Treasury Inflation-Protected Securities (TIPS) are a type of security sold by the US Treasury. They sell for a term of 5, 10 or 30 years. TIPS offer many advantages to investors including as a hedge against inflation, diversification benefits and tax efficiency. During times of inflation, TIPS can provide higher levels of income and higher total return than other nominal treasuries since TIPS adjust for inflation. Below is a brief description of TIPS from Treasury Direct site:

As the name implies, TIPS are set up to protect you against inflation.

Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.

When the TIPS matures, if the principal is higher than the original amount, you get the increased amount. If the principal is equal to or lower than the original amount, you get the original amount.

TIPS pay a fixed rate of interest every six months until they mature. Because we pay interest on the adjusted principal, the amount of interest payment also varies.

You can hold a TIPS until it matures or sell it before it matures.

Source: Treasury Direct

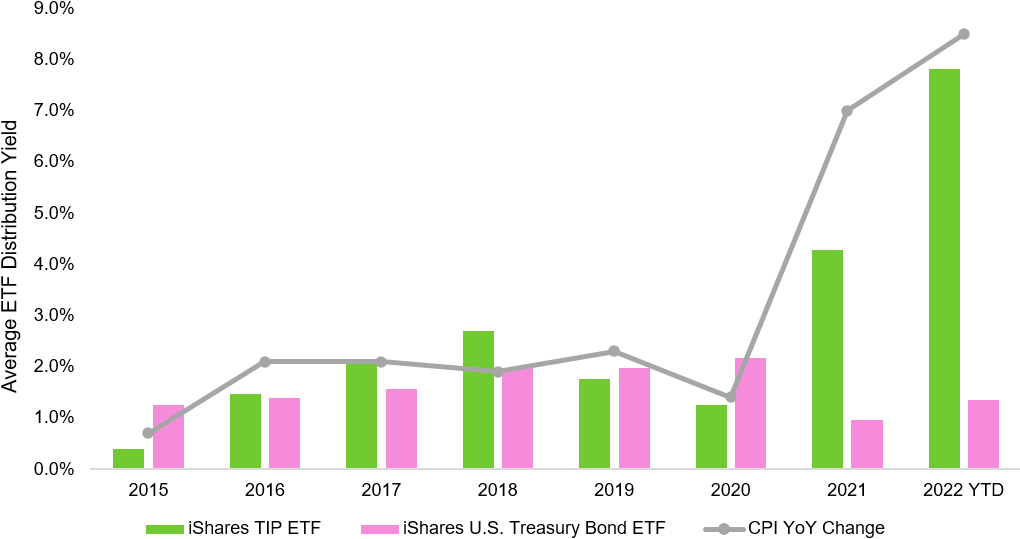

The following chart shows the performance of TIPS in terms of income generated by inflation-protected securities based on iShares TIP ETF, TIP and iShares U.S. Treasury Bond ETF, GOVT:

Click to enlarge

Source: 3 reasons investors should consider TIPS — even if inflation slows down, iShares

Two TIPS ETFs:

Two of the largest TIPS ETFs on the market are the iShares TIPS Bond ETF (TIP) and the iShares 0-5 Year TIPS Bond ETF (STIP).

The iShares TIPS Bond ETF (TIP) has an asset base of over $22.0 billion as of Feb 3, 2023 and the expense ratio is 0.19%. It closed at $108.21 on Friday. The ETF is up by 2.62% YTD.

The iShares 0-5 Year TIPS Bond ETF (STIP) has an asset base of over $13.0 billion as of Feb 3, 2023 and the expense ratio is 0.03%. It closed at $97.54 on Friday. The ETF is up by 1.07% YTD.

Disclosure: No positions