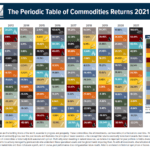

Commodities have been in a downward trend for many years now though they have recovered slightly this year. As China’s voracious appetite for all types of commodities decreased commodities declined sharply. Other countries were unable to drive the demand like China did.

According to a report from Schroder’s China’s demand for commodities created a super cycle in commodity prices. From the report:

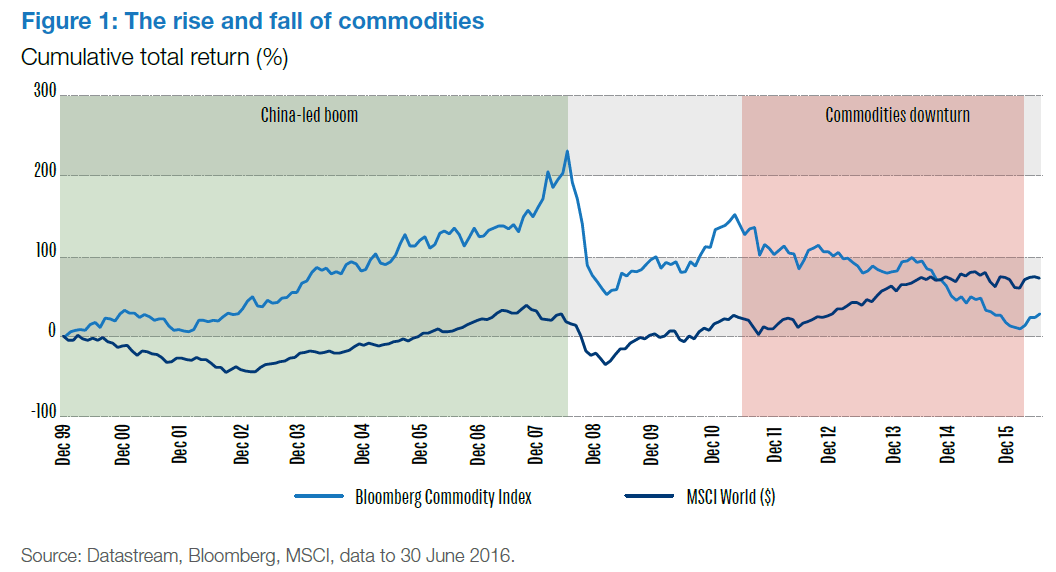

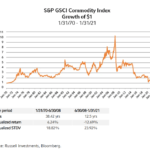

Between December 1999 and June 2008, the Bloomberg Commodity Index (BCOM, previously known as the Dow Jones-UBS index) delivered total returns of around 15% a year with similar volatility to equities, during a period where equities barely broke even 2 (Figure 1).

Click to enlarge

Note: 2.BCOM was established in 1991 and is more diversified by commodity than the longer standing S&P GSCI index (GSCI, established 1970), which has an over 70% allocation to the energy sector. In this paper we have used BCOM to represent commodity returns where possible as it is more reflective of the broader commodity universe. However, when longer term analysis has been carried out we have used the GSCI as a result of its longer track record.

Source: Reappraising the case for commodities by Duncan Lamont, Schroder’s

Commodities are down 50% from their 2011 peak based on the Bloomberg Commodity Return Index. They are off by 60% based on another benchmark, the GSCI return index.

A few points to remember about commodity investing:

- Commodities can be highly volatile relative to equities.

- Investing in commodities either directly or thru derivative products like futures are not suitable for most retail investors.

- Investors in oil have to understand and deal with unique situations such as Contango.

- Though Wall Street has been pushing commodities as another asset class to retail investors, they are not. Other than a few exceptions like gold most other commodities are best avoided.

