Airlines generally tend to perform well when the economy where they are based at is in expansion mode. This has been the case with Latin American airlines. Latin American carriers have performed poorly recently due to the adverse economic conditions in countries like Brazil, Chile, Colombia, etc.

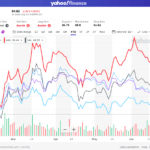

Panama-based Copa Holdings SA (CPA) which operates Copa Airlines is down over 50% year-to-date and so is Chile’s LATAM Airlines Group S.A. (LFL). In the past five years CPA has declined by about 4%. From a high of over $160 in 2014, the stock price closed at $49.99 today. This shows the dramatic decline airline investors can expect. Until mid-2014, Copa was a hot stock among the airline stocks. LATAM is down an astonishing 82% in the past five years. As the airline focuses mainly on Brazil and Chile, the economic suffering of those countries has impacted the airline’s earnings. LATAM was formed a few years after LAN Chile merged with TAM of Brazil.

The relatively new ADR of Avianca Holdings S.A. (AVH) has plunged by nearly 67% year-to-date. Avianca, based in Colombia, also had great potential when it was listed.Mexico-based Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (VLRS) is reaping the benefits of the strong US economy. The airline is a major operator of low-cost flights between many US and Mexican cities. With rising traffic by Mexicans and tourists alike, the airline is performing well in recent months. The stock is has nearly doubled so far this year.

Brazilian carrier Gol Linhas Aereas Inteligentes’ (GOL) ADR is down by 85% year-to-date.

In summary, investing in airline stocks is not a great idea. Most US airline stocks were awful for investors for many years. Only recently they have gained some traction upwards. Similarly in Latin America, economic turbulence has hit airlines pretty hard. So from an investment point of view, it is better to stay away from Latin American airlines for now.

Disclosure; No Positions