One of the best sectors to invest for the long-term is the North American railroad sector. Railroad stocks offer many unique advantages over stocks from other sectors. For instance, the industry is dominated by a handful of companies effectively making it an oligopoly. Moreover for many shippers or locations, railroad companies are a monopoly. I have written about this industry many times over the years. Some of those posts are:

- Monopoly Madness in the U.S. Railroad Industry

- Invest in North American Railroads for 2013 and Beyond

- Why Invest in Railroad Stocks

- All Aboard The North American Railroad Stocks

- Invest in North American Railroad Stocks for the Long Term

- Long-Term Investors Can Consider Adding North American Railroad Stocks

- How the US Railroad Industry Became a Monopoly: Chart

Yesterday’s journal had interesting piece on the long-term investment case for railroads. From the article:

Since Warren Buffett’s Berkshire Hathaway BRK.B 0.21% announced in November 2009 that it would pay $44 billion including assumed debt for Burlington Northern Santa Fe, the market value of North American railroads has risen sharply. That is despite a collapse in demand for the most lucrative commodity that they hauled prior to Mr. Buffett’s deal—coal shipped to power plants—and the fact that volumes have been sluggish for about three years.

An equal-weighted basket of shares of the remaining six Class 1 North American railroads bought the day before Berkshire Hathaway announced the deal would have had a total return of 862% through Monday compared with less than 300% for the S&P 500. Kansas City Southern, including the jump following announcement of its merger with Canadian Pacific, is the best performer over that time with a more than 1,000% return.

A successful deal could bode well for other players if it unlocks further consolidation. Analyst Bascome Majors of Susquehanna Financial Group notes that more deals could follow after 2022 if the official attitude toward consolidation has improved.

But even if the deal is blocked by the Surface Transportation Board, there are reasons to like railroads. A big one is the spread of precision-scheduled railroading—a management concept that has increased efficiency and train speeds but annoyed some smaller customers. Kansas City Southern’s operating ratio, a measure of efficiency, improved to 60.7% last year from 72.8% a decade earlier. And, as concerns mount over global warming, trains are well-placed to take advantage given their far greater fuel efficiency per ton mile than trucks for intercity freight. Railroads are also an excellent hedge against rising energy prices, truck-driver shortages or worsening highway congestion. More expensive diesel often leads to an uptick in rail traffic.

Source: Railroads, Growth Stocks of the 19th Century, Are Hot Again,By By Spencer Jakab, WSJ

I agree with the author’s arguments in favor of railroads.

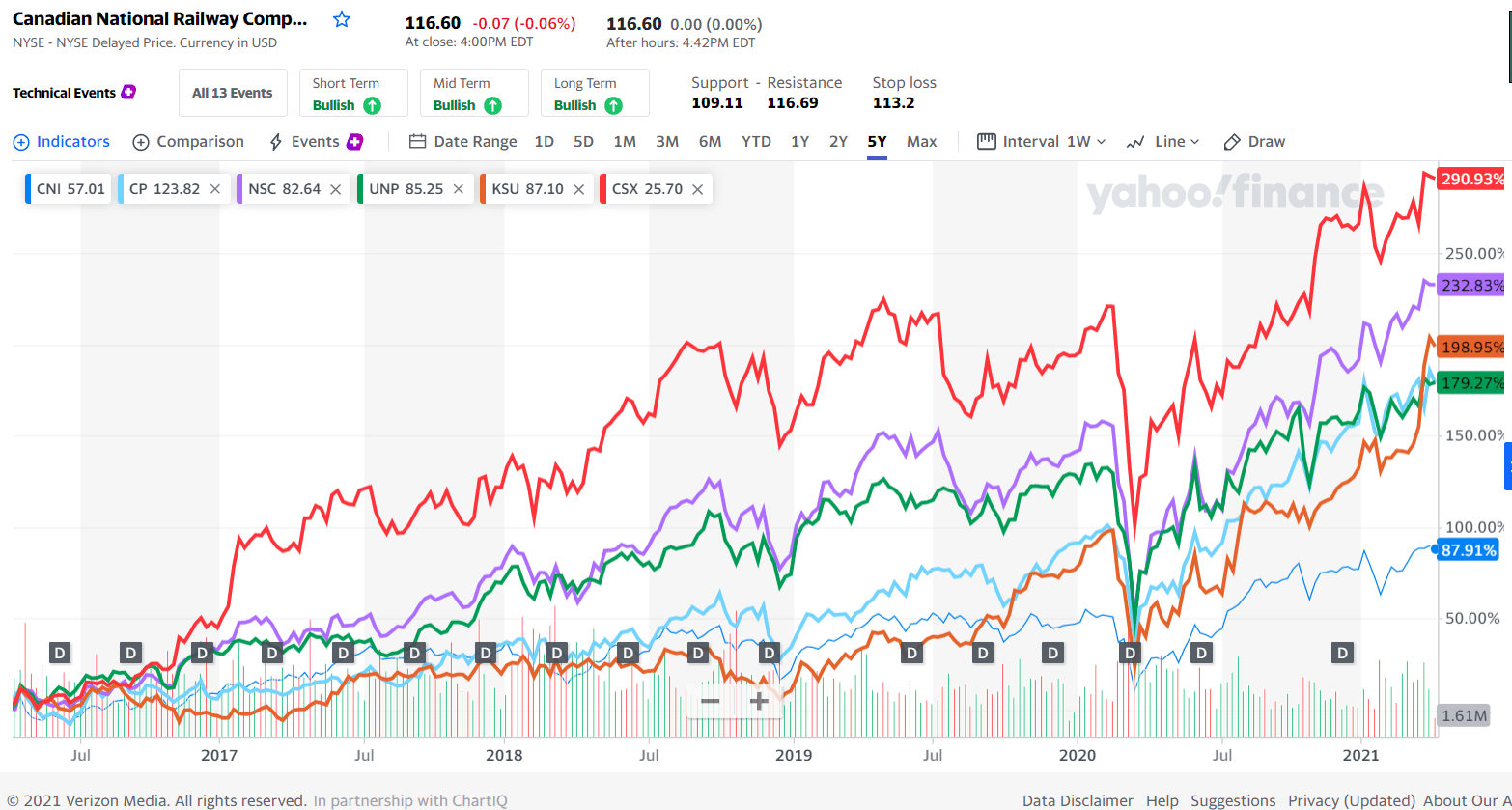

The following chart shows the price return of Class I railroads in the past 5 years:

Click to enlarge

Source: Yahoo Finance

CSX (CSX) was the best performer in the past 5 years while Canadian National (CNI) was the worst. Still CNI stock increased by nearly 88%.

From an investment perspective, investors with a horizon of 5 years or more can consider adding railroads during market dips in a phased manner.

Disclosure: Long CSX, CNI, UNP and NSC