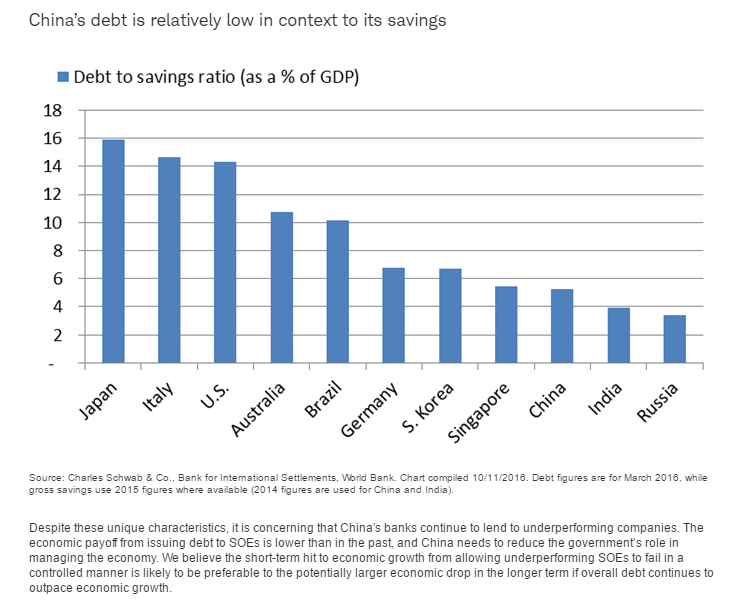

China is creditor country while the US is the largest debtor country in the world. China has also one of the low debt to savings ratio in the world as shown in the chart below:

Click to enlarge

Source: 5 Big Risks Posed by China (And Why They Shouldn’t Crash Global Markets in 2017) by Michelle Gibley, Charles Schwab

China’s debt to savings ratio(as a % of GDP) is especially low when compared to developed countries.