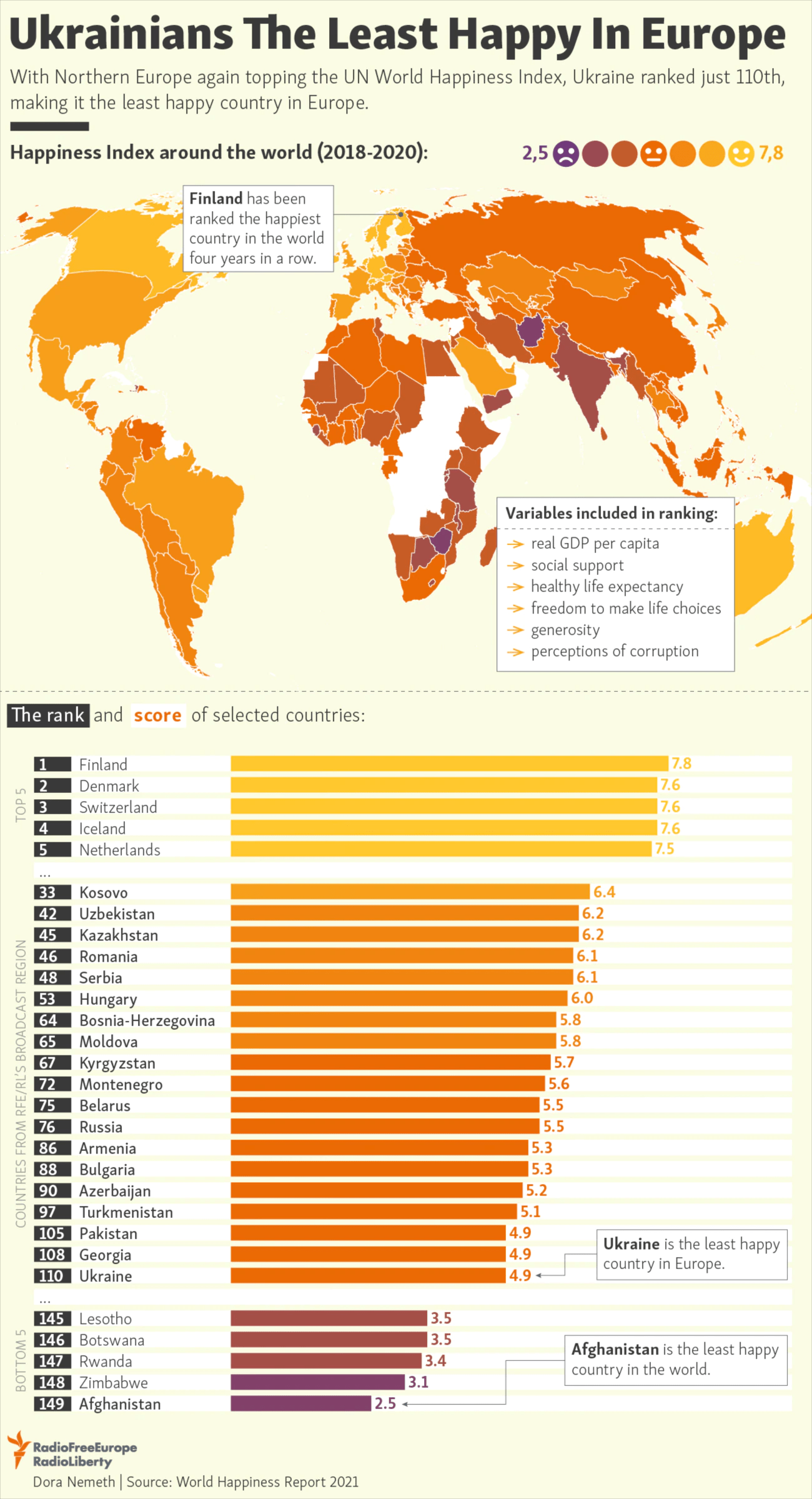

The most and the least happy country in the world are shown in the graphic below. For four years in row, Finland was the most happy country followed by Denmark and Switzerland. Ukraine was the least happy country in Europe and Afghanistan was the least happy country in the world.

Click to enlarge

Source: RFE/RL Infographic