I have written many times in the past on the impact geopolitical crises on equity markets. The overwhelming research shows that markets are more driven by other factors such as earnings, interest rates, inflation, recession, etc. than crisis events. You can find some of the past posts here and here and here and here. Recently while researching on this topic I came across another article at BMO where the authors came to the same conclusion. The following is a brief excerpt from that piece:

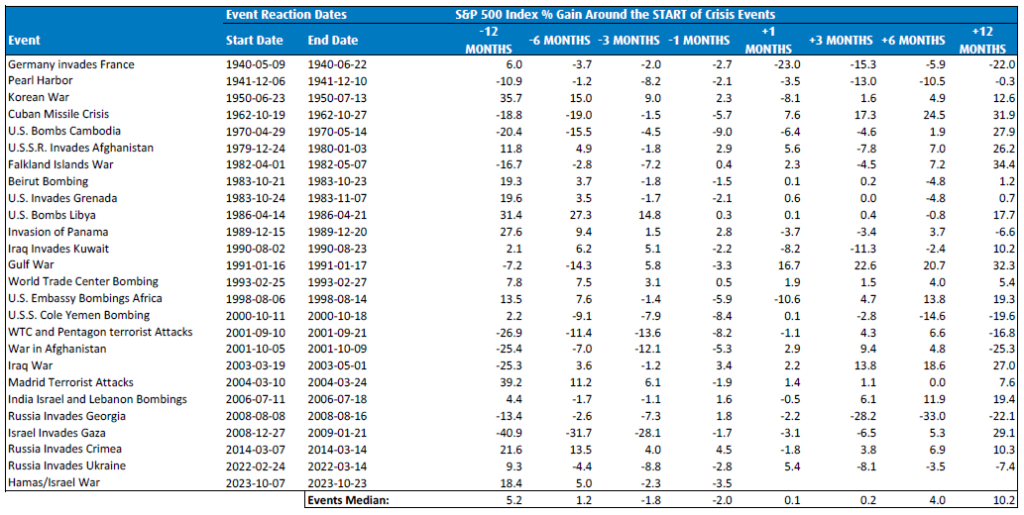

Returning to the conflicts in the Middle East and Ukraine, we have long maintained that exogenous shocks tend not to have a long-lasting impact on the markets and that the economic cycle and interest rates are by far the most important drivers of financial asset returns. We stand by that view. Figure 3 shows the market impact of different military conflicts, and the results are clear: a negative initial reaction with a subsequent recovery in the vast majority of cases. Going back to 1940, the median downdraft was 2% in the month leading up to the event, followed by a gain of 10% in the subsequent year.

Figure 3: Market Impact of Major Military Conflicts

Click to enlarge

Source: War and Higher Rates: A Volatile Mix, BMO

The key point to remember is that markets have the ability to sustain all types of external shocks and investors need to focus on their long-term goals and should not make knee-jerk reactions by liquidating a portfolio for instance.