When US investors consider overseas markets for investments they rarely consider Russia. Unlike other major emerging markets Russia does not appear on the radar of American investors because of many

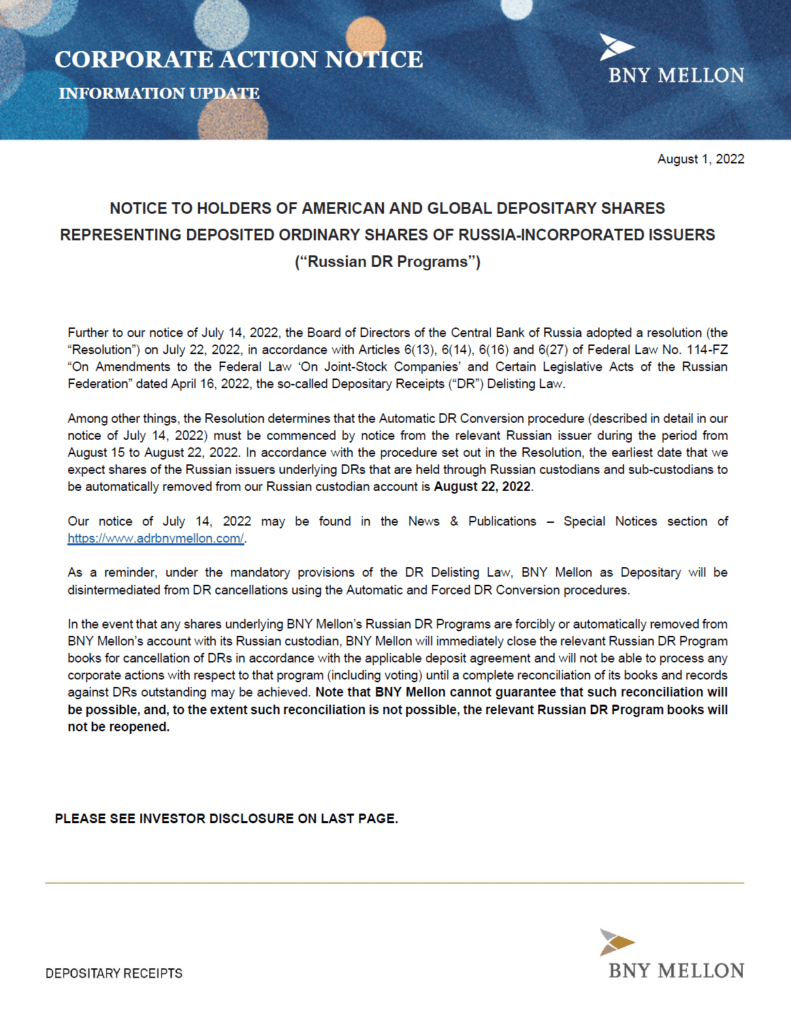

Note #1: Trading of Russian Companies on US Stock Exchanges Halted (Effective Feb 28, 2022)

consider it to have a weak economy, a dictatorship form of government, lack of transparency, poor enforcement of laws and regulations, no leading technological companies, etc. However nothing could be farther from the truth. For investors willing to dig deep plenty of opportunities can be found in the Russian equity market. I recently came across two articles that offered excellent insights on why investors ought to explore Russian stocks.

From the article titled The Contrarian Investment Case for Russian Stocks by Frank Holmes at U.S. Global Investors:

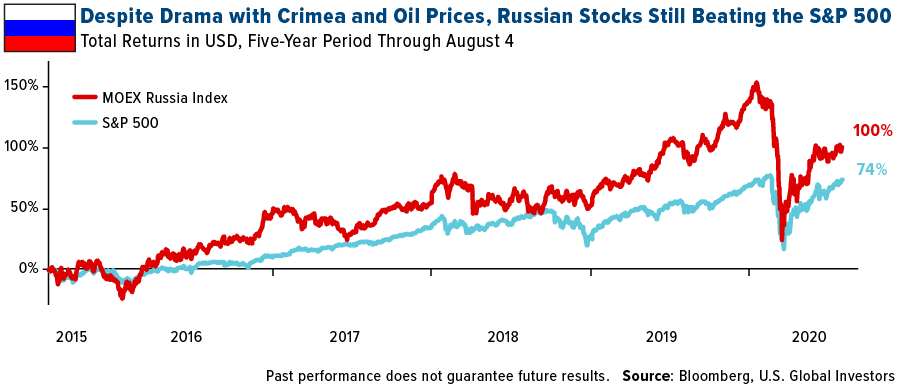

Russian stocks, as measured by the MOEX Russia Index, turned positive for the year on Tuesday of this week after plunging 30 percent due to the pandemic. This puts them slightly behind the S&P 500, but did you know that, despite the drama surrounding the annexation of Crimea and volatile oil prices, stocks trading on the Moscow Exchange have beaten U.S. equities for the five-year period? Even when priced in U.S. dollars, the MOEX is up 100 percent, compared to the S&P, up 74 percent as of August 4.

This resilience helps support the idea of wisdom of crowds and the power of contrarian thinking. Think of all the bad press Russian stocks have had to overcome during the past few years, from international sanctions to U.S. election meddling. The MOEX slipped to a four-year low in March 2014 after the U.S. slapped Russia with fresh sanctions for violating Ukrainian sovereignty, after which it followed a mostly upward trajectory until the pandemic put the brakes on the rally.

