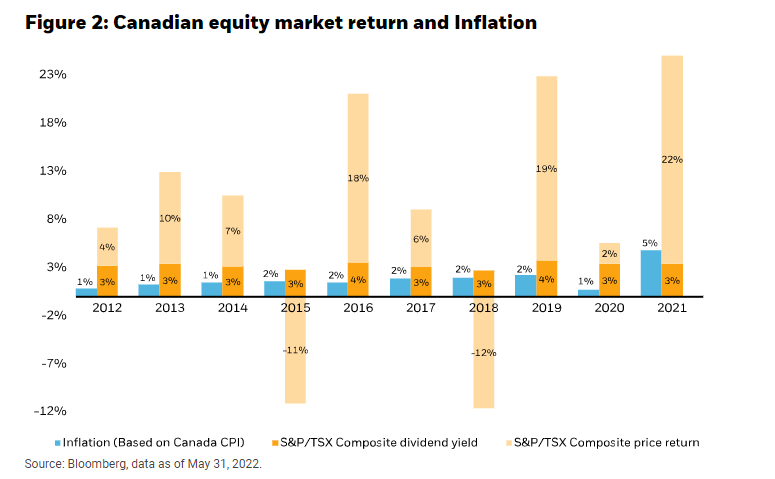

Dividend-paying stocks have many advantages over non-dividend payers. Dividend stocks only offer extra income but also offer protection against inflation. In many counties, dividend yields could match or exceed the inflation rates. In the following example, Canadian dividend equities offered income that met or exceeded inflation. From an article at RBC:

Income for protection against inflation

Dividend stocks distribute regular income, which can help investors meet their current spending needs. Fixed bond payments are also regular but tend to be more exposed to inflation than equities. This is because stocks may grow their dividends and realize capital appreciation (Figure 2), potentially making them better positioned to keep pace with, or exceed, inflation over the long term.