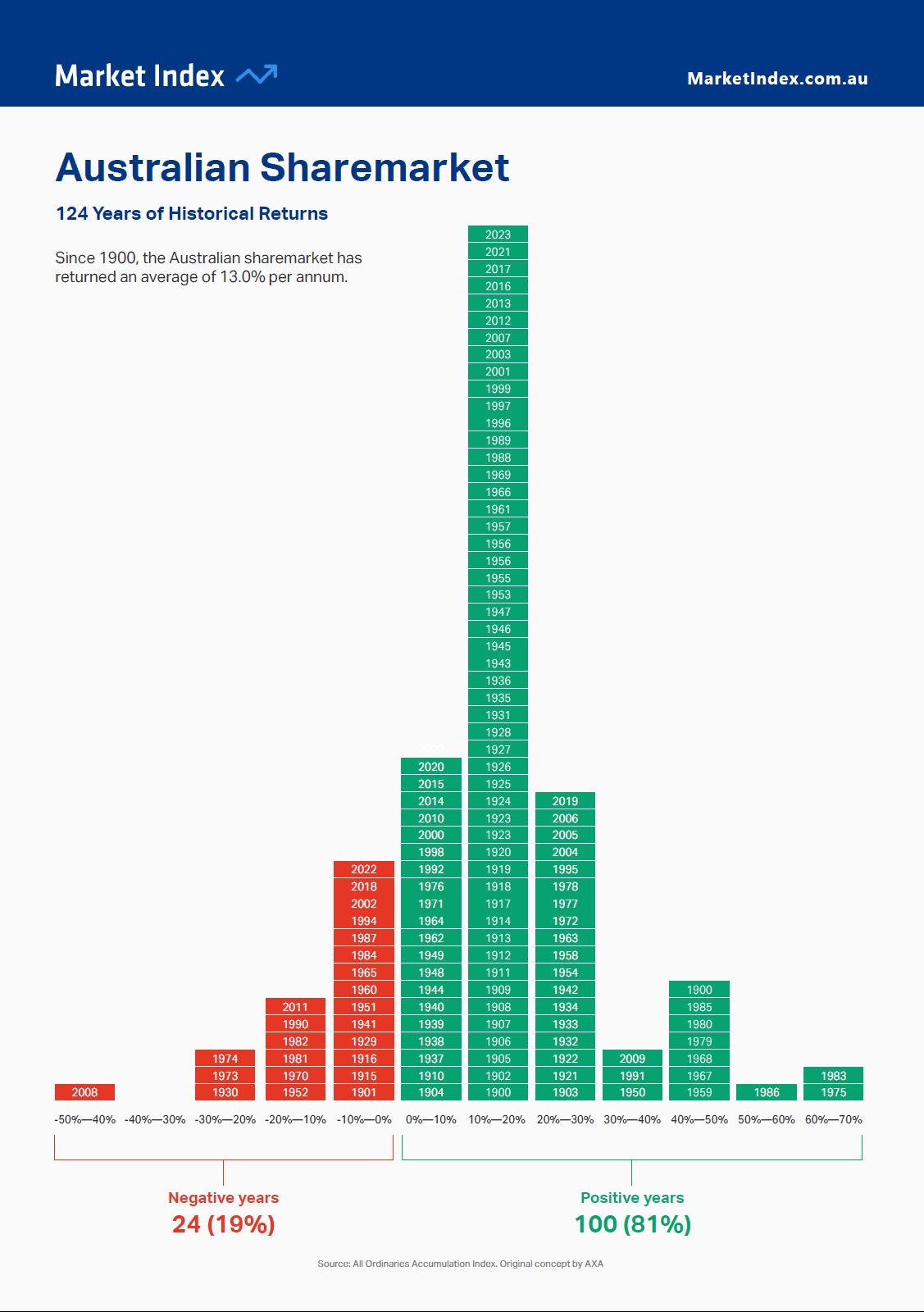

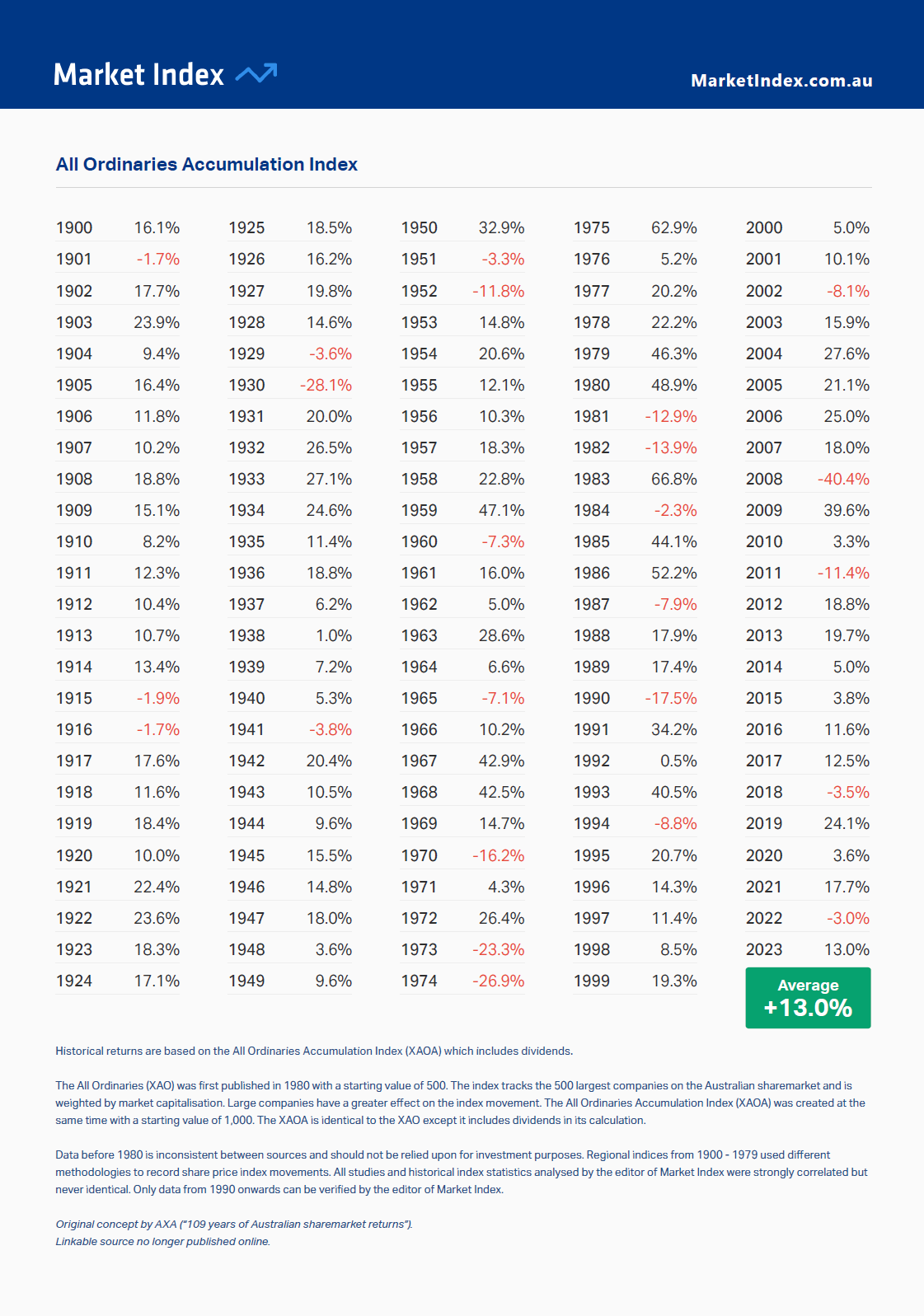

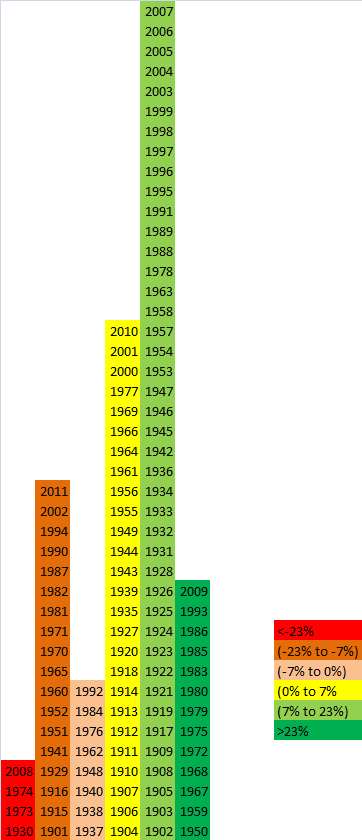

The 124 historical returns from 1900 to 2023 of the Australian stock market is shown in the chart below. The average annual return was 13.0%. In addition, for the majority of the years shown Aussie stocks earned a positive return. In 2023, the market had a return of 13%.

Click to enlarge

-Updated on Jan 23, 2024 with 2023 data.

Source: Market Index

Download the 124 historical returns of the Australian Market in pdf format:

- Australian Market – 124 years of returns chart (pdf as of 2023)

____________________________________________________________________________________________

Older posts:

