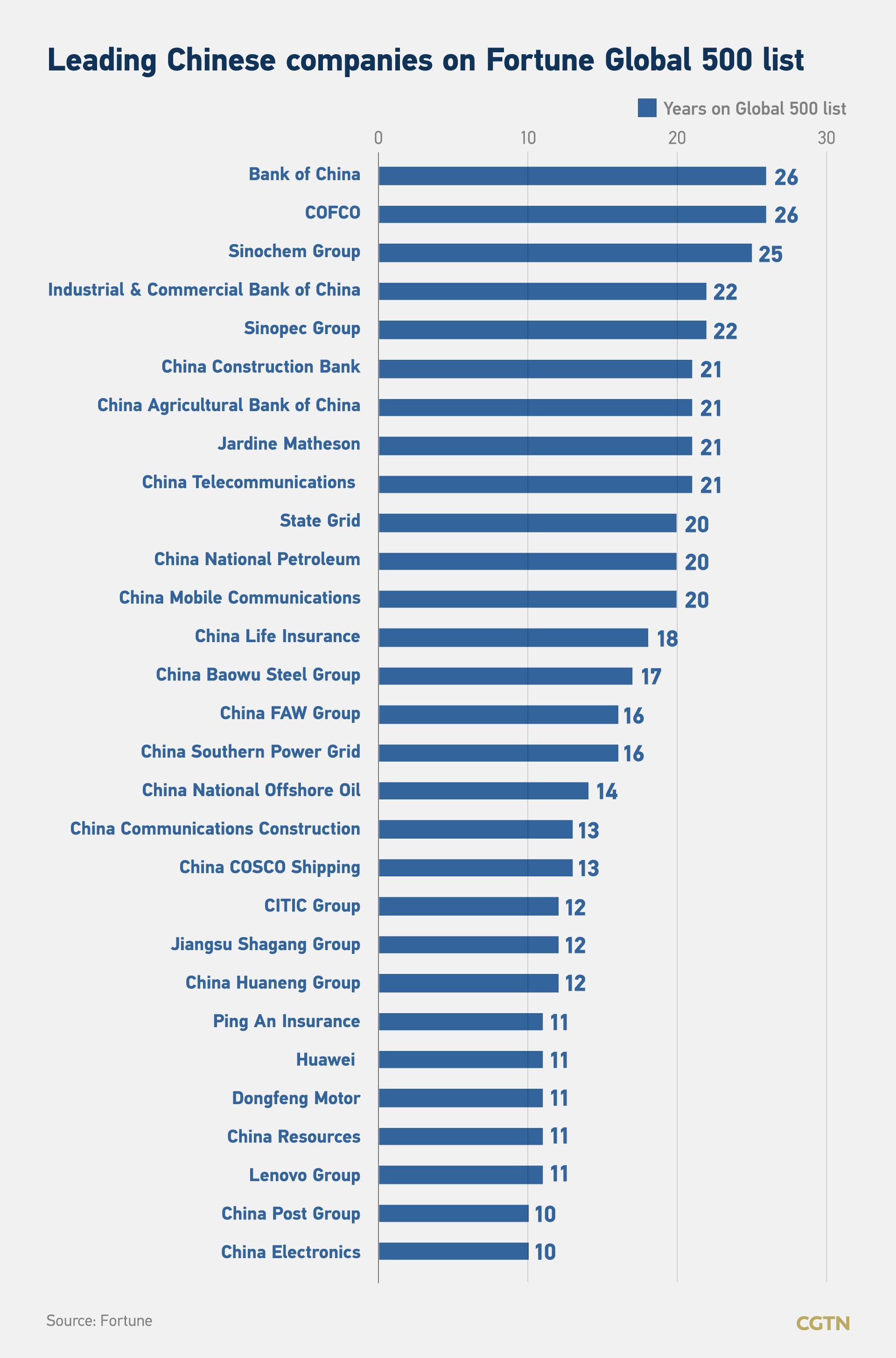

Chinese companies are increasingly competing and growing at a global level. As China’s economy grew relatively better than other countries last year, companies from China dominated the Fortune Global 500 list for 2020 overtaking the US. To put this feat in perspective, in the 1990 list there were no Chinese companies in the list. Sinopec, State Grid and China National Petroleum were in the top 10. The annual Fortune Global 500 is compiled based on revenue.

The following top Chinese firms were in the 2020 Fortune Global 500 list:

Click to enlarge

It is not just more Chinese firms are in this global ranking. Companies from China are also taking the leadership positions in many industries engineering and construction, petroleum refining, shipping, etc. as shown in the graphic below:

Source: Charts: A breakdown of Chinese companies ranked on Fortune Global 500, CGTN

Related:

Disclosure: No positions