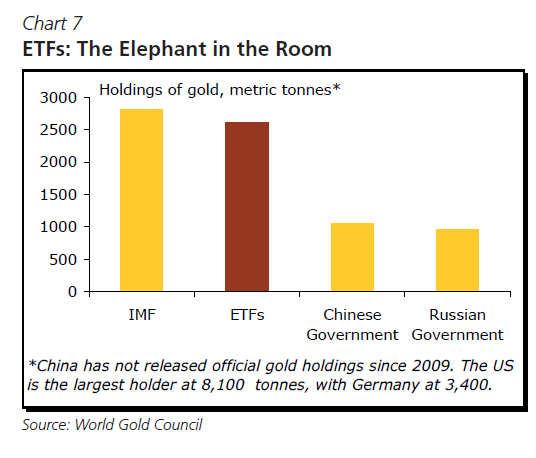

Many Central Banks were the sellers of gold from 2002 to 2009 during which time gold prices rose steadily.As they sold, private investors have been the net accumulators of gold many via the ETF route. As a result, currently ETFs hold more than 2,500 metric tons of the stuff approaching the holdings of the mighty IMF. The top holders of gold are shown in the chart below:

Click to enlarge

Source: Why Gold’s Lustre Will Fade (In Focus) (Feb 21 2013). CIBC World Markets

It is indeed interesting to see how much gold ETFs have become popular with the investing public.

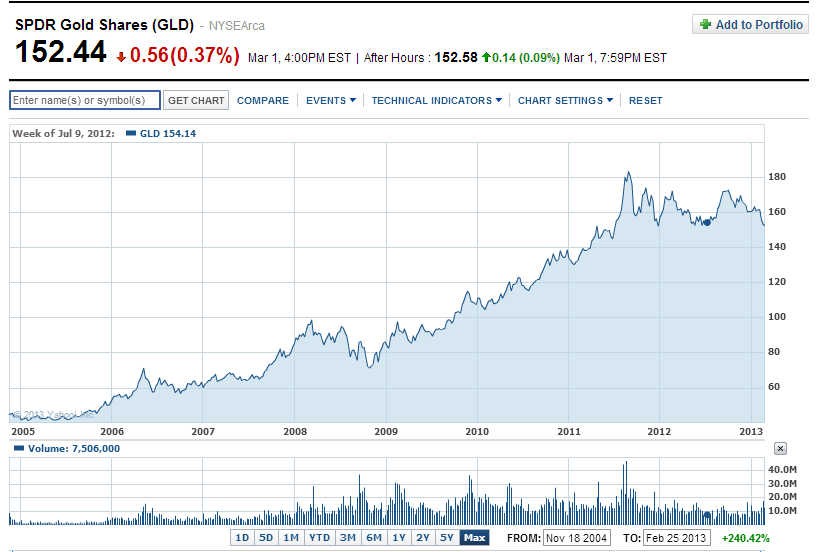

SPDR® Gold Shares (GLD) is the largest gold ETF in the world. It was listed first on the NYSE in November 2004. According to the provider’s site:

SPDR® Gold Shares is the largest physically backed gold exchange traded fund (ETF) in the world. SPDR® Gold Shares also trade on the Singapore Stock Exchange as well as the Tokyo Stock Exchange and the Stock Exchange of Hong Kong.

As of today, the trust holds 1,53.88 tons of gold worth over an astonishing $63.0 billion.Here is the long-term return of this ETF:

Source: Yahoo Finance

Disclosure: No Positions