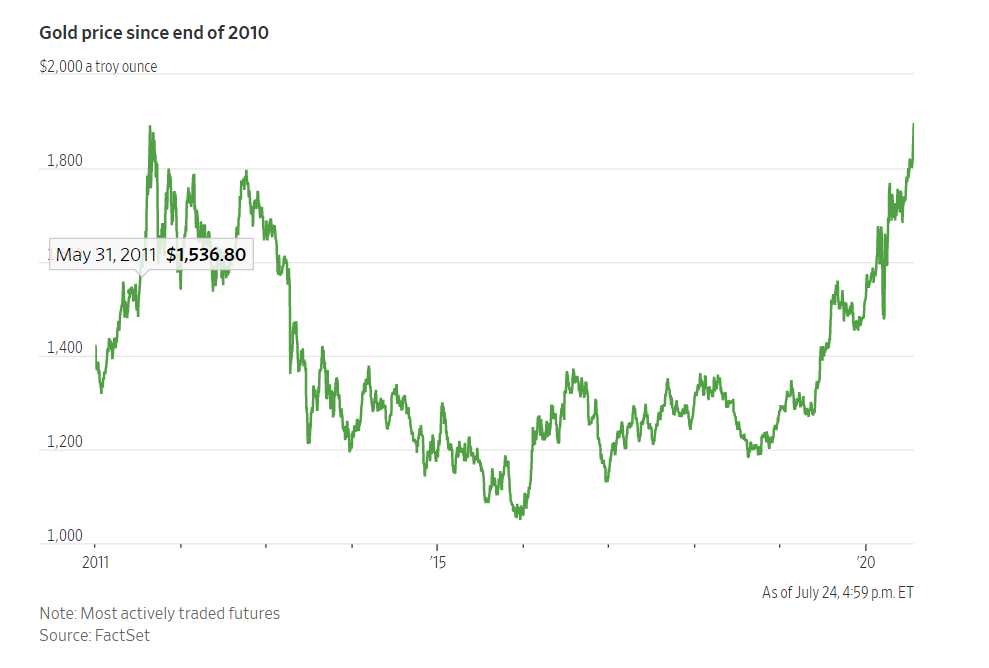

Gold prices are climbing to record highs this year. Prices reached $1,900 yesterday in the futures market. This is the highest levels since 2011. Gold prices are in a tear this year due to coronavirus-induced recession. The yellow metal may continue to rise as investors seek safe-heaven assets in uncertain times such as now. Though gold does not produce income like a dividend paying stock for example it is considered as an asset that stores value. Fiat currencies including the US dollar are just paper and can reduce in value. In fact, the value of the dollar today is not the same as it was in 50 years or 20 years. Every year the value of the paper dollar loses its value due to inflation.

With that brief intro, below is an excerpt from an article in the journal this weekend:

Expectations for the world’s central banks and governments to continue flooding the global economy with cash are also lifting demand for bullion. Ultralow interest rates make gold more appealing because the metal offers no income simply from holding it. Many analysts also expect historic stimulus measures to eventually spur inflation, eroding the purchasing power of paper money and boosting the value of precious metals.

European Union leaders recently reached an agreement on more than $2 trillion in spending, and traders anticipate U.S. lawmakers will soon approve additional coronavirus aid.

Many big-name investors including Ray Dalio, Jeffrey Gundlach and Paul Tudor Jones have touted the benefits of owning the metal in recent months, with the pandemic stinging business activity and a global pile of debt expanding.

Source: Gold Climbs to a High, Topping Its 2011 Record, WSJ, July 24, 2020

From an article by Jason Zweig at the journal:

In the aftermath of the 2008-09 global financial crisis, investors piled into gold on the belief that low interest rates and trillions of dollars in government spending would ignite hyperinflation and make gold more valuable.

Gold shot up close to $1,900 in the summer of 2011, but the hyperinflation never materialized. In real, inflation-adjusted terms, gold gained about 6% annually in both 2011 and 2012, then lost 38% from 2013 through 2015, according to Christophe Spaenjers, a finance professor at the HEC Paris business school in Jouy-en-Josas, France. By late 2015 the gold price had sagged to $1,050.

Gold is, in fact, a poor hedge against inflation. Accounting for changes in the cost of living, gold has returned an average of minus 0.4% annually since 1980, versus positive annualized returns of 7.9% for U.S. stocks, 6.2% for U.S. bonds and 1.2% for cash, according to Prof. Spaenjers.

Adjusted for inflation, he reckons, gold would still have to rise approximately 52% from this week’s prices to match its level of January 1980. That is when it peaked in inflation-adjusted terms.

So you hear less about gold’s purported inflation-fighting powers nowadays. Instead, fans argue the dollar is losing value and, above all, that low interest rates in the U.S. and negative rates elsewhere will drive gold higher.