Australia is one of the top-performing equity market especially in the long run. As a developed country Australia offers many of the advantages of a typical developed market such as transparency and the rule of law.

Investors looking to diversify by holding international stocks should consider Aussie stocks. This is because not only they have one of the highest dividend yields in the world but also in the long run their performance is excellent.

Update(2/19/19): An earlier version of this chart incorrectly showed the average annual returns as 9.96%.

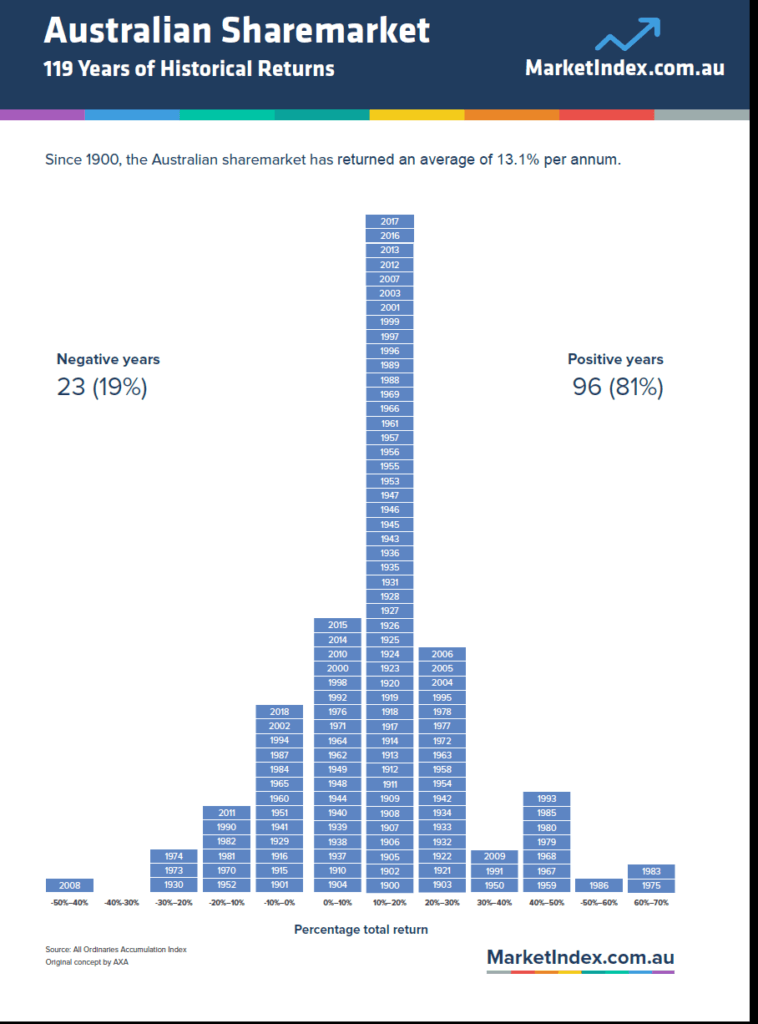

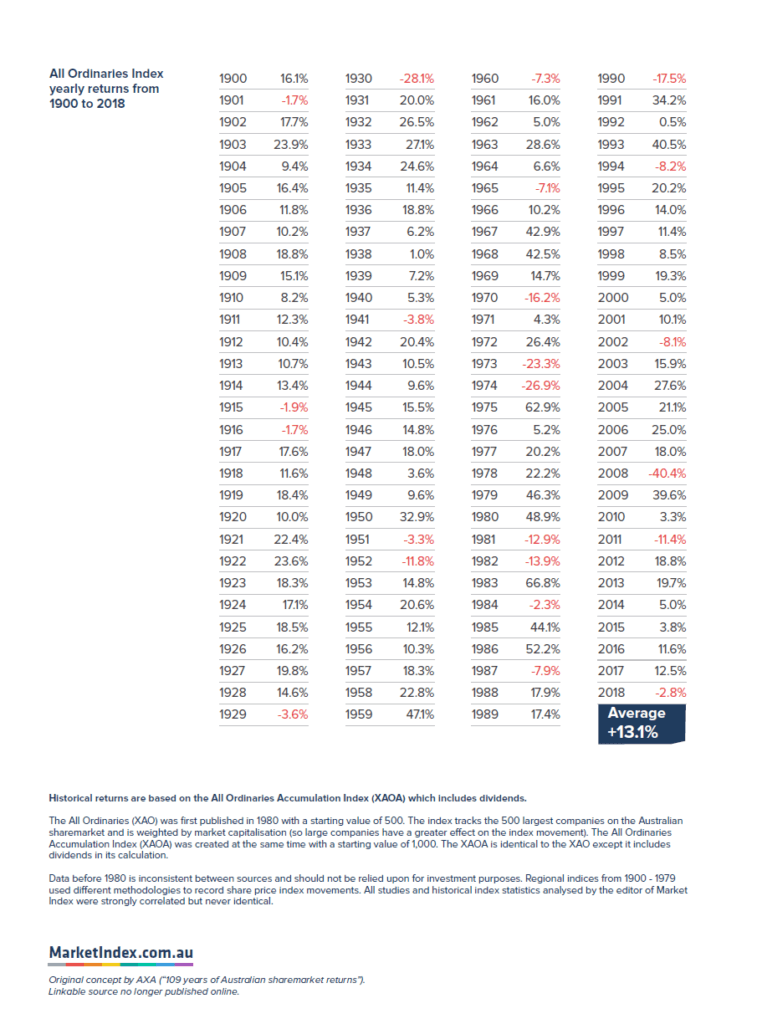

The following graphic shows the historical annual returns of Australian stocks from 1990 thru 2018:

Click to enlarge

Notes:

- The returns shown above are total returns (i.e. share price returns + dividends).

