****** UPDATE ****:

For the 2021 tax rates go to: Dividend Withholding Tax Rates By Country 2021

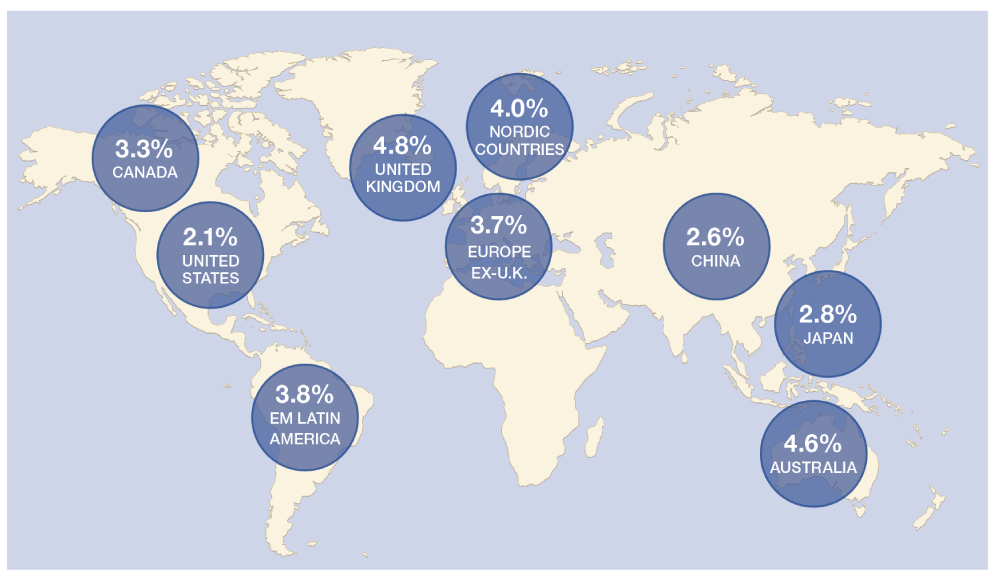

One of the factors that investors need to consider when investing in foreign stocks is taxes since it reduces the effective rate of return on an investment. Governments of most countries try to recoup millions in taxes from dividends that are paid to foreign investors by companies located in their countries. For example, when a U.S.-based investor invests in France Telecom (FTE) ADRs, the French government will deduct 25% in taxes on all dividends paid. Hence though TEF currently has a 6.98% dividend yield, the actual yield that this investor receives will be less. However the IRS allows a foreign tax credit (filed with IRS Form #1116) to be taken using which this investor can deduct the taxes paid to the French government. This is done to avoid double taxation of dividends. There is a maximum limit to this tax credit.

A few countries do not charge any taxes on dividends paid to foreign investors. So foreign investors receive the entire dividends paid by companies based in those countries. For example, the U.K. charges no taxes on dividends paid by British companies (excluding REITS) to U.S. investors. So an investor in National Gird Plc (NGG) will receive the complete dividends paid at the current dividend yield of 4.68%.

*Companies incorporated in mainland China and listed in Shanghai and Shenzhen. These companies are quoted in Renminbi and are only available to Mainland and Qualified Foreign Institution Investors (QFII).

** Companies incorporated in mainland China and listed in Shanghai and Shenzhen. B-shares in Shanghai are traded in U.S. dollars, while B-shares in Shenzhen are traded in Hong Kong dollars. B-shares are available to mainland and foreign investors.

***Companies incorporated in mainland China and listed on the Hong Kong Stock Exchange.

^Companies incorporated in Hong Kong and listed on the Hong Kong Stock Exchange.

Source: Dow Jones Indexes, Other

Note: Please note that the above information is known to be accurate from the sources used. These rates do not apply to non-U.S. residents. Consult with a tax adviser before making any investment decisions.

Some points to remember before investing in foreign stocks:

1. Germany charges 26.4% tax on dividends only on stocks held in taxable accounts.

Update (2/23/17): Germany charges dividend withholding taxes on stocks held in any qualified retirement account such as a Roth, Traditional IRA, etc.

2. The following countries have tax-treaties with the U.S. which allows favorable treatment of dividends earned by US investors investing in those countries:

Australia, Austria, Bangladesh, Barbados, Belgium, Canada, China, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Kazakhstan, Korea, Latvia, Lithuania, Luxembourg, Mexico, Morocco, Netherlands, New Zealand, Norway, Pakistan, Philippines, Poland, Portugal, Romania, Russian Federation, Slovak Republic, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Thailand, Trinidad and Tobago, Tunisia, Turkey, Ukraine, United Kingdom, and Venezuela.

Source: The IRS

Without the tax treaties U.S investors will pay higher taxes. The Netherlands has a statutory tax rate of 25%. But due to the special tax treaty with the U.S., American investors in Dutch companies are charged only 15% as shown in the table above.

3. It is generally not advisable to hold foreign dividend-paying ADRs in IRAs and other non-taxable accounts since one cannot recover the taxes paid to a foreign country.

4. Canada charges a 15% tax on dividends held in non-taxable accounts. But due to a policy change in 2009, dividends and interest income are exempt from this 15% tax if the investments are held in IRA or 401(K) accounts. So U.S. investors can hold Canadian banks such as bank of Novo Scotia (BNS), Royal Bank of Canada(RY) or other dividend-paying stocks like Enbridge (ENB)Â in their IRAs for the long-term without worrying about taxes on dividends.

5. Though the above table shows that Chile has a 35% withholding tax rate, in my personal accounts the depository has deducted only about 22% in taxes on my Chilean dividends. This could be due to any recent change in Chilean tax laws.

