Dividends form an important source of return when calculating the overall total return of an equity investment. While price appreciation is not guaranteed dividends can continue to paid out by firms. Though dividends can be suspended or cut, mature high-quality companies large-cap companies do not take such actions other than in extreme circumstances. For investors looking to each a higher total return over the long run, it is important that they reinvest the dividends received instead of spending them. Compounding of reinvested dividends over many years can boost returns further.

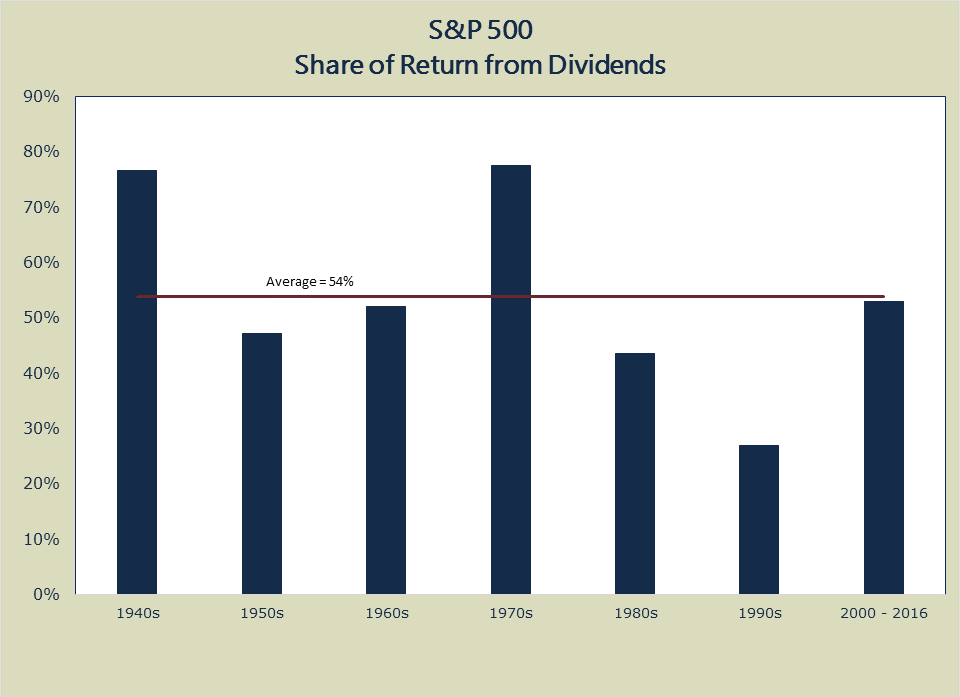

Dividends are very important even in a low dividend-paying market like the US. This is because dividends can act as a cushion during down market and yield higher overall returns and the compounding effect over the long-term. According to an article by Matthew A. Young of Richard C. Young & Co dividends accounted for about 54% of the US stock market returns since the 1940s. The following chart shows the dividend contribution to returns on the S&P by decades:

Click to enlarge

Source: Client Letter – February 2017, Richard C. Young & Co

An excerpt from the piece:

Dividends can play an especially important role when valuations are elevated (as we would argue is the case today) and appreciation potential is limited. In the first 15 years of this century, the ultra-low dividend-paying Nasdaq Composite Index didn’t gain a single point. However, an investment in high-dividend-paying stocks compounded investors’ money at 7% per year. And during the 16 years from 1965 to 1981 when the Dow delivered nothing in the way of capital gains, high-dividend-yielding stocks gained 8.1% annually.

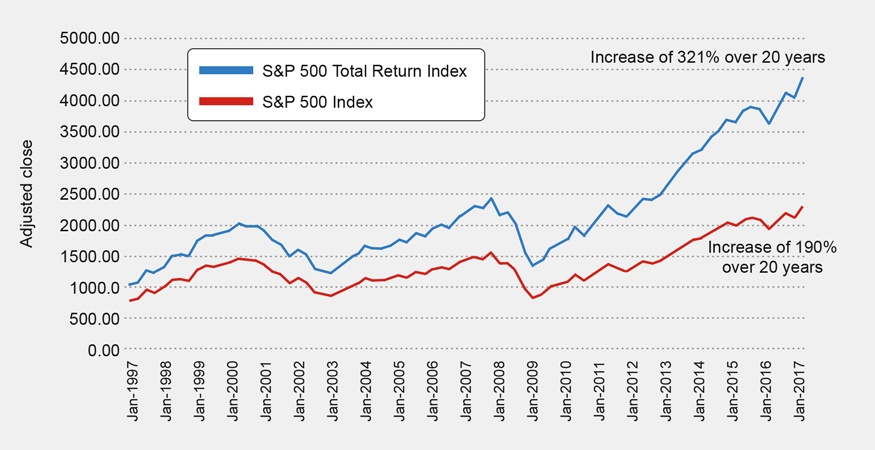

The importance of dividends cannot be overstated. While much of the media focus on the S&P Price Index, the correct index to pay attention to for most retail investors is the S&P 500 Total Return Index which includes returns with dividends reinvested. The following chart from a recent Fidelity article shows the huge gap in returns between the S&P 500 Index and the S&P 500 Total Return Index.

Click to enlarge

Source: Dividends: not just for income, Fidelity

From the article:

Consider this example: between 1997 and 2017, the price of the S&P 500® index was up about 190%, but if you look at the S&P 500 Total Return Index, which includes the reinvestment of dividends and other distributions, the index increased by 321%. That shows the power of reinvesting dividends over time. It works out to a compound annual growth rate of 7.45% compared to 5.47% for the price-only index.

Also checkout:

- Foreign S&P Dividend Aristocrats Could Produce Higher Total Returns Than Their US Peers, TFS

- Historical S&P 500 Total Returns and US Treasury Total Returns By Year, TFS

- On the Importance of Dividends to Total Returns, TFS

- Dividends Matter, Rational Advisors

- What Matters for Investors in the Long Run, MSCI

Related ETF:

Disclosure: No Positions