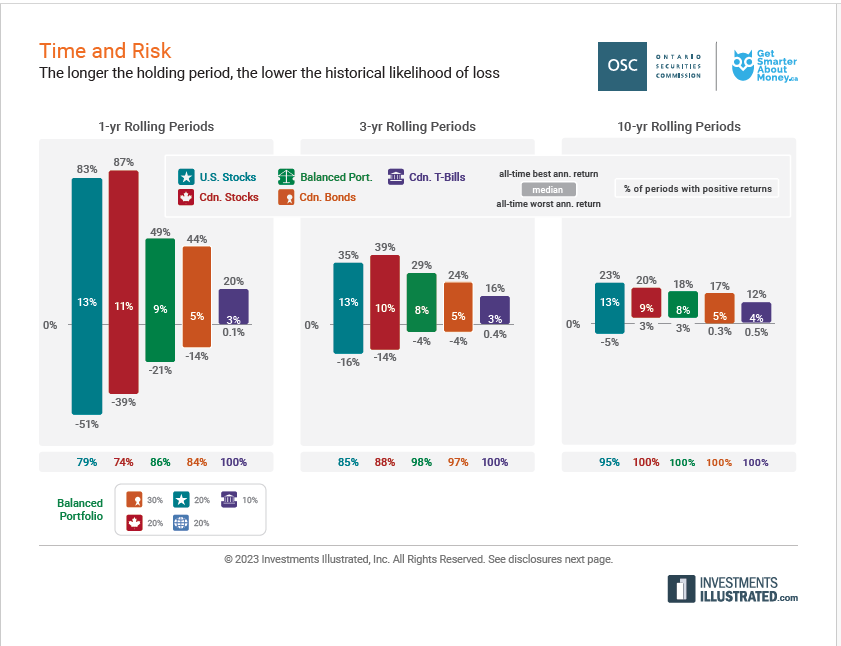

The relationship between time and risk is inversely proportional. The longer time one holds an asset the loss of risk reduces. This is true with equity and other markets. So the easiest way to avoid loss is to hold stocks for the longer term. Engaging in risky behaviors like day-trading will only lead to loss and stress. The following chart shows the importance of holding assets over longer periods:

Click to enlarge

Source: Ontario Securities Commission

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Vanguard Total Bond Market ETF (BND)

- SPDR® Barclays High Yield Bond ETF (JNK)

- iShares Core Total U.S. Bond Market ETF (HYG)

- iShares TIPS Bond ETF (TIP)

- iShares MSCI Canada Index Fund (EWC)

Disclosure: No positions