One of the investment theories with respect to investing in dividend stocks is that when the dividend grows year after year the stock price will appreciate as well. So identifying companies that consistently raise their dividends would generate excellent returns as the share price also grows in tandem. This is because dividends are out of profits and any firm would not increase the dividend payouts unless it earns higher profits or feels confident in the future earnings. Sometimes the stock price may not consistently follow the dividend growth pattern. However over the long run the stock price will follow the dividend growth rate. Recently I came across a good illustration of this concept by Matthew A. Young at Young Investments with a blue chip stock.

From the article titled “The Primary Reason to Save and Invest“:

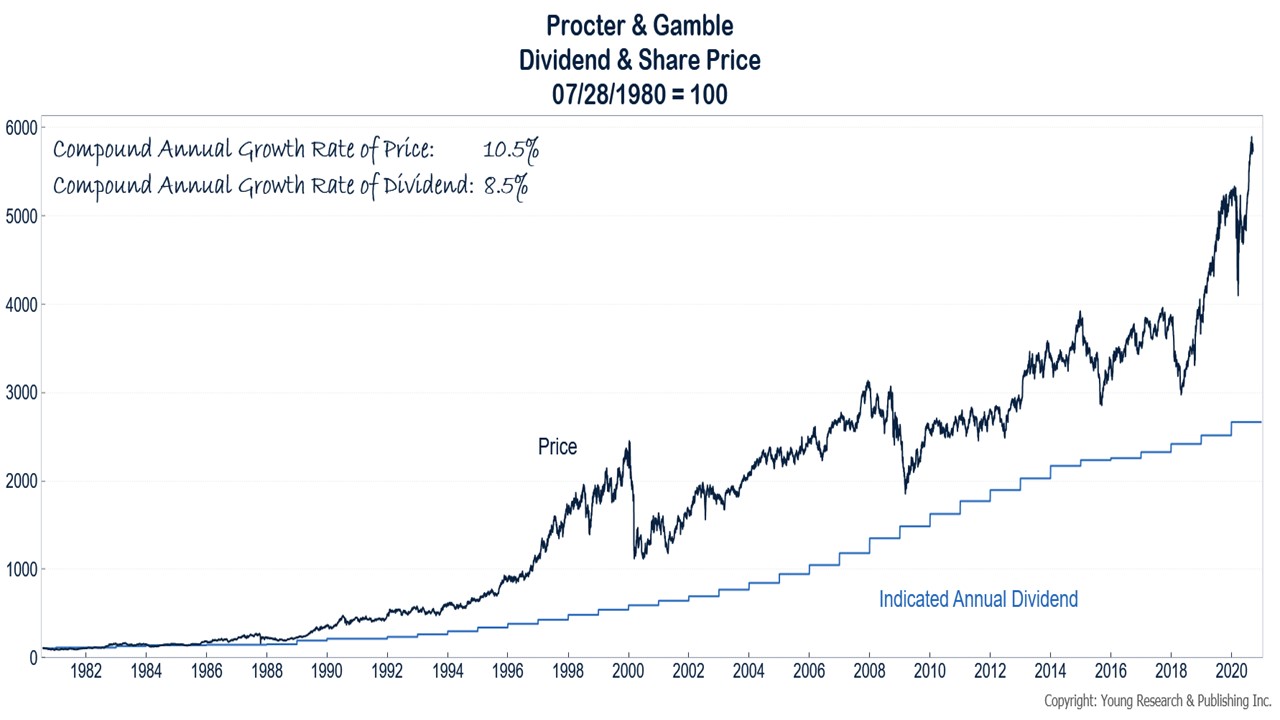

The chart shows the price of Procter & Gamble stock and the indicated annual dividend rate. Both series start in July of 1980 and are set equal to 100 on that date. Over the last 40 years, Procter & Gamble’s share price has compounded at a 10.5% annual rate, and the dividend has compounded at an 8.5% annual rate. As goes the dividend, so goes the stock price.

When you concentrate on dividend growth and stability, you don’t have to think about capital appreciation. Capital appreciation will take care of itself as long as the dividend is growing. Consider what would happen if P&G’s share price didn’t keep pace with its dividend. In July of 1980, P&G paid a dividend of about $0.12 per share. The split-adjusted price of the stock was $2.38. Today, P&G’s dividend is about $3.16 per share. If P&G was still trading at the $2.38 it traded at in July of 1980, the stock would yield over 132%. You probably have a better chance of getting struck by lightning than seeing a big blue-chip stock with strong dividend coverage, offering a yield of 132%.

Source: The Primary Reason to Save and Invest, Young Investments

Indeed when the dividend keeps rising it is almost impossible for the share price to stay flat or even go down. A similar study can be done for other blue chip stocks like certain utilities, Canadian banks, railroads, dividend aristocrats, etc.

Related Stock:

- Procter & Gamble (PG)

Disclosure: No Positions