The number of public listed companies has declined for many years now in the US. I have written many articles before on this topic. More recently last weekend I posted a blog quoting Vanguard.

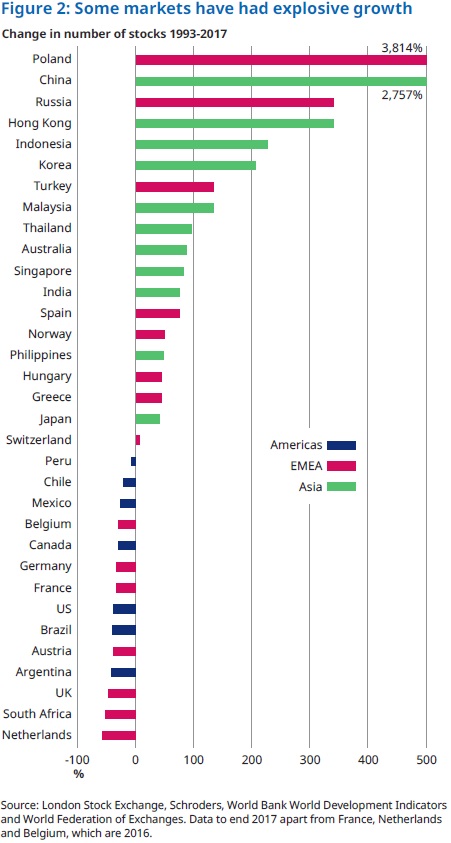

While the number of public firms has decreased in the US, some markets abroad have seen strong growth in the number of public companies. According to an article by Duncan Lamont at Schroders, some markets have seen explosive growth since 1993.

The chart below shows the Change in Number of Listed Stocks by Country 1993-2017:

Click to enlarge

Source: What is the point of the equity market?, Schroders

Emerging markets such as Poland, Russia, Indonesia, China, India, etc. have seen more companies going public in recent years.

The decline in the number of public firms is not limited to the US. Other developed countries such as the UK, Canada and Germany also have lower number of public companies now than in 1993.

Implications for investors:

I have discussed before that going abroad gives American investors more investing options. The above chart shows that foreign markets especially those in emerging countries offer many investing opportunities.