There are many reasons to invest in dividend-paying stocks. One of the reason for example is to earn income. Another critical factor to invest in these equities is to keep pace with or exceed the rate of inflation. Inflation is the mysterious force that stealthily decreases the purchases power of the dollar. So for example, the value of 1 dollar may be worth only 97 cents in April next year, 95 cents in April 2023, etc. This erosion in the value of the dollar can be called the scourge of inflation.

These days the Effective Fed Funds Rate is ultra-low at just 0.07 percent. The Fed has stated its intention to keep interest rates ultra-low for the foreseeable future. With interest rates so low, savers can only get only under 1.00% in interest rate for a 1-year CD. Earning this rate is less than the rate of inflation. Though keep cash in banks is safe and secure, savers will lose money by investing in CDs. CD rates in the past used to be decent. However for many years now CD rates for different time periods have declined as shown in the chart below:

Click to enlarge

Source: Historical CD interest rates: 1984-2021, Bankrate

With CD interest rates so low, savers are better off investing in high-quality dividend payers. In a recent article, Steven P. Greiner, Ph.D. of Schwab noted that dividends can help preserve purchasing power. From the article:

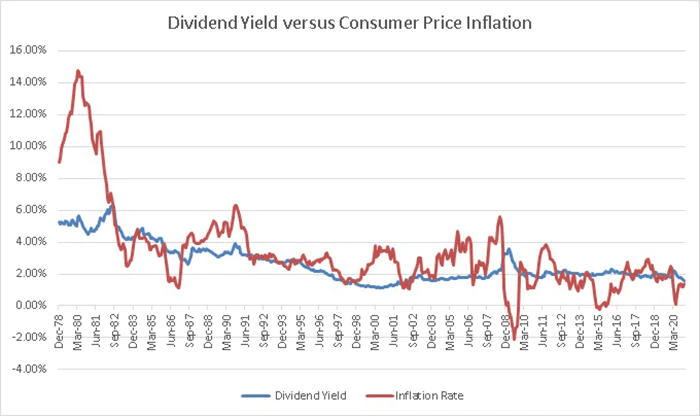

For retirees, on the other hand, the regular payouts from dividend-producing stocks have the potential to provide a steady stream of income. And whereas dividend yields from companies in the S&P 500 may have declined over time, it’s important to consider them in the context of inflation.

When inflation is high, it erodes your purchasing power, meaning your dividends must be greater to keep pace with rising prices. The opposite is also true: A low-inflation environment, like the current one, puts less pressure on income. Consequently, you want your dividends to regularly exceed, or at least keep pace with, the rate of inflation—something companies in the S&P 500 has been doing for the better part of five years (see “Preserving purchasing power,” below).

Preserving purchasing power

Dividends from companies in the S&P 500 may have declined, but they have surpassed inflation since 2012.

Source: Robert Shiller and the U.S. Bureau of Labor Statistics. Data are from 01/01/1979 through 12/31/2020. Past performance is no guarantee of future results.

Source: Why and How to Invest in Dividend-Paying Stocks, Schwab

Below are 10 S&P 500 constituents that pay dividends:

- Abbott Laboratories(ABT)

- Pfizer Inc (PFE)

- Walmart Stores(WMT)

- NextEra Energy Inc (NEE)

- Union Pacific Corp (UNP)

- FedEx(FDX)

- Emerson Electric Co (EMR)

- PPG Industries Inc (PPG)

- The Clorox Co (CLX)

- Kansas City Southern (KSU)

Disclosure: Long NEE, UNP

Dustin Cone

[email protected]

RYCEY is not a car manufacturer. BMW owns Rolls Royce Vehicles. Rolls Royce Holdings (RYCEY) is an aerospace and defense contractor, plus many more things. They sold the vehicle to BMW in the 90’s.

Dustin

Thanks for the clarification. Agree Rolls Royce is a Aerospace and Defense contractor and other things. For some reason the source I used had it classified as an auto maker. I have removed it now.