*** UPDATE: For the latest Dividend Withholding Tax Rates click : Dividend Withholding Tax Rates By Country 2017

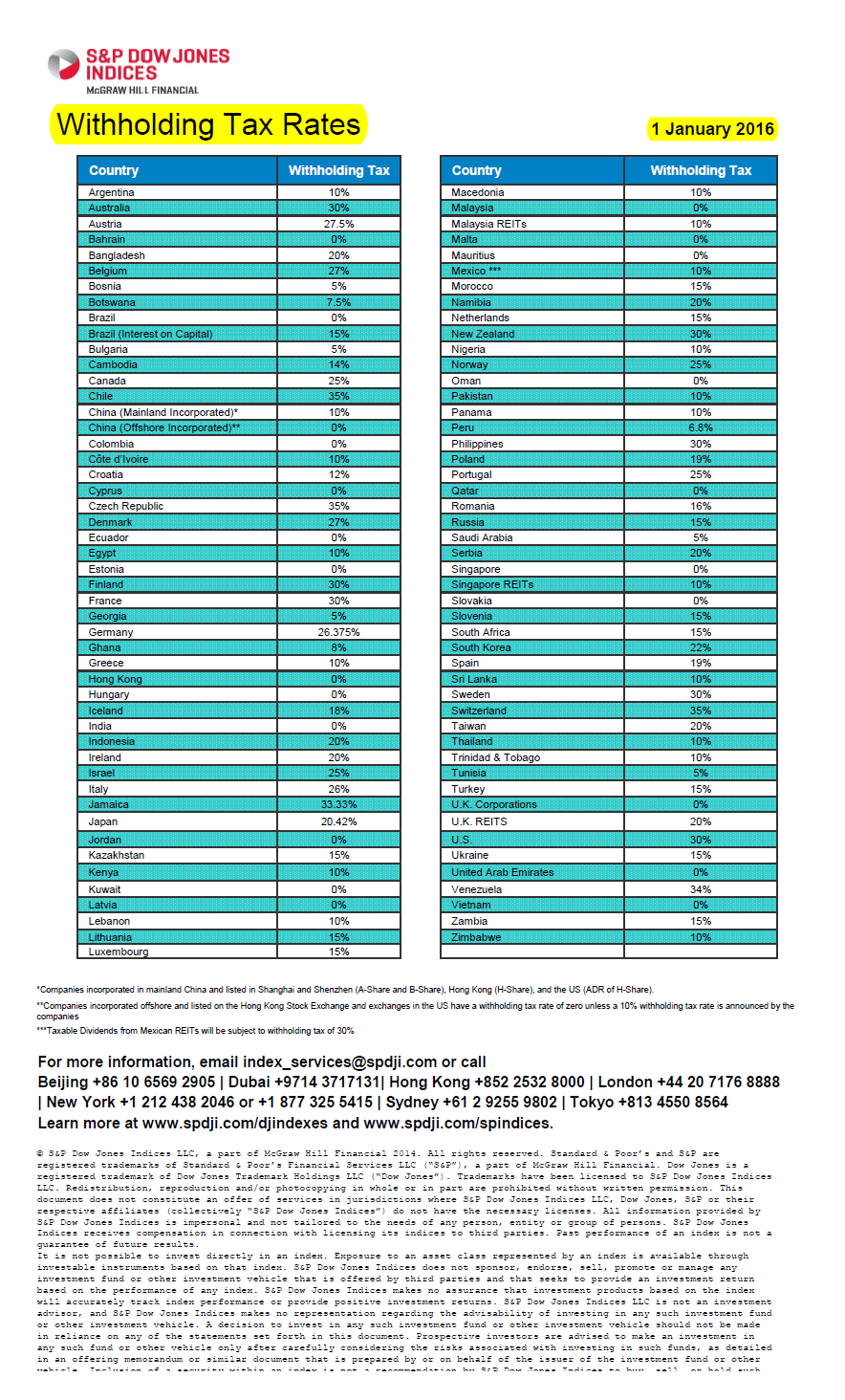

When investing in overseas stocks investors have to pay withholding taxes on dividends paid out by a foreign company. Usually this tax is held by the country when dividends are sent out to non-resident investors. US investors can lose a big chunk of the dividends to this taxes depending on the tax rate imposed by the country of dividend origin. For example, Switzerland has a high withholding tax rate at 35% but a country like Singapore does not deduct any taxes at all for dividends paid to foreign investors by Singapore-based firms.

Just like other taxes, the dividend withholding tax rates also change sometime every year. So here is a simple and easy table that shows the Dividend Withholding Tax Rates By Country for 2016:

NOTE: These rates are standard rates and do not include lower rates which may be available due to tax treaties between countries or other reasons. For example, one can get lower tax rates for Canada by filing special forms with Canada. Details here.

Click to enlarge

Source: S&P Dow Jones Indices LLC

*** UPDATE: For the latest Dividend Withholding Tax Rates click : Dividend Withholding Tax Rates By Country 2017

Another source: Dividend Withholding Tax Table for 2016, NYSE

Related:

- New Requirements for Canadian Tax Withholding for US Investors

- An Important Update On Canadian Reduced Tax Withholding Rate For US Investors