Source:The Contrarian Investment Case for Russian Stocks, U.S. Global Investors

In addition, Frank also noted valuation wise that MOEX index was trading at just 8.6 times earnings. This is much cheaper the US, European and other emerging markets. The dividend yield offered by Russian companies is also very high at 6.4% compared to under 2% for the S&P 500.

Below is an excerpt from an article by Nicole Vettise at Franklin Templeton:

In our view, Russia is in an enviable position when looking at a number of fundamental factors; it has very little sovereign debt, a current-account surplus and considerable foreign exchange reserves of US$570 billion, equivalent to 33% of its gross domestic product (GDP).1

Oil—an old economy sector—is Russia’s bread and butter, representing 35% of its GDP and 70% of exports. Therefore, it’s fortunate that Russia enjoys a number of advantages over many (or most of) its international peers such as low cost of production, costs denominated in local currency and—perhaps driven out of necessity from years of sanctions—a keen interest in developing its own technology to improve efficiency.

Take one of Russia’s top tier vertically integrated oil companies. It benefits from a strong balance sheet, long-term reserves estimated to be more than 18 years and is free cash flow positive with oil priced at just US$15 a barrel. Furthermore, it operates in a progressive-tax-regime environment, so when the price of oil declines, the government bears the cost and margins are almost unchanged.

In recent years, the company has been embracing technology and innovation through its own research and development lab, investing in upgrading its refineries and developing techniques to improve efficiencies and drive down costs.

New Economy Thriving

Elsewhere in Russia, the new economy is thriving. Russia’s leading bank, originally founded in 1841 by order of the Russian Tsar Nikolai I, is steeped in history but today claims to “compete with global technology firms, whilst remaining the first choice bank for retail and corporate clients.”

Certainly, from a traditional banking perspective, it appears impressive, as it reports that it services 70% of Russia’s population of around 92 million people through 15,000 branches.

But it is so much more than a traditional bank. Its digital eco-system incorporates artificial intelligence (AI), big data and robotization. Already it reports that 40% of client queries are solved by its chat box, and it has created its own private cloud and collaborated with others to offer services such as video streaming, e-education, restaurant bookings and ride sharing.

Similarly, Russia’s leading search engine has built an impressive ecosystem. Already successfully competing with Google, it offers services such as e-commerce, ride sharing and online music in a similar fashion to Apple Music. Initiatives include a Russian version of Netflix with a plan to create its own content, and it is even developing autonomous cars.

Source: Time to Revise Outdated Perceptions of Russia?, Franklin Templeton

Despite all the positive aspects of investing in Russia, it should be noted that like any other foreign country there are many risks as well. Political risk is one major risk that investors have to pay attention to before jumping into Russian equities.

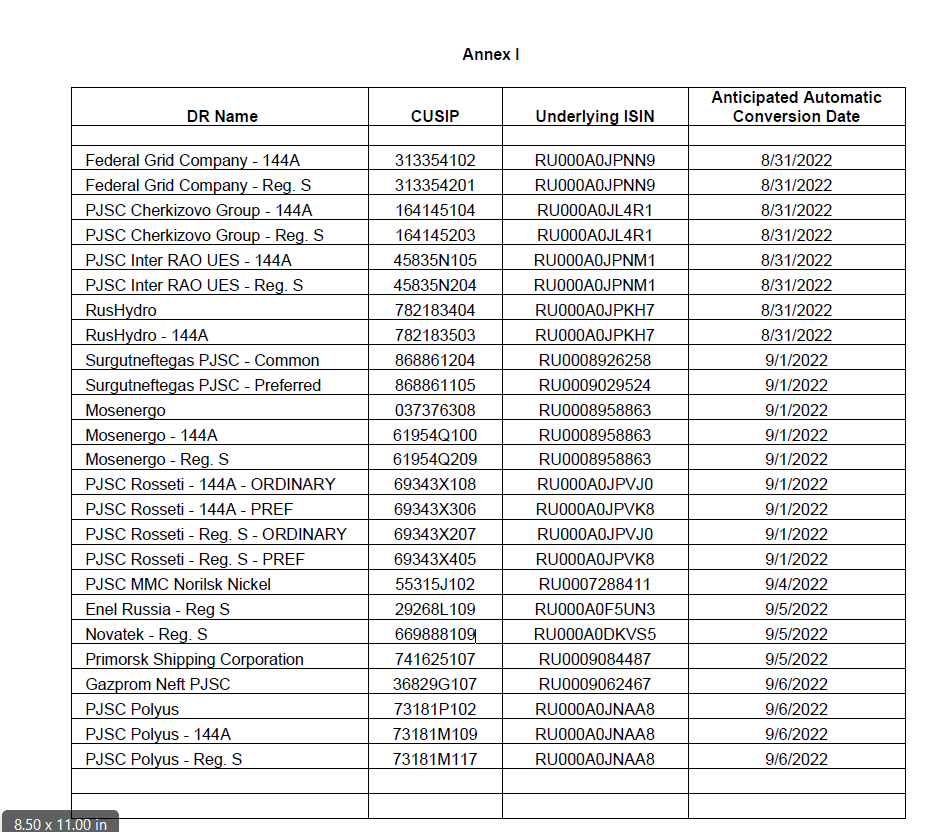

Some of the notable Russian companies trading as ADRs are oil companies Gazprom (OGZPY) and Lukoil (LUKOY), banking group Sberbank (SBRCY) and mining giant Norilsk Nickel (NILSY).

The complete list of Russian ADRs trading on the US markets can be found here.

Disclosure: No Positions