- The returns shown are in the local currency.

- The returns are for the All Ordinaries Index.

Source: Australian Sharemarket – 117 Years of Historical Returns, MarketIndex.com.au

Since 1990, Aussie stocks have returned an average of 13.1% per year. A return of this magnitude is indeed great. In most of the years the market yielded positive returns.

Related ETF:

- iShares MSCI Australia ETF (EWA)

Download: Australian Sharemarket – 119 Years of Historical Returns (in pdf)

See Also:

Updated – 6/5/21:

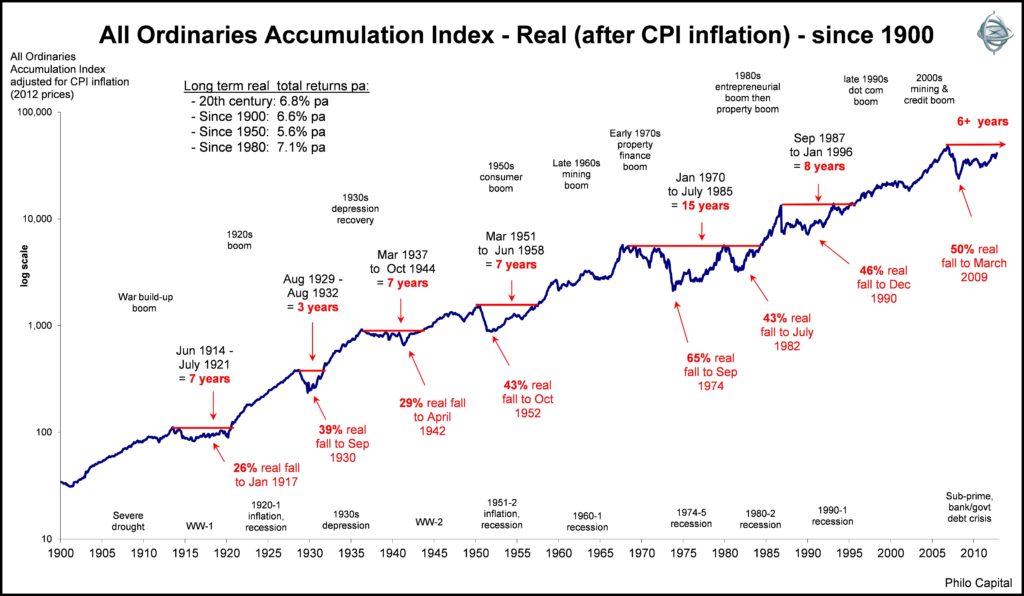

1)All Ordinaries Accumulation Index returns from 1900 to 2010:

Click to enlarge

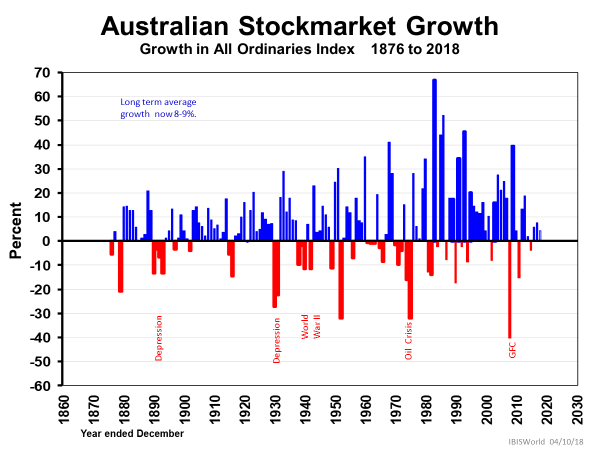

Australia Stock Market Growth From 1876 To 2018:

Source: CuffeLinks

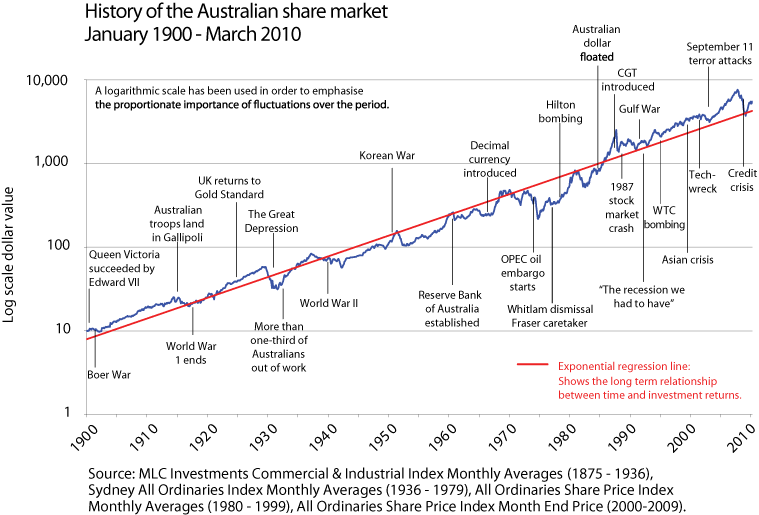

2) History of Australian Share Market From 1900 Thru 2010:

Source: Sapience

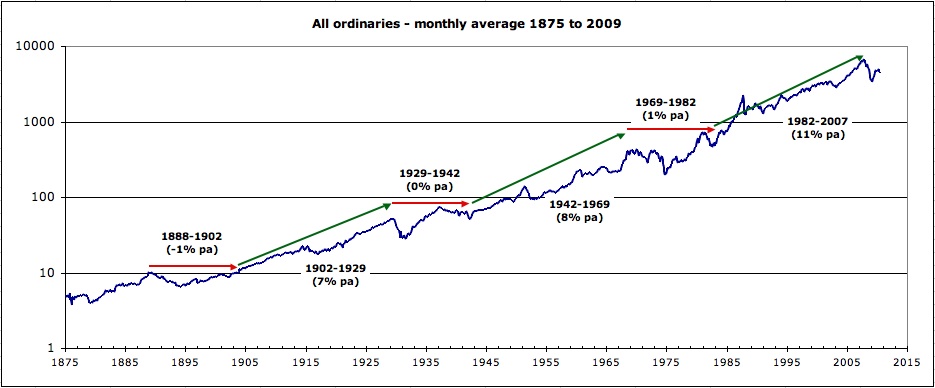

3. All Ordinaries Cycles from 1875 to 2007:

Click to enlarge

Source: Fusion Investing

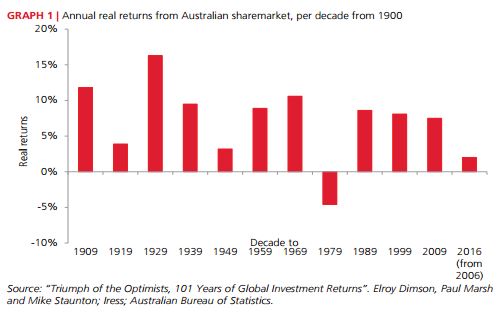

4.Annual Real Return from Australian Stock Market by Decade from 1900:

