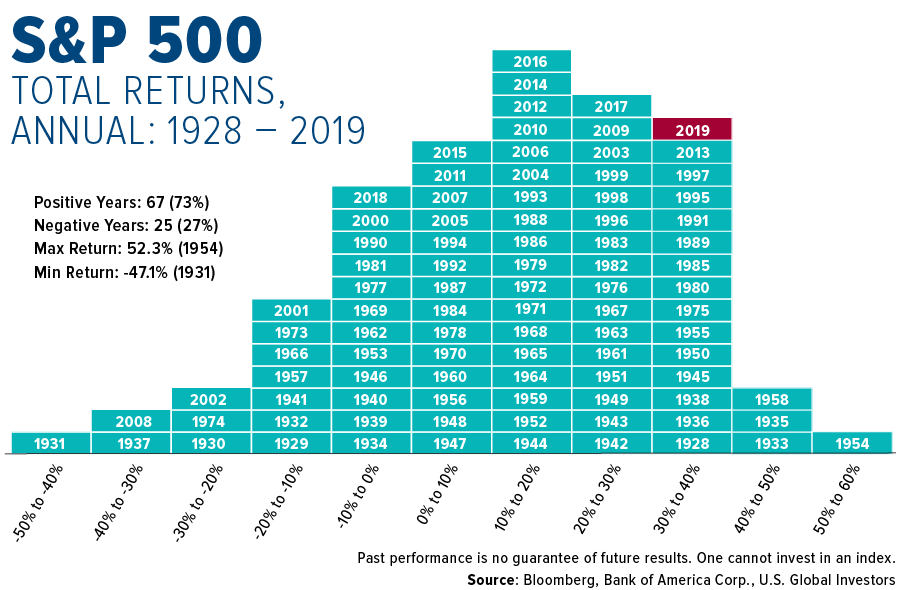

The S&P had one of the spectacular returns in 2019. The index shot by nearly 31% on price only basis. With dividends reinvested, the total return was 33%. This return was the best return in the 30 to 40% range since 1928.

The following chart shows the annual total return of the S&P since 1928:

Click to enlarge

Source: “Buy-and-Hold” Has Historically Been a Winning Investment Strategy by U.S. Global Investors

The S&P has positive returns in nearly three-fourths of the time period.

Related ETFs:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions

S&P 500 Index Related Articles:

- The Complete List of Constituents of the S&P 500 Index

- On The Evolution Of The S&P 500 Since Inception

- S&P 500 Calendar Year Returns vs. Intra-Year Returns: Chart

- S&P 500 Annual Total Returns From 1928 To 2019: Chart

- The S&P 500 Dividend Yield is at a 20-Year Low

- The Top 30 Stocks in the S&P 500 over the Past 30 Years

- Contribution of Price Appreciation and Dividends to the S&P 500 Total Return by Decade

- The Average Company Lifespan in the S&P 500 Index is Falling

- Gold vs. S&P 500 Long-Term Returns: Chart

- How Much Dividends Contribute to S&P 500’s Total Return

- Intra-Year Declines of S&P 500 Index Since 1948