Germany is the largest economy in Europe and many German firms hold leadership positions at the global level in their respective fields. So when I came across an article that was way off on German stocks, I had to clarify a few issues. Fund manager and author Sven Carlin wrote a piece titled The Case Against International Diversification: Trying To Find Good Stocks In Germany in Seeking Alpha recently. The author is incorrect on many points and few readers noted those in the comments section following the article.

Here is a summary of his article:

Due to many companies with negative earnings or high PE ratios and low growth, investing in German ETFs or index funds is not advised (especially small and mid cap).

The overvaluation of the German market is proved with companies like Zalando (PE=649) and Zooplus (PE=165) and the DAX average PE of 22.2.

Currency tailwinds aid German companies and I believe that a stronger euro would have a severe influence on their businesses.

A detailed comparison and inspection of German stocks shows that there are much better investments on the NYSE and Nasdaq.

After researching some German 447 stocks on various metrics the author came to the following conclusion:

Unfortunately not much has been found from my German research but sometimes it is good to know where not to go and not to invest. The currency tailwinds and the consequent future risks related to potential currency headwind plus the weaker fundamentals put me off from investing in Germany.

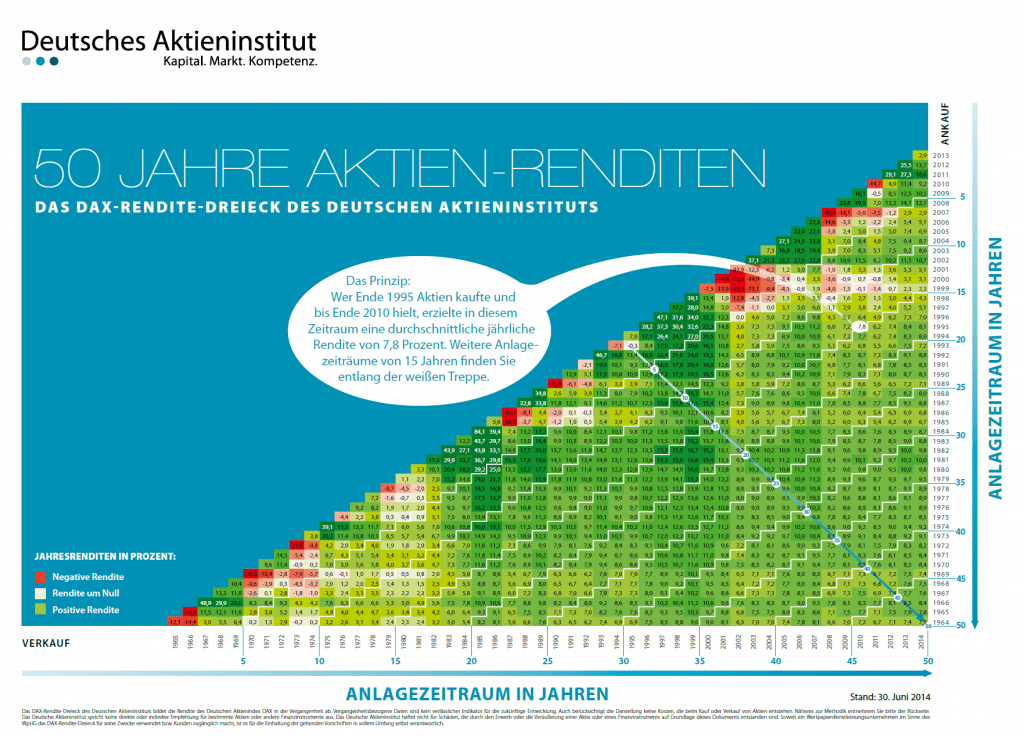

For long-term investors holding German equities is a no-brainer. Though German stocks may be volatile in short-term, they have returned positive returns in the long-term. The following fascinating chart shows the returns over various time periods:

Click to enlarge

Source: Deutsches Aktieninstitut

From a Motley Fool article that explains the above chart:

Each individual box in the triangle shows the annual return for an investor who bought the DAX at the end of one year (Y-axis) and held through the end of another year (X-axis). Green boxes show gains, boxes closer to white show flat returns, and red boxes show losses.

First, take a moment to admire all the green in that chart. In the vast majority of years and time periods, the DAX has had a positive annual return.

Now look what happens as you move down and toward the right of the triangle. The red squares disappear completely. In plain language: The longer the holding period, the higher the chance of a positive annual return. In fact, you won’t find a single 15-year holding period in the entire 50-year span of the chart that doesn’t result in a positive annual return.

Even using 10 years as a holding period, there are only two instances (out of 41 possibilities) where your returns would have ended up negative. That means that if you bought the DAX any time over the last 50 years, and held for at least 10 years, you had a 95% chance of a positive annual return.

Source: Why you need to own stocks, Motley Fool Germany, 2014

All the green squares in the chart makes it clear that German equities have returned positive returns than negative returns in many time periods. The red concentration around 2008-09 and during the dot-com crash of 2000 are understandable. So though Sven Carlin concluded that he could not find German companies worth investing in, it misses the point big time. History has shown time and again that long-term investors are richly rewarded.

Some of the excellent companies that investors can consider are Adidas AG(ADDYY), Continental AG (CTTAY), Henkel (HENKY), Fresenius Medical Care AG(FMS) and Siemens Aktiengesellschaft (SIEGY)

Disclosure: No Positions