Source: 10 years of investing in Australia, Allan Gray

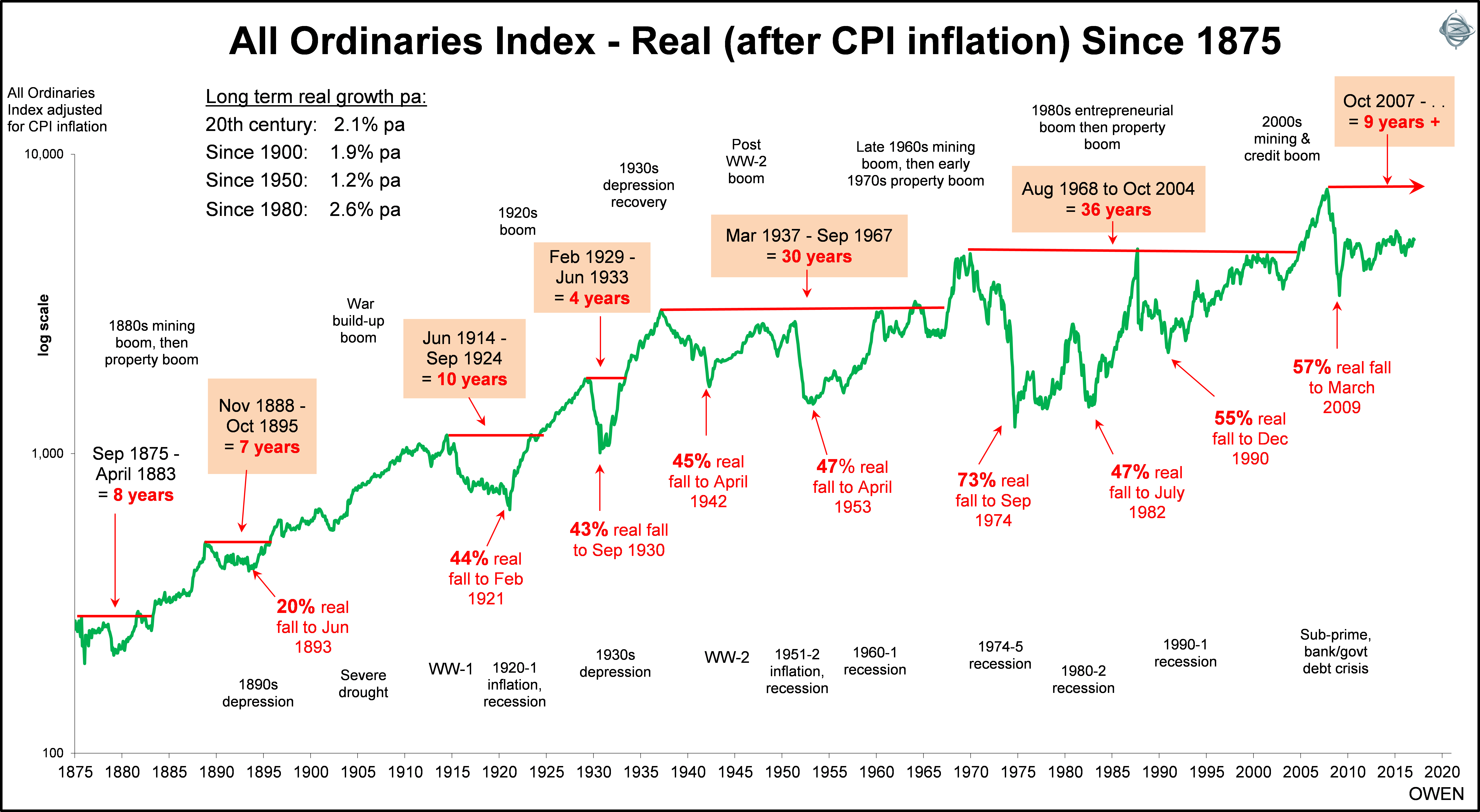

5.All Ordinaries Index Real Returns since 1875:

Source: The Dow Hitting 20,000 And What It Hides, Investing,com

6.Australian Equity Price 1897:

Source: RBA

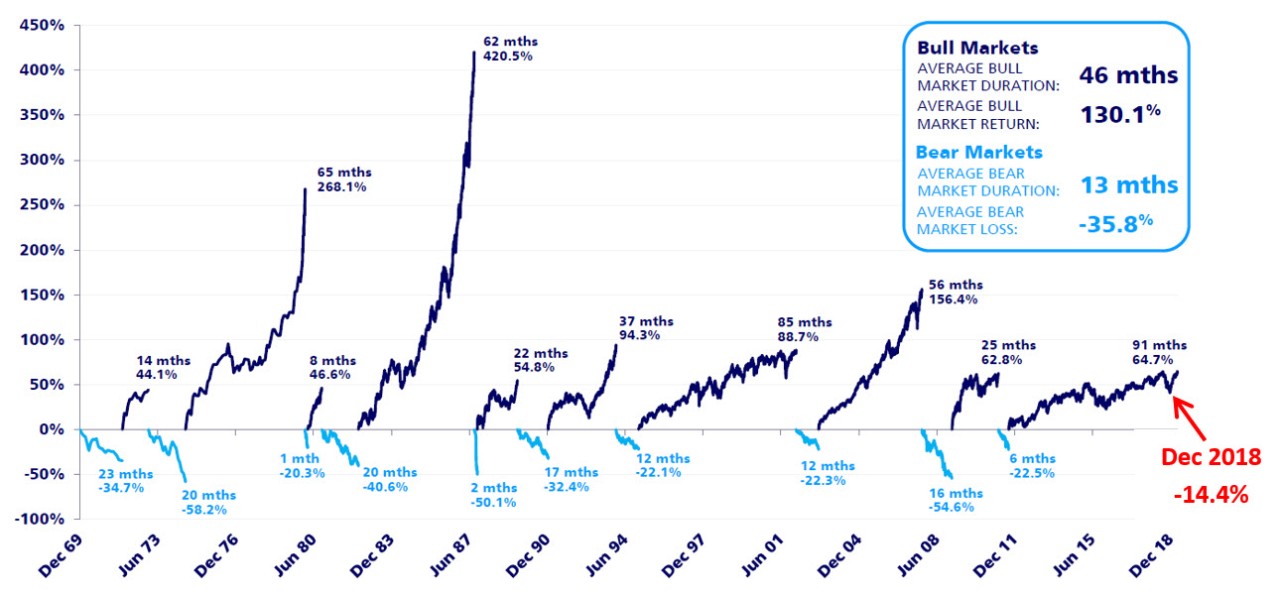

7.Australia Bull and Bear Markets since 1970:

