Volatility in the U.S. equity markets late last year especially in December around Christmas time was extreme to say the least. Instead of a Santa Claus rally, investors were given a lump of coal with markets taking them on a stomach-churning ride. With stocks entering the bear market territory pundits and media alike listed all kinds of reasons why the bear was wildly active. Some of the factors mentioned include:

- US government shutdown

- Political paralysis in the US

- The Federal Reserve raising interest rates

- US-China Trade War

- The Bumbling British and their Brexit Drama

- Peak Bull Market

- Oil Price Collapse

- Trump trashes Fed Chairman Powell

- Global Growth Worries

- Trump and his plan to build “The Great Wall of America” (preferably to be made of steel or concrete but not of clay or see-thru shower door glass)

- Stocks are way over-valued especially the over-hyped FAANGs

- The Treasury Secretary spoke to top bank CEOs about the market situation (who knows why he did that. Maybe he got bored sitting on the beach all-day in Cabo San Lucas, Mexico and just wanted to be a hero that saved the US and possibly the whole world from total collapse just like any other real American guy dreams of)

- …..

- and so on.

Below are some of the headlines from the month of December:

- Dow skids to end down 2.9%; S&P 500 on cusp of bear market (Marketwatch)

- Stocks Crash In Christmas Eve Bloodbath After Trump Insults Jerome Powell’s Golf Game On Twitter (Heisenberg Report)

- ‘Worst Christmas Eve’ in US stock market history as Trump takes aim at Federal Reserve amid government shutdown (The Independent)

- Stocks on track for worst December since the Great Depression (CNN)

Below is an excerpt from the above CNN piece:

The economy is strong and the jobless rate at the lowest in a generation. So what’s wrong?The view among investors is 2018 was a year of peak earnings and growth that can’t last. The sugar rush of the corporate tax cuts will fade. The trade war with China is raising costs for business. And most importantly, interest rates are rising. The Fed is widely expected to raise interest rates for a fourth time this year to keep a strong US economy from overheating.Remember, interest rates after the financial crisis a decade ago were kept at near zero to resuscitate the economy. Now that the economy is healed and strong, the Fed is raising rates back to a more neutral policy. Raising them too much or too quickly could thwart the expansion.At the same time, signs of slowing growth are popping up from China to Germany.“There’s a fear of weaker economic growth virtually everywhere, as the world emerges from quantitative easing and confronts tighter monetary policy,” says Greg Valliere, political economist at Horizon Investments. “That, in a nutshell, is the greatest concern.”

As we reflect on 2018 market performance, it is very clear that volatility returned with a vengeance. While this volatility was triggered by fundamental economic factors like rising US interest rates, global trade disputes, and concerns of a US recession in 2019, we believe that market volatility is and will continue to be greatly enhanced by the rise of machines that are conducting a good portion of the daily trading on global markets. By the “rise of the machines”, we are referring to the world of quantitative computer trading and a specific trading system within this domain called “algo-trading”.

What is Algo-trading?

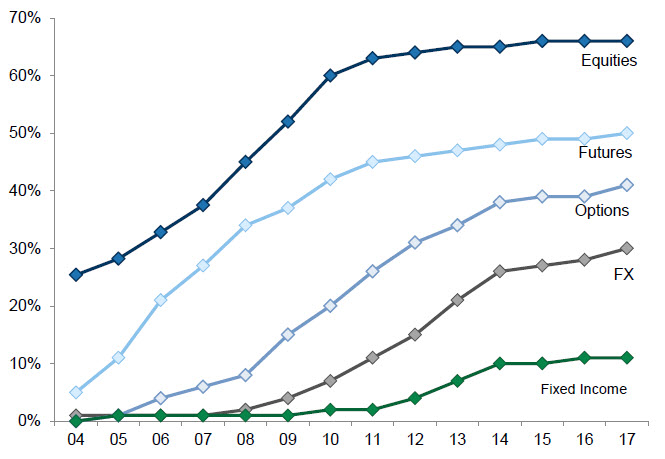

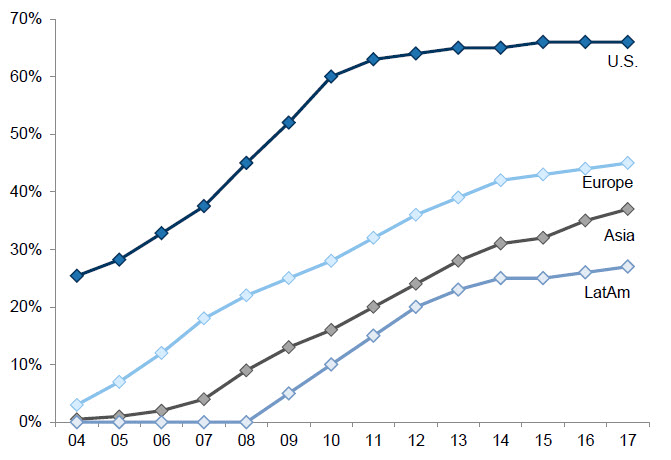

Algo-trading is the process of using super computers programmed to follow a defined set of instructions (an algorithm) for placing a trade in order to generate profits. Algo-trading has disrupted the structure of the market and now makes up a significant amount of the daily trading volume on US and Global Exchanges (Figure 1).

Figure 1: The market share of algorithmic trading has grown across asset classes and regions.

Source: Aite Group, Goldman Sachs Global Investment Research

Should investors shift money away from human investment teams to machine teams?

Although our research team is in favour of utilizing computing power and formulas for screening in the initial stages of our investment process, we firmly believe in the benefits of having a human team researching and carrying out investment decisions. Algo-trading strategies utilizing super computers process immense amounts of data, unearth patterns, and follow rules-based trading strategies with little regard to WHY markets are moving, only that they ARE moving.

Take this past Christmas as an example. The US stock market experienced the largest percentage loss ever recorded on Christmas Eve (down 2.7%) – only to experience the largest one-day percentage gain (5%) since March 23, 2009 on Boxing Day. Did economic conditions change that much between Christmas Eve and Boxing Day?

As fundamental (human) investors, we’re able to conduct deep analysis to uncover the WHY and take advantage of market volatility especially when there is a large gap between the current stock price and the underlying intrinsic value of the business. Sometimes we may be early in our investment decision or wrong, however we will utilize our research process as a guide to navigate these situations as they arise.

Source: The Rise of the Machines, McLean & Partners

So the key point to remember is volatility and more specifically violent movements in US markets are now a feature in the system and not an exception. Accordingly investors should not panic when markets decline sharply and maintain their patience and avoid making rash decision. More importantly they should also ignore all the noises emanated by the media.