Gold is an important asset class to own in a portfolio. However how much gold one should hold depends on an individual risk tolerance, goal and other factors. Regardless of the percentage of allocation, there are a few points to remember about investing in gold. Unlike stocks or bonds gold does not produce periodic income. As a commodity the price of gold is dependent on a multitude of factors including supply and demand. Since gold does not pay a dividend or interest, a gold investor is purely betting on price appreciation.

Despite the many disadvantages of the yellow metal, there are many advantages as well. Factors such as hedging against inflation, store of value, hedge against fiat currency collapse, safe haven during adverse market conditions, etc. tilt the scale in favor of gold. There have been many periods where gold has outperformed stocks. In fact, gold has beaten stocks as represented by S&P 500 from 2000 thru the end of 2018 according to a report at U.S. Funds.

From the report:

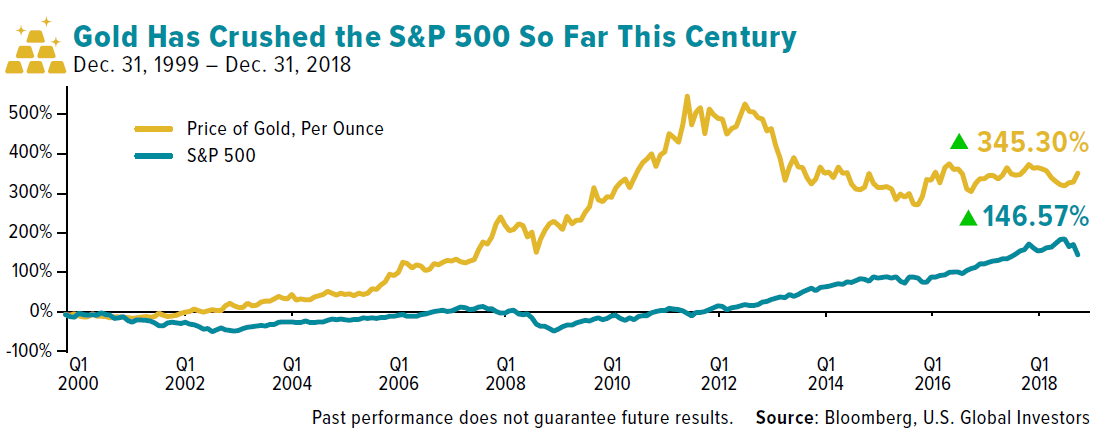

After gold swiftly rose from around $200 per ounce in 2002 to over $1,900 in 2011, it took a tumble over the next few years, finally steadying at $1,280 by the end of 2018. The yellow metal is known as a store of value and hedge against drops in other asset classes. In fact, gold has actually outperformed the broader market for several time periods, despite its price swings.

While the S&P 500 finished 2018 down 6.24 percent, gold was down only 1.55 percent. Even more impressive is that for the century so far, the yellow metal has returned a massive 345.30 percent, while the S&P has only returned 146.57 percent. Gold, after all, has historically had a strong negative correlation with the market. Despite gold trending lower from its 2011 peak, investors continue to see its value.

Source: Two Key Drivers of Gold Demand: Fear Trade and Love Trade, U.S. Funds

So the key takeaway is that gold can yield better returns than stocks sometimes. So investors have to allocate some portion of their net assets to gold. During bear market gold investments will offer a cushion to a portfolio and can generate higher returns during bull markets.

Related ETFs:

Disclosure: No Positions