Source: Zurich Australia

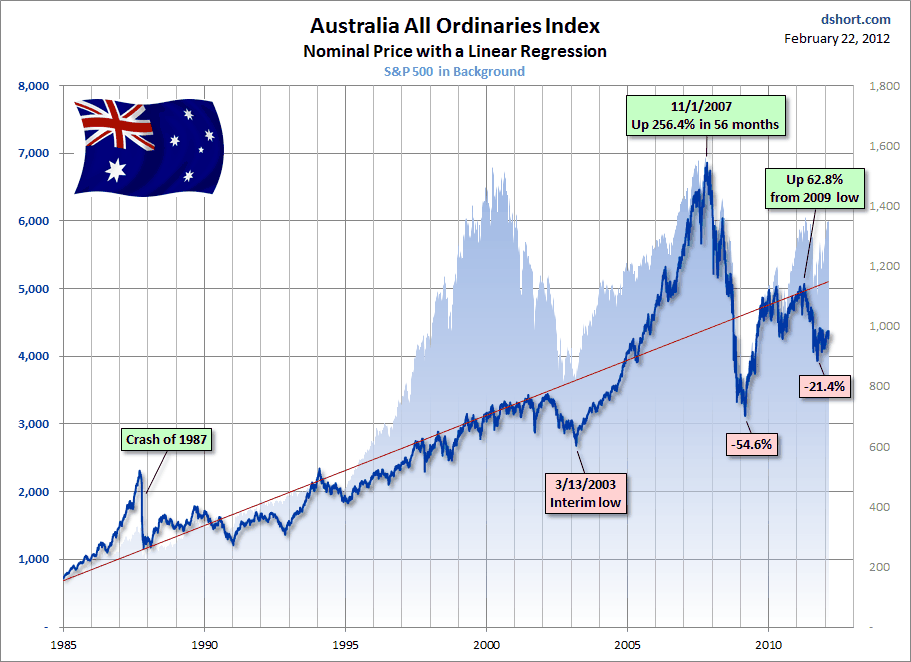

8.Australia All Ordinaries Index Vs SP 500 from 1980 to 2012:

Source: dshort.com

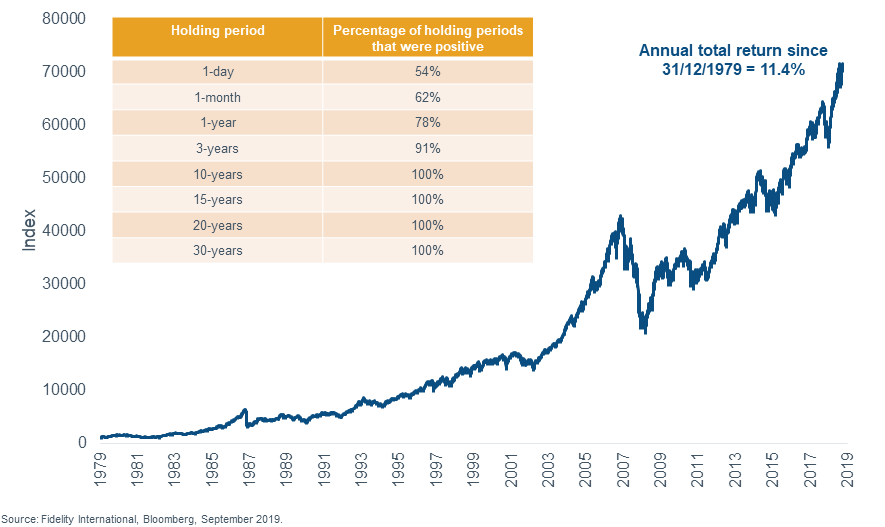

9.Australian All Ordinaries Accumulation Index from 1979 to 2019:

Source: Livemarkets

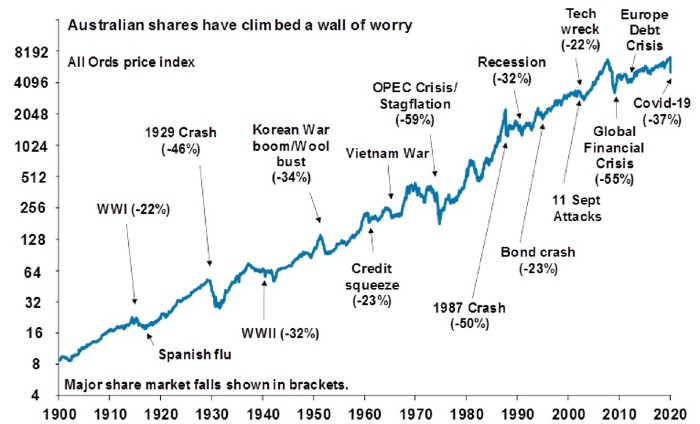

10.Australia All Ordinaries Price Index Returns from 1900 to early 2020:

Source: ABC News

Disclosure: No Positions

11) 111 Years Returns of the Australia Stock Market:

Source: Macrobusiness

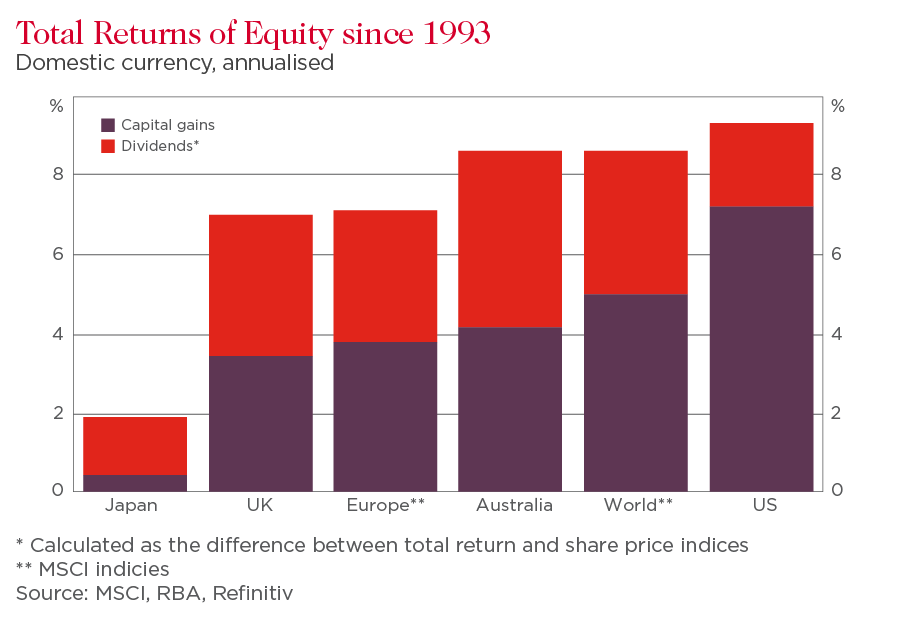

12.Dividend and Capital Gains contributions to Total Returns in Select Countries:

Source: Property vs shares? The long-term verdict, Westpac

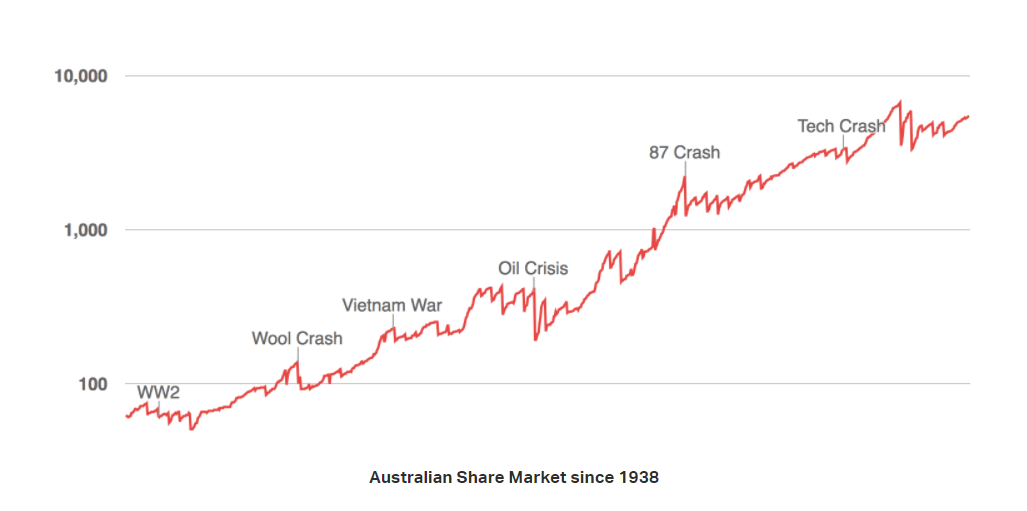

13.Australian Stock Market since 1938:

Source: Market Index

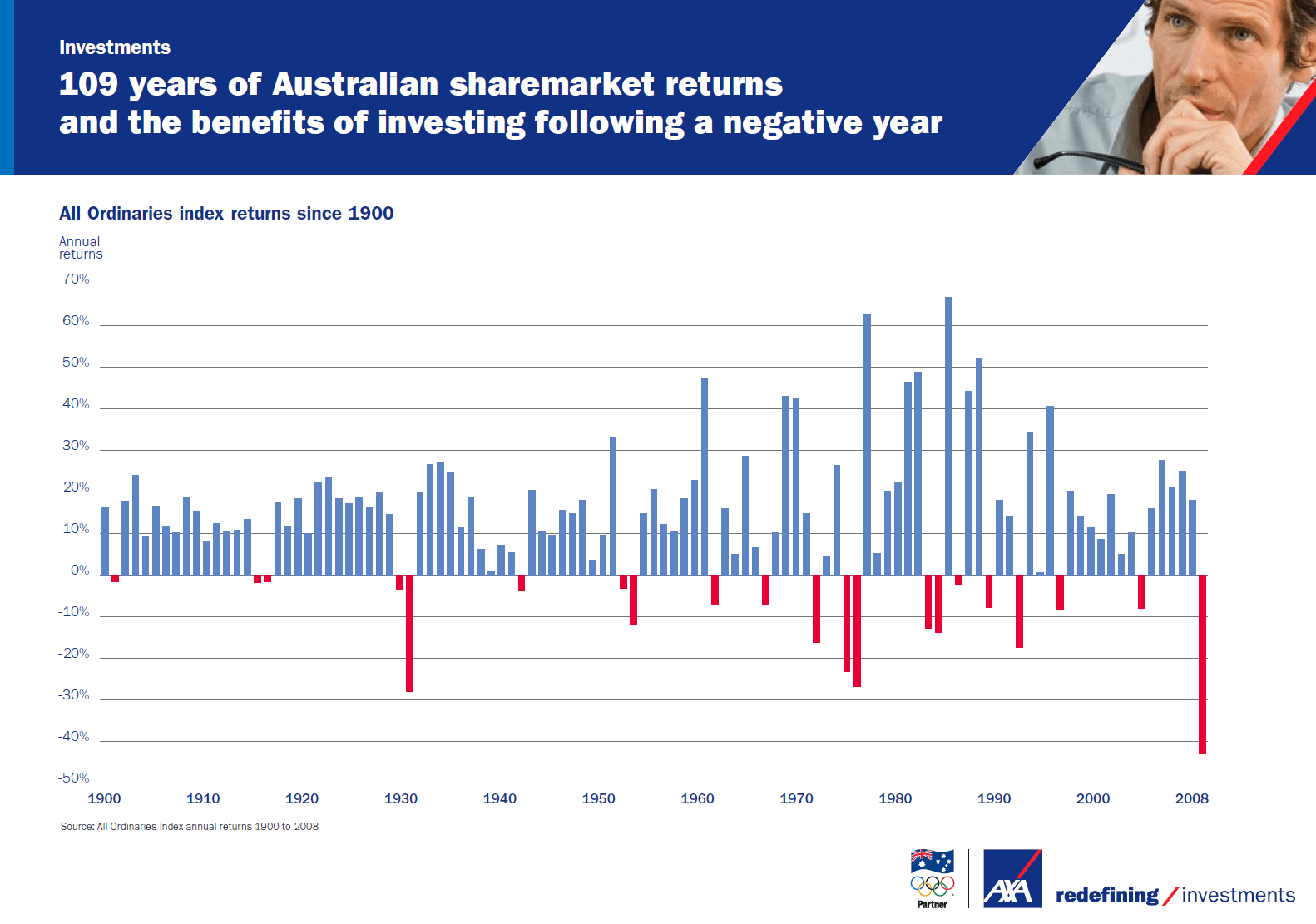

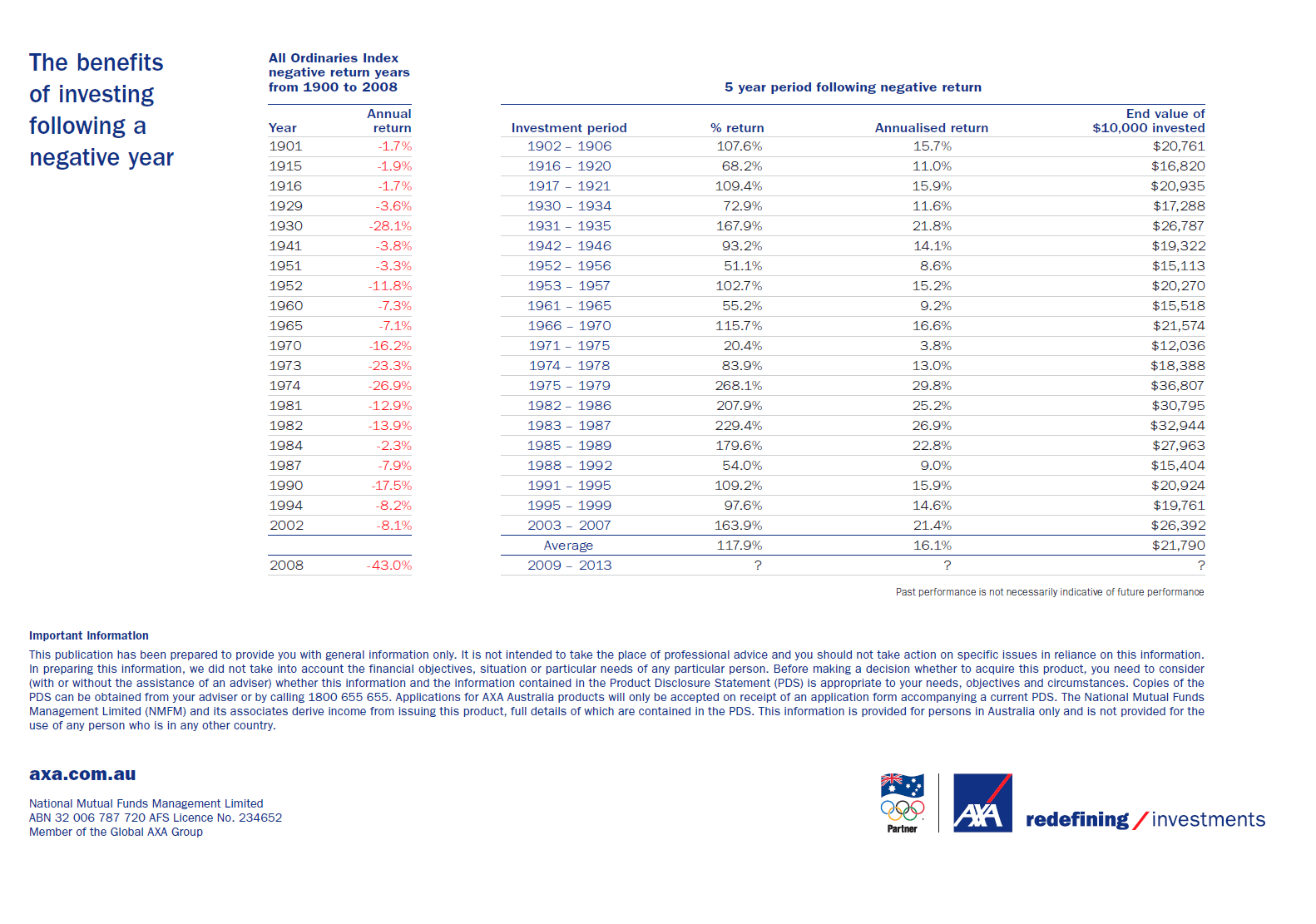

14) 109 years of Australian sharemarket returns and the benefits of investing following a negative year:

Click to enlarge

Source: Merideon

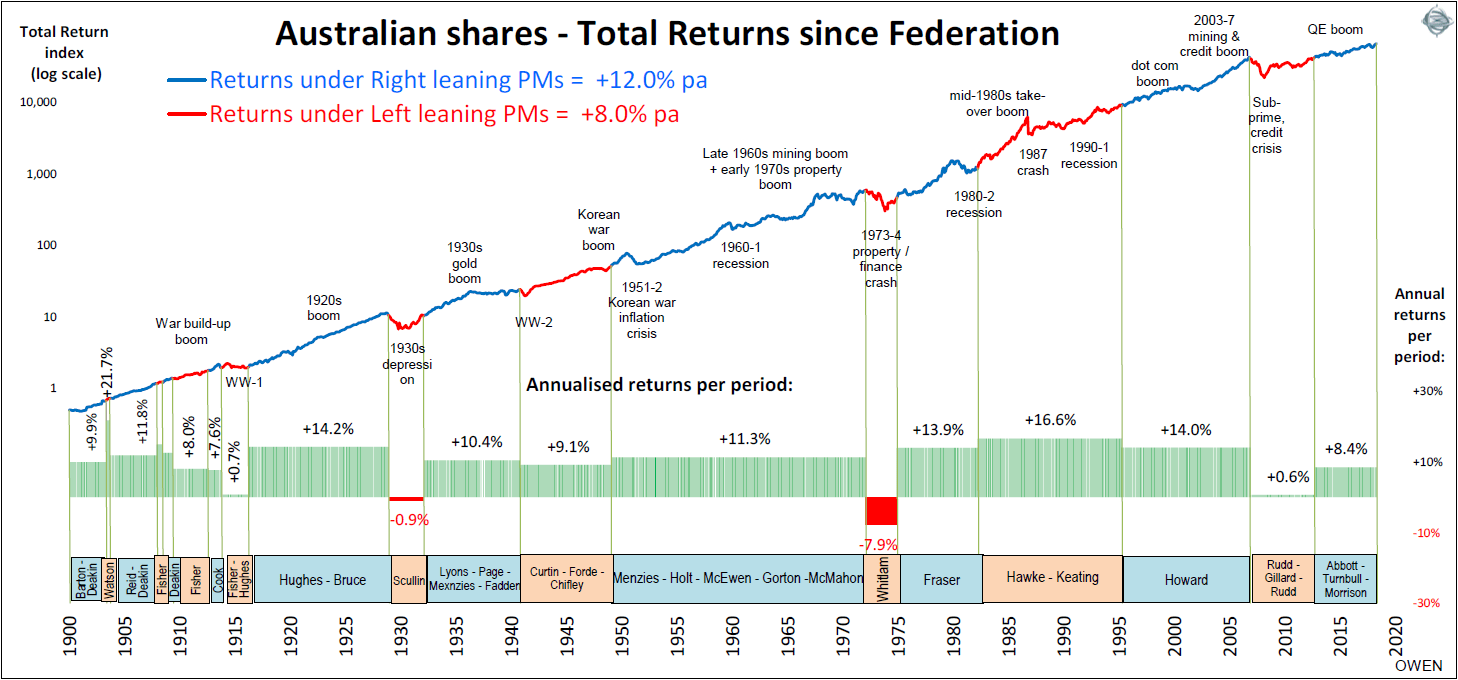

15) Australian Shares Total Returns Since Federation – Under Right and Left Political Parties:

