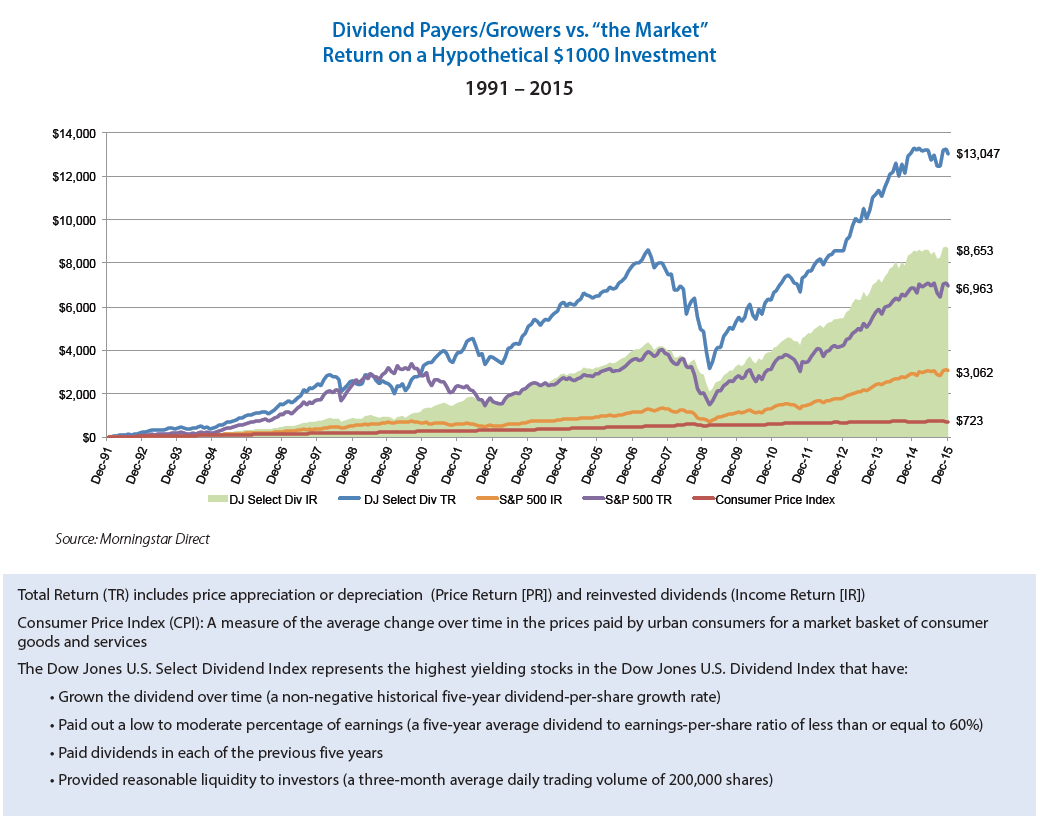

Dividend paying/growing stocks generally outperform non-dividend paying stocks. When dividends are reinvested the compounding effect gives a boost to the overall total return of an equity investment. This effect becomes especially strong over long time periods for obvious reasons. Stocks that not only pay dividends but also grow their dividends consistently year after year tend to yield the highest total return relative to just dividend payers and non-payers.

The following chart shows the dramatic difference in returns between Dividend Payers/Growers vs.“the Market”:

Click to enlarge

Source: Investing for Dividend Growth, Touchstone Investments

From the research report:

As companies become more profitable, they may share more by increasing their dividends. The chart below illustrates a hypothetical

example of dividend payers or growers based on a simulation of the S&P 500 Index. This select group of dividend payers and growers

has outpaced the hypothetical $1,000 investment in the S&P 500 Index on a total return basis by more than a two-to-one margin over

the past 24 years. In fact, the compounded growth of reinvested dividends of this hypothetical model of the Index has exceeded the total

return of the S&P 500 Index (and far outperformed the growth of reinvested S&P 500 Index dividends).

Related ETFs:

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard High Dividend Yield ETF (VYM)

Disclosure: No Positions