That makes some sense. It costs money to store and insure gold, which—unlike cash or bonds—produces no income. When the return on cash is nil or negative after inflation, gold’s income disadvantage disappears. Investors then become more willing to “look to assets where the value will at least be retained, which benefits gold,” Ms. Cooper says.

Source: A Golden Rule From a Golden Fool, WSJ, July 24, 2020

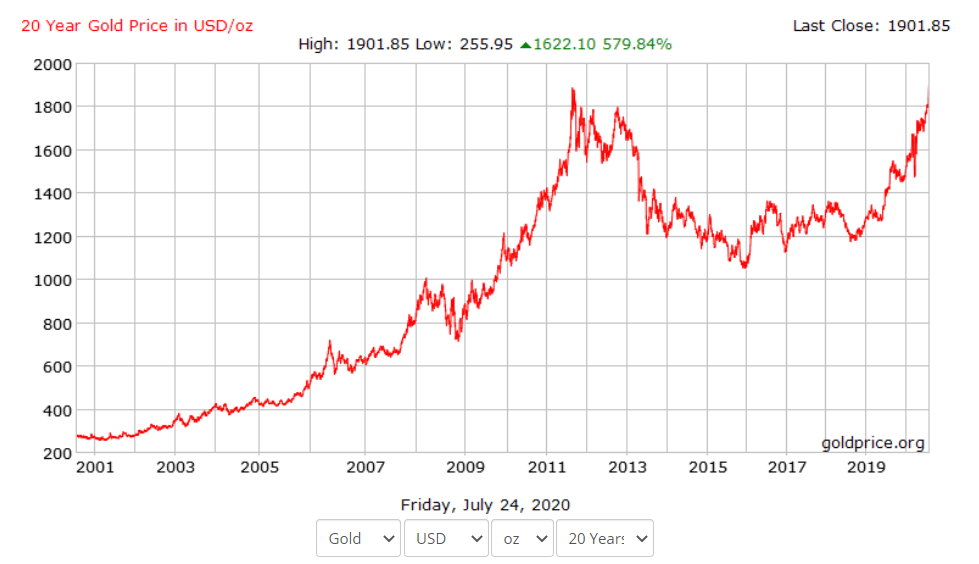

The below shows the 20-year return chart of gold:

Click to enlarge

Source: GoldPrice.Org

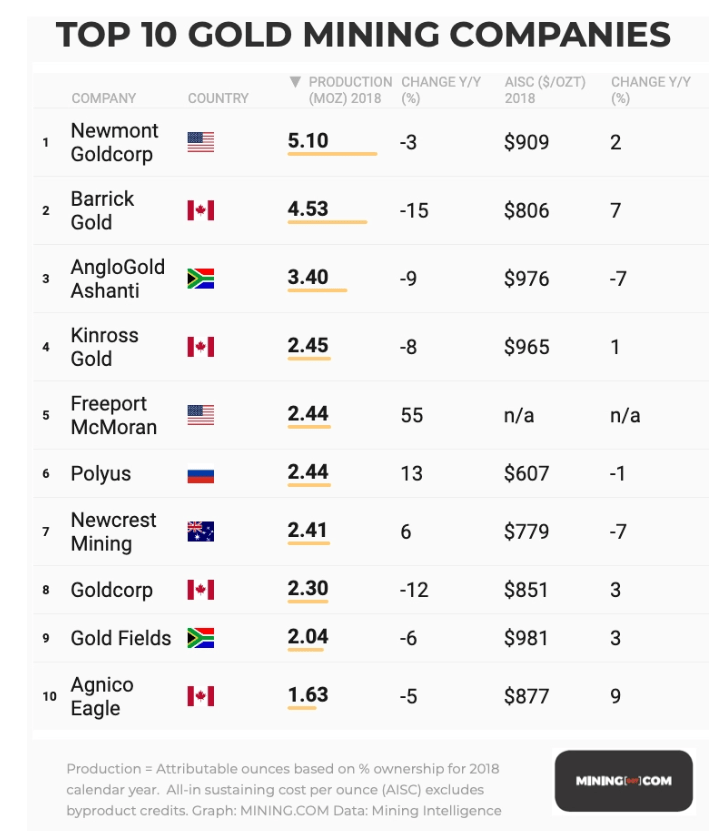

The Top 10 gold mining companies in the world:

Source: Top 10 biggest gold mining companies in the world, Mining.com

Related ETF and stocks:

- SPDR Gold Trust ETF(GLD)

- The Complete List of Precious Metals Stocks Trading on the NYSE

- The Complete List of Precious Metal Stocks Trading on the NASDAQ

Related Posts:

- Gold Prices Since 1920: Chart

- Gold: Bull and Bear Markets

- Gold Returns in Bull and Bear Markets

- Gold Beat Stocks So Far This Century

- How Does Gold Perform During Recessions ?

- Gold Offers Portfolio Protection During Drawdowns

- Gold vs. S&P 500 Long-Term Returns: Chart

Disclosure; No Positions