The railroad sector is one of the best sectors in the US equity market to invest in for steady and long-term growth. Railroad stocks tend to perform much better than other freight transportation stocks like those in the trucking industry for example. Trucking industry is highly fragmented and go through periods of booms and busts. Railroads on the other hand is dominated by a handful of players and offer excellent growth potential for a variety of reasons including the simple fact that they are cheaper to transport goods over long distances.

Recently I came across an article at Manning & Napier that discussed the investment case for railroads. From the article:

The Value of Precision

In our view, the pricing power characteristics and barriers to entry for railroads are essentially the same as they have always been. Railroads are extremely capital intensive, literally requiring billions of spend each year in maintenance costs. It would be nearly impossible for a new entrant to compete with existing players.

The rails also continue to raise prices at a steady clip for several reasons. First, the industry has consolidated down to 7 rails, and they each operate in different geographies as to reduce competition. There are also few substitutes for a large percentage of the cargo that they carry, and in our estimates, that figure is as high as 70%. Their ownership of their networks, small share of total shipping costs, and demonstrated recent track record of pricing power all suggest that their revenue growth trajectory remains stable.

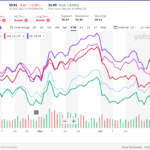

Beyond the top-line, in recent years the cash flow generation of the rails has materially improved as a result of the adoption of what is known as Precision Scheduled Railroading (PSR). PSR has become an industry standard, and it was first adopted by a US railroad in 2017 by famed CEO Hunter Harrison. The basic principles are to operate a more agile railroad with less traffic congestion, fewer equipment, and fewer employees. This is achieved by running fewer longer and heavier trains, reducing the need for as many locomotives, operators, railyards, and fuel. The result has been an evident reduction in the expense profile of the entire industry, and a material improvement in free cash flow generation.

Source: Investments that chug along, Manning & Napier

The six major railroads listed below will soon to shrink to five when KSU mergers with CP. That leaves the industry even more concentrated. Many years ago BNSF was taken over by Berkshire & Hathaway. So BNSF is no longer publicly traded.

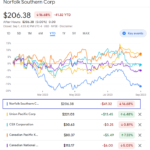

Related Stocks:

- Canadian National Railway Co (CNI)

- Canadian Pacific Railway Ltd(CP)

- CSX Corp (CSX)

- Kansas City Southern (KSU)

- Union Pacific(UNP)

- Norfolk Southern Corp(NSC)

Disclosure: Long CNI, CSX, NSC and UNP