The Global Finance magazine has published its first-ever ranking of the Safest Banks in Emerging Markets. While the banking industry in the developed world is struggling to gain some credibility, investors are increasingly focusing their attention on emerging market banks which are much more risk-averse and have better potential for growth. In fact, many developed banks such as HSBC plc (HBC), Bank of Nova Scotia (BNS), etc. are expanding their operations in emerging countries to earn higher profits.

From the Global Finance report:

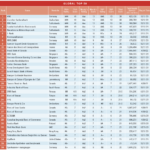

We evaluate the ratings and total assets of the main players in developing economies to create the rankings—providing an overview of the key banks in each region and which financial institutions offer the greatest security. Winners were selected through an evaluation of long-term credit ratings—from Moody’s, Standard & Poor’s and Fitch Ratings—and total assets of the 500 largest banks in emerging markets.

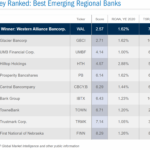

The rankings clearly show the ever-growing dominance of China’s banks both within Asia and throughout the emerging markets. Chilean and South Korean banks also feature prominently in the rankings, as do those of Kuwait, Saudi Arabia and the UAE.

The Safest Emerging Market Banks 2011:

[TABLE=1048]

Banco de Chile(BCH) and Banco Santander-Chile (SAN) currently have dividend yields of more than 4%. In spite of turmoil in global equity markets since the Global Financial Crisis (GFC) both the banks have performed very well. An investment of $10K five years ago in each bank would have grown to over $28K and $19K respectively according to S&P data.

Though many South Korean banks are present in this list, they are average to poor performers and hence they can be avoided. It is interesting to note that none of the banks from India, Brazil and Russia made it to this ranking.

In August 2010, I mentioned Czech-based Komercni Banka(KMBNY) in an article on foreign bank stocks trading on the OTC market.

Disclosure: Long BCH