Click to enlarge

Source: Which political party is best for share prices?, Firstlinks

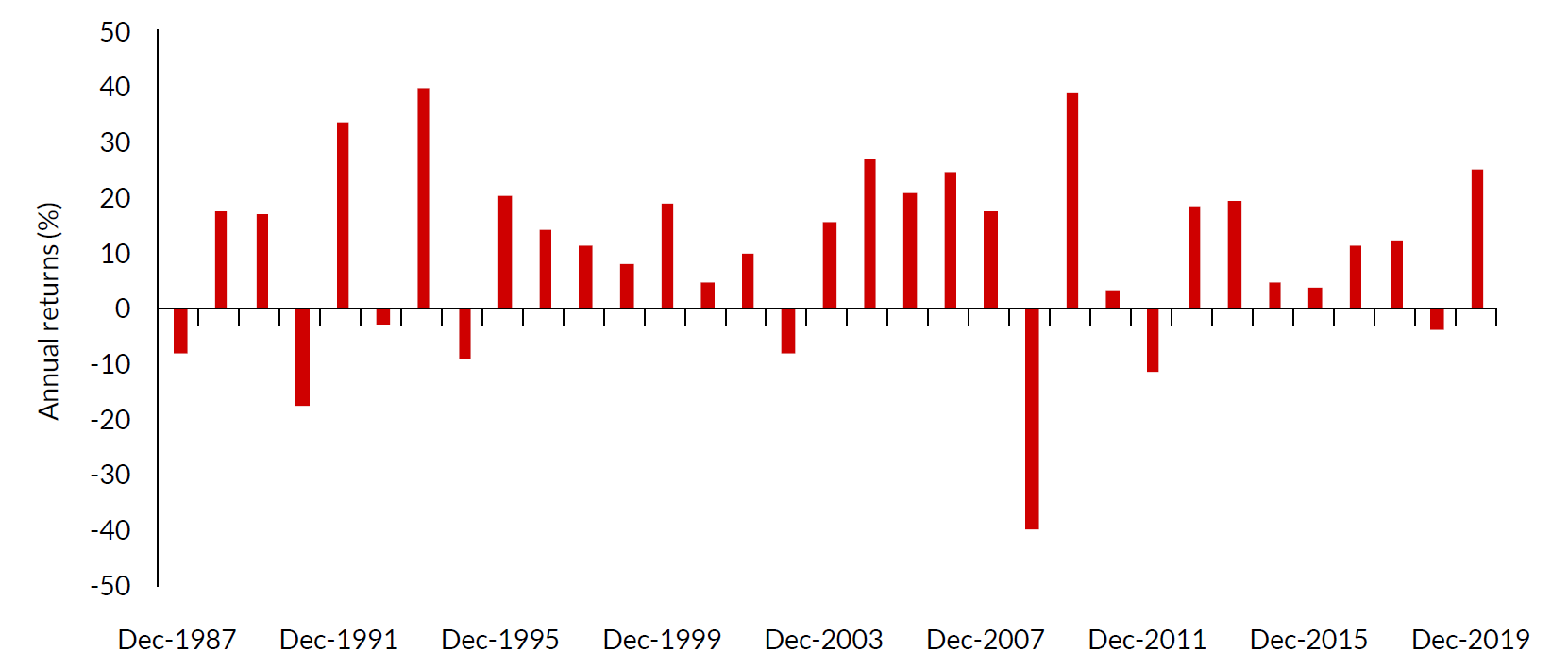

16) ASX All Ordinaries sharemarket annual returns:

Click to enlarge

Source: Allan Gray

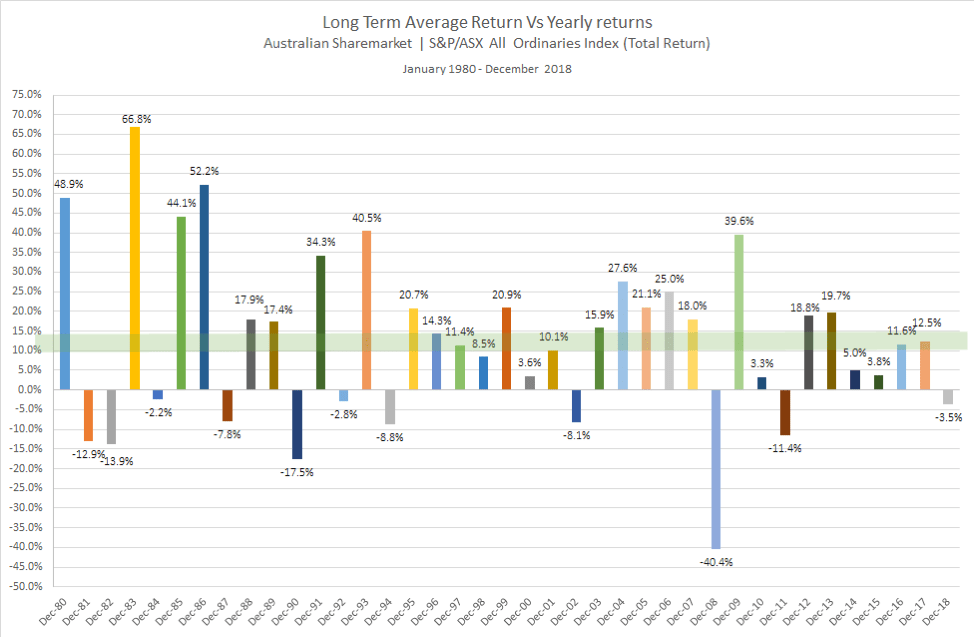

17)Long Term Average Return vs. yearly Returns:

Click to enlarge

Source: APW Partners

__________________________________ _______________________________

Checkout also:

You may also like:

- The Complete List of Australian ADRs

- The 2021 Andex Chart for Australian Investors: Chart

- The Australian ASX Index Returns by Year

- Bear Markets in Australian Stocks since 1900

- Australian Stock Market Intra-Year Gains and Declines vs. Calendar Year Returns 2001 To 2017

- Real Total Returns From Stocks – Australia vs. USA Since 1900: Chart

- Australian Stocks: Dividend Contribution to Total Returns Since 1900

- Australian vs. Global Share Returns in 30 Years: Chart

- The Economy of Australia: Infographic

- Why Australia Is Attractive For Dividend Stock Investors

Hi David, I have been looking at your article above while doing some research. The first 2 diagrams indicate that the return of the XAOA between 1900 and 2016 was 9.96%. I also happened upon the original chart at the Market Index website and found that the return on the same 2 charts indicated a return of 13.22%. Just wondering if you have any comment on the discrepancy. I realise that this article is over 18 months old now but still the facts are unclear.

Location of the other charts if you are interested https://www.marketindex.com.au/sites/default/files/statistics/historical-returns-infographic-2016-updated.pdf

Thanks, the article was interesting, though frustrating later due to the conflicting information.

James

James

Thanks for pointing out the discrepancy.

It looks like 13.22% is the correct average return based on the updated diagrams in the link you posted. I haven’t had the time to calculate and confirm the return.But you can do it simply by calculating the average for the years listed in the diagram.

I looked at the updated diagram for 2019 with data upto 2018. That also shows 13.1% which is closer to 13.22% and last year’s return was negative for the Australian market. You can find the updated chart here:

https://www.marketindex.com.au/sites/default/files/statistics/historical-returns-infographic-2018.pdf

I will update my page with the corrected returns tomorrow. Hope this helps.

-David

Visitor Comment re-posted by David:

Author: fay (xxxx.optusnet.com.au)

Email: [email protected]

URL:

Comment:

Great charts thank you. Given the current market correction, could you please update your graphs to include April 2020?

Fay

Sorry for the delay. Unfortunately the graphs are sourced from other sites. So if I find them updated I will post it there. Thanks.

I am typically concerned what has happened to my investment I have invested $500,000.00 with perpetual finances in many Australian stocks in 1998 and my current exit value is now $574,580.00 as at 2020 this does not make sense if the average gain over the last 20 years has been between 8.8%-13.3%annual growth that being 533% and should be in the range of $2.66million au so where has my investment failed so badly

Sorry for the delayed reply.

You investment failed to grow at the rate of 8.8%-13.3% because I am not sure what Australian stocks you are invested in. The return posted in the chart are based on the All Ordinaries Accumulation Index returns over the period shown. So in order to replicate the return you should have invested in a find that tracks this index. Otherwise your returns could be lower or higher depending on what you invested in. Hope this clarifies your questions.

Thanks

Very impressive re search and data, If by any chance as posted earlier you have updated data could you please provide a link as we are heading into interesting times.

Thanks,

James

Hi – I currently do not have the update data. But if I find it I will update this post. Thanks.