Generally most investors aim achieve their long-term goal with equity investing with capital appreciation of their holdings. Only some of the investors pay attention to dividend yield and dividend growth in the long-term. While there are many reasons for this situation, one of the main factor is that growth stocks tned to have solid and strong growth over many years and their yields tend to be low Similarly value stocks tend to have low growth.

Contrary to populate belief, dividend yield and growth have played a major role in total annual returns over the past 15 years than price appreciation. In a recent article, Mark Whitehead at Legg Mason discussed the importance of dividends in total returns.

From the above article:

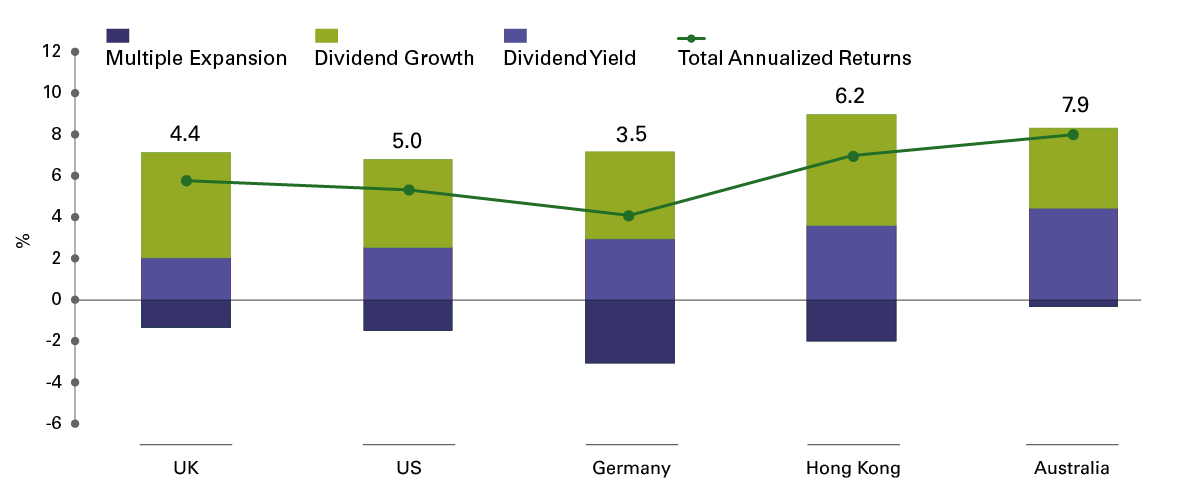

Equities are intimately associated with capital appreciation, but this overlooks the fact that income is the main driver of long-term returns. Indeed, as Chart 2 shows the multiple-expansion component has actually been a detractor of returns over the past 15 years, with the dividend yield and dividend growth doing all the pulling – an observation that applies across markets. Not to forget the fulcrum that is compounding. Dividends reinvested can materially boost returns over time, thanks to some very simple – but often ignored – arithmetic.

The risk in a yield-starved environment such as the current one is that investors start moving along the quality curve in a desperate hunt for income. Rarely is this wise. Higher-quality dividend payers can provide better risk-adjusted returns than both the broader equity market and bonds. A related observation is that dividend-paying stocks tend to be less volatile – typically with a lower maximum drawdown – than their non-paying counterparts, making the journey less nerve-wracking for shareholders worried about the gyrations of markets.

Click to enlarge

Source: THE CASE FOR GLOBAL EQUITY INCOME, Legg Mason

Dividend growth has contributed significantly to the overall total annual returns than tultiple expansion in all the five countries shown above. The contribution of dividends to total annual return was much higher in the UK than the US.

The key point to rememeber is that dividends play a major role in total returns and investors should not focus mostly on price gainss especially in the long run. Due to the effect of compouding and growth year after year, dividends can exceed price gains in some periods.