Credit Suisse published the popular Global Investment Returns Yearbook for 2016 last month. The report contains a wealth of data especially from a long-term and country-specific perspective.

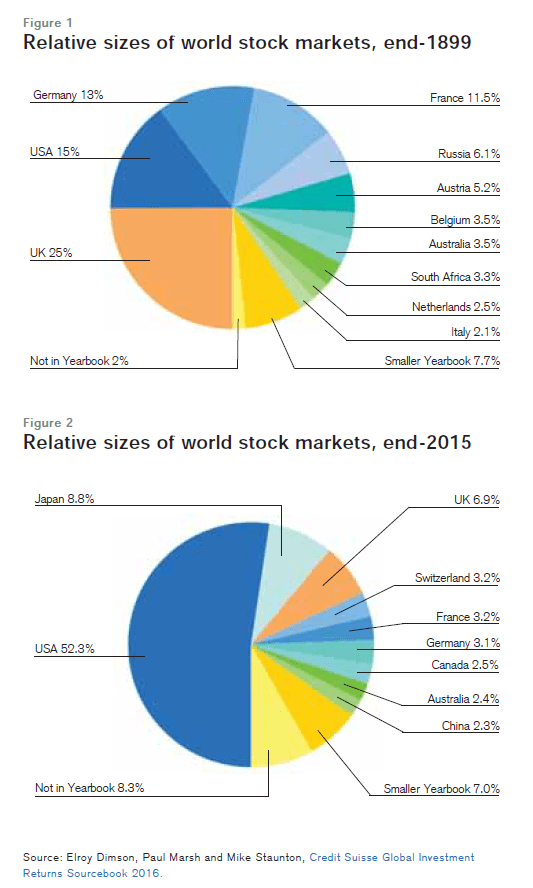

The following is a sample chart from the report. It shows the relative shows of the equity markets by country at the end of 1899 and 2015:

Click to enlarge

Credit Suisse Global Investment Returns Yearbook 2016

The US equity market capitalization of the end of 1899 was just one-fourth of the world markets capitalization. Today it accounts for over 52%. UK on the other hand fell from over 25% of the world market size to just about 6% now.

Download the full Credit Suisse Global Investment Returns Yearbook for 2016 report (in pdf) by clicking on the above image.

Source: Credit Suisse

Related: Download: Credit Suisse Global Investment Returns Yearbook 2015