Gold prices have declined greatly in the past few years. From a peak of over $1,800 a few years ago it has now fallen to about $1,115 this past Friday.

Click to enlarge

Source: Kitco

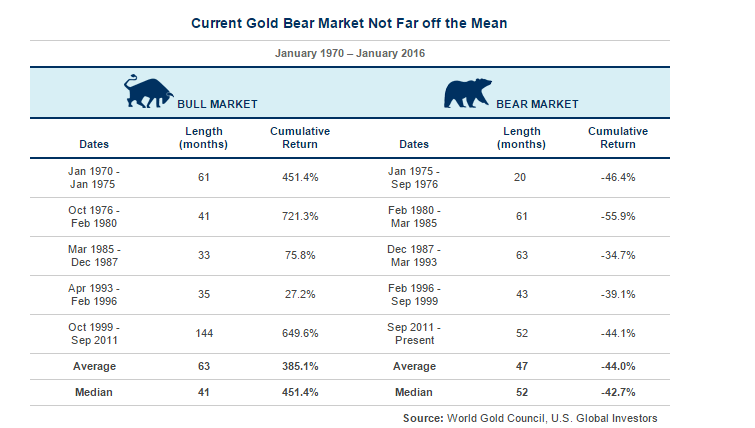

The current bear market is in- line with past bear markets. The following table the shows the duration of the past bull and bear markets;

Click to enlarge

Source: US Funds

From the US Funds article:

With the Fear Trade heating up, it’s important that we manage our expectations. The length and extent of the current bear market, which began in September 2011, might seem unprecedented to many investors. In actuality, it doesn’t veer very far from what we’ve seen in the past, according to data presented by the World Gold Council (WGC).

Reaching back to 1970, the WGC identified five bull and bear markets, with bull markets defined as periods when gold prices rose for longer than two consecutive years, bear markets as the subsequent periods when they fell for a sustained length of time. Although these lengths vary, the cumulative loss in each bear market is relatively uniform, with median returns at negative 42.7 percent.

The present bear market, at negative 44.1 percent, falls easily within the realm of normalcy.

Further, the table suggests that a turnaround in gold prices is overdue.

A few points to remember about investing in Gold:

- As an asset class, gold does not produce regular income such as dividends or interest.

- So the only way to profit from investing in gold is waiting for price appreciation.

- Gold can be a hedge against inflation.

- Like oil, gold is also a commodity. Hence prices will be volatile.

- In a well-diversified portfolio, gold can be allocated a small portion of the total assets. However just because equities crash, one should not move all their assets to gold.

- The largest gold ETF is SPDR Gold Shares (GLD) ETF.

Disclosure; No Positions