I have written many times before that no country is the consistent winner in equity market returns every year. The winner in one year could be the loser in next and vice versa. Though US stocks have performed very well for over a decade now, their leadership could be overtaken by their foreign peers. According to an article by Jeffrey Kleintop of Charles Schwab now may be the time to invest in foreign equities. From the article:

Change in leadership

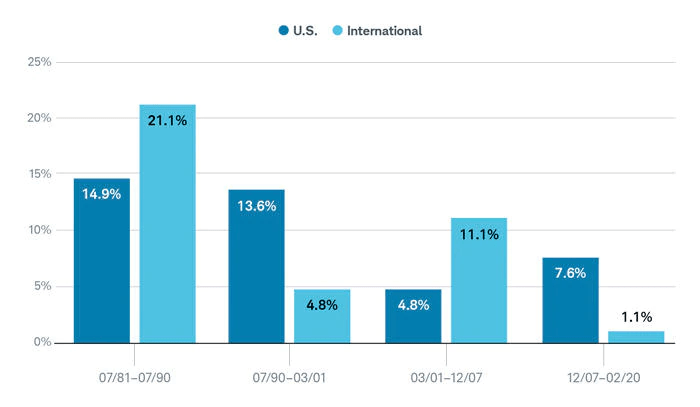

Market leadership usually switches between U.S. and international stocks at the start of a new economic cycle:

- In the 1980s, international stocks—led by Japan—outperformed the United States for most of the decade.

- In the 1990s, the dot-com economy paved the way for U.S. stock market leadership.

- In the 2000s, international markets again took the lead—until the 2008–2009 global financial crisis restored the reign of U.S. stocks (see “And the winner is …,” below).

And the winner is …

U.S. and international stocks keep trading the title of greatest annualized total returns.

Source: Charles Schwab and Bloomberg, as of 10/27/2020. Annualized total return between cycle peaks measured by MSCI USA Index and MSCI EAFE Index. Past performance is no guarantee of future results.

These changes in leadership typically are triggered by a breakdown in fundamentals, such as unsustainably high stock valuations and dwindling earnings expectations. We’re currently seeing signs of fundamental deterioration in U.S. stocks—and as a result, international stocks may again take the lead.

Source: Is It Time to Increase Your International Exposure, Schwab

Related ETFs:

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard High Dividend Yield ETF (VYM)

- SPDR Dow Jones Industrial Average ETF (DIA)

- Vanguard MSCI Emerging Markets ETF (VWO)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard Developed Markets Index Fund ETF (VEA)

Disclosure: No Positions

Related article with an opposite view:

- U.S. stocks will continue to beat the alternatives, Marketwatch