Gold offers excellent protection to a well diversified portfolio during market crashes. Gold, as an asset class is not a great tool for generating income. However when markets head south most investors dump stocks and try to seek refuge in assets like gold. In general, gold tends to perform well during crises. For example, during the Global Financial Crisis(GFC) 2007-2009, the S&P 500 fell nearly 53% but gold actually went up by over 20%. The difference in returns is of course over 70%. Similarly during the dot com collapse also gold performed very well.

In the current crisis also gold should perform well relative to other assets.

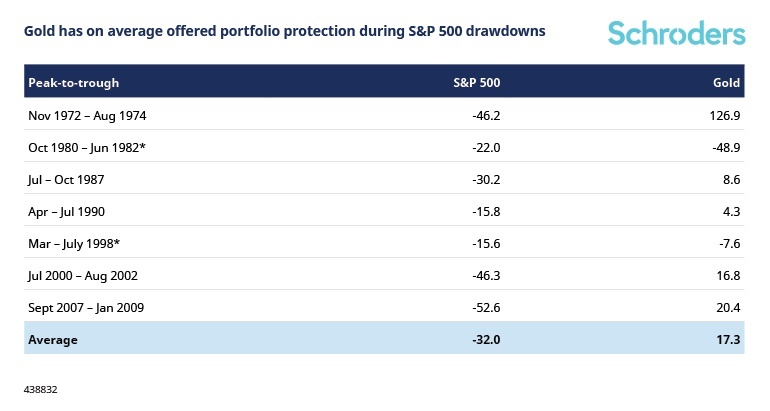

The following table from a recent article at Schroders compares the returns of S&P 500 and gold during drawdowns:

Click to enlarge

Past performance is not a guide to future performance and may not be repeated.

Source: Refinitiv Datastream and Schroders. Notes: S&P 500 drawdown calculated as change in index price level from peak to trough. *Exceptions in 1980-1982 can be attributed to real yields jumping from -5% to 8% while dollar debasement fears subsided, and in 1998, when the Asian Financial Crisis triggered a rapid reversal in Asian gold jewellery demand.

Source: Is now the time to own gold?, Schroders

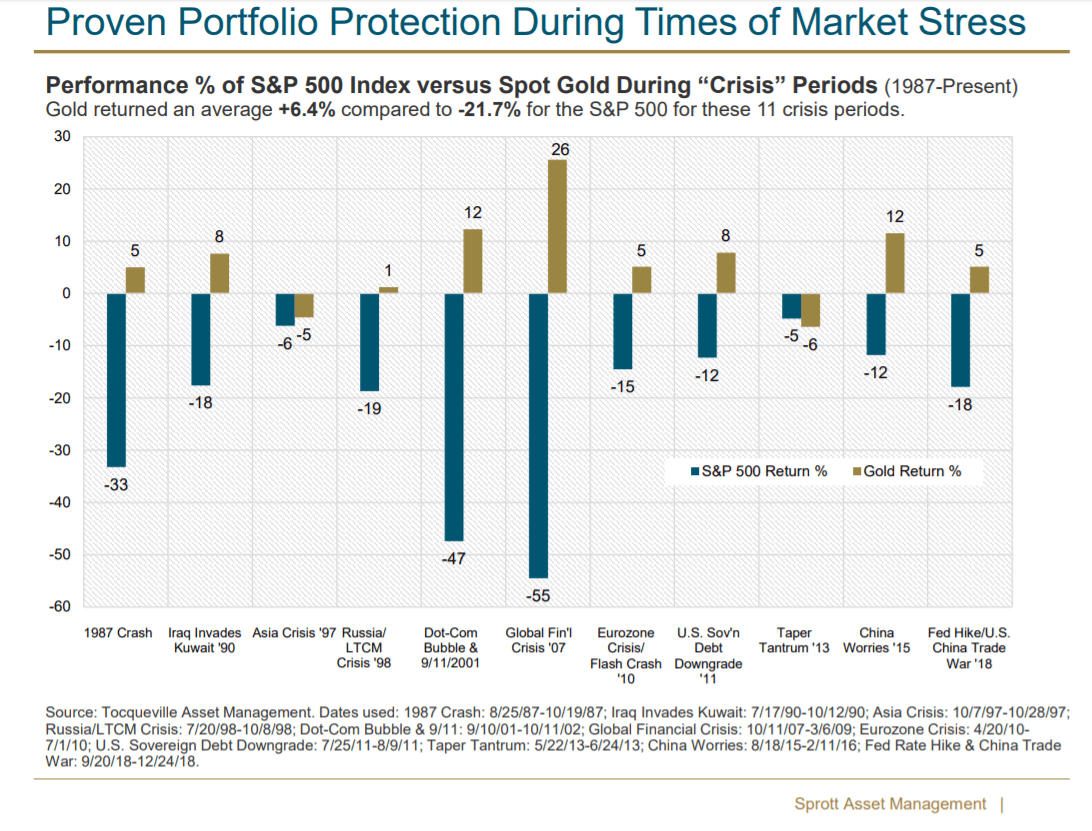

Below is another interesting chart that shows the performance of gold vs. S&P 500 during the past 11 crises periods:

Click to enlarge

Source: Sprott Asset Management

Related ETFs:

Disclosure: No Positions