For more information about U.S. tax treaties with other countries refer to the Publication 901 on the IRS web site.

Click to download:

- Withholding Tax Rates by Country (as of Feb, 2013) document in pdf (Source: Dow Jones Indexes).

- Withholding Tax Rates by Country (as of March, 2012) document in pdf (Source: Dow Jones Indexes).

- Withholding Tax Rates by Country (as of Sept, 2010) document in pdf (Source: Dow Jones Indexes).

Also checkout:

- Withholding Taxes on Dividends, Interest and Royalties by Country (Source: Deloitte International Tax Source)

- Compare Tax Treaty Rates Between Countries for Dividends, Interest and Royalties (Source: Deloitte International Tax Source)

- Claiming Foreign Taxes: Credit or Deduction?, April 2013 (Charles Schwab)

- Dividend Withholding Tax Rates By Country 2014 *** NEW

Disclosure: Long BNS, RY

Dan

You can find the latest rates my new post here:

https://topforeignstocks.com/2014/10/03/dividend-withholding-tax-rates-by-country-2014/

Germany will take out taxes even if you hold stocks in IRA accounts. The current tax rate is just over 26.375%.Check out this link:

https://www.adr.com/Site/LoadPDF?CMSID=ad0b36adb70749b18f2ba35da8e56c0d

But my broker has deducted only 21% last year in regular and IRA accounts for last year.

So you can assume it will be the 26.375% and hope your broker takes out only 21%. Hope this helps.

Thanks.

Hi David,

Thank you very much for your paper, very extensive and correct for the EU countries I know. Belgium changed recently the rules: 33% on dividends.

As an options non-professional trader, it is quite difficult to know how I will be taxed.

I am looking for an EU country to expatriate where I will not be taxed on my capital AND taxed below 15 % on my annual profit. I exclude Monaco, Andorre, Gibraltar and eastern countries.

I read that Greece is not taxing portfolio profit, but is it still true ?

Thank you for your help.

Victor

Thanks for the comment.I will update the info for Belgium.

Unfortunately I do not have answer to your question.Since your situation is unique you may want to research online on this issue or contact your broker or tax advisor for help.

Thanks

-David

Please reply with withholding rate for Monaco as I hold stock DLNG. Thank You for time and reply.

Kay Mare

Kay

Monaco has 0% for dividend withholding tax rate. So you should not have any taxes withheld on your dividends from DLNG.

See the source here:

https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-withholding-tax-rates.pdf

Hope this helps. Good luck !

-David

Great article. I learned a lot from the info ! Does anyone know where my assistant might be able to get a blank IRS 1042 document to type on ?

You indicated that Germany ADR’s do not tax Roth IRA’s. I am being taxed for Siemens ADR.My broker told me that the money goes to the IRS. It’s not worth it to fill out form 8802 and pay an $85.00 fee for each year. How do I get the IRS citation as indicated in the article? How do I get this not withheld from my account? The response I got from Siemens referred me to the German tax website to fill out forms for reimbursement and submit the 6106 that the IRS would send me after submitting the 8802 with a fee. Is there any relief?

Michael

Sorry for the delayed repky. You are correct. Germany does charges withholding taxes on stocks held in Roth IRAs. I also paid such taxes in my Roth and I believe there is no way to recoup it. Unless a country specifically does not charge this tax for qualified retirement acocunts – like Canada for example – brokers will deduct the tax.

The latest US-German tax treaty details are found here:

https://www.irs.gov/businesses/international-businesses/germany-tax-treaty-documents

I am not sure about the IRS citation I used in my post back in 2011.

Like you experienced with Siemens, I doubt companies will help us recoup the taxes. I am afraid there is no way to recoup. Maybe it is possible if you are willing to put in lots of hours to deal with tax authorities and do the complicated paperwork. For me personally it is not worth it since I do not own thousands of shares.

Hope this helps.

-David

Author: Gene

Email: [email protected]

URL:

Comment:

I own TOT. Some shares are held in an IRA and some in a non IRA account. Why is the withholding tax for the stock dividends in the IRA a greater amount than the tax withholding amount for the stock dividends held in the non IRA account? Also, why is the ADR fee for the ADRs held in the non IRA account greater than the ADR fee for ADRs held in the IRA account?

Hi Gene

Sorry for the delayed reply. I lost your comment during database cleanup. So cut and posted it above myself.

1.The dividend withholding tax in the IRA is usually lower than non-IRA accounts, although not for all countries. Otherwise it must be the same. I am not sure why it is higher for you in the IRA account. It is possible, the higher rate is due to the period you held the TOT shares.

From Total website:

In the United States: taxation on the dividends of

Total shares not held in an IRA (Individual Retirement

Account) depends on the length of time the shares were

held (their holding period). “Qualified dividends” (from

shares held for more than 60 days during the 121-day

period beginning 60 days before the ex-dividend date)

will be taxable at the preferential rates applicable to

long-term capital gains (i.e. 0%, 15% or 20%, depending

on the tax bracket). Other dividends are taxed at the

ordinary income tax rates (i.e. between 10% and 37%,

depending on the tax bracket). Investment income

(including dividends) is subject to an additional net

investment income tax of 3.8% (‘the Medicare tax’), if it

exceeds certain thresholds.

Link: https://www.total.com/sites/g/files/nytnzq111/files/atoms/files/ga-april-2018-en-web.pdf

2.The ADR fee must be the same regardless or IRA or non-IRA account. This is the first time I am hearing. Please contact the depository for the fee discrepancy. https://www.adr.com/drprofile/89151E109

Hope this helps. Thanks.