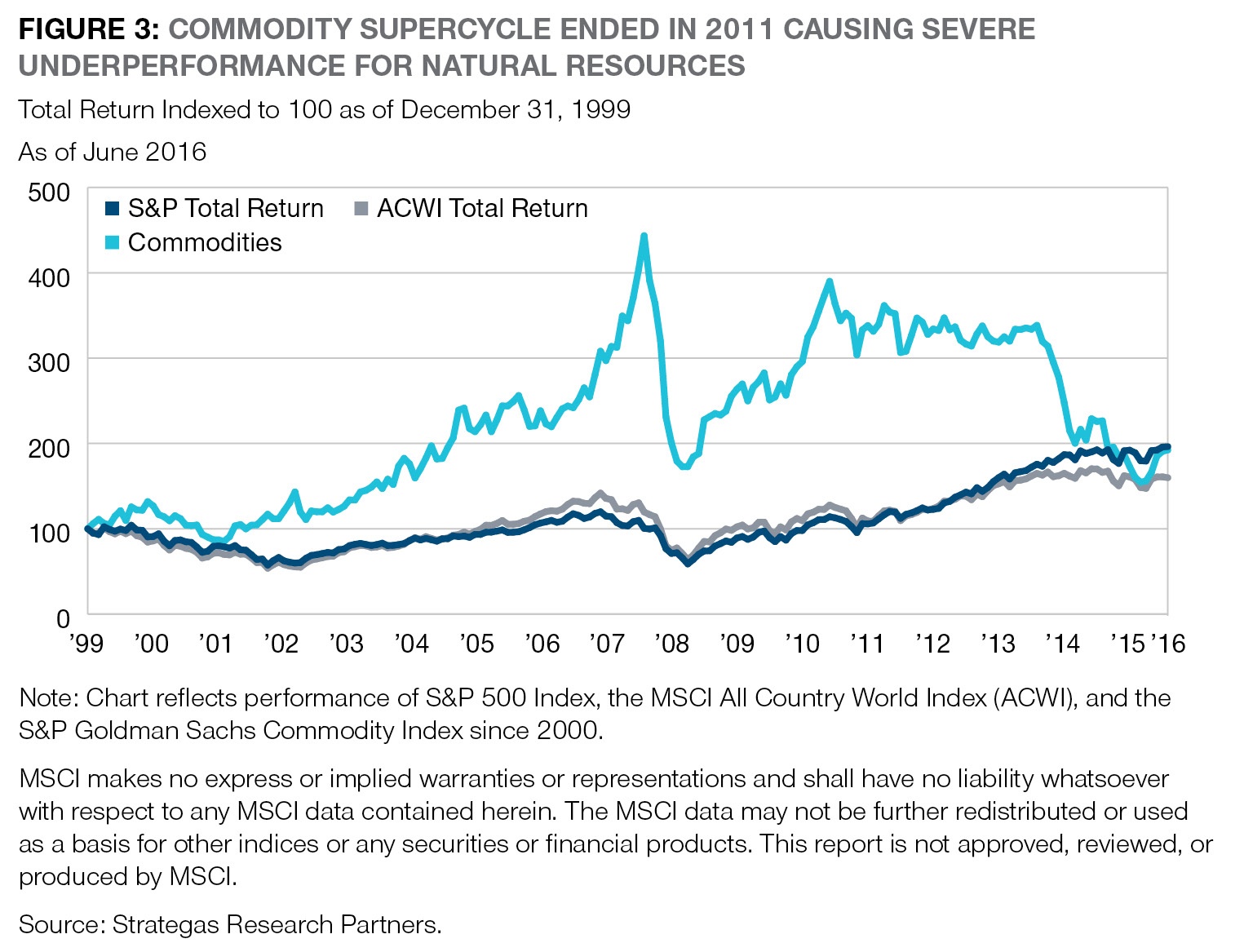

Here is another chart comparing the performance of commodities and equities:

Click to enlarge

Source: Natural Resources – Uncovering Opportunity in a Secular Commodity Bear Market, T.Rowe Price