S&P BSE Sensex Index, the benchmark of India’s equity market is down 4.5% year-to-date. Though the index closed at 24, 952 on Friday, in February it went below 23,000. During February, the Sensex was in a bear market having fallen over 23% from the previous peak reached in March 2015. Last month the index fell over 800 points one day. In general, the equity market in India is volatile just like other emerging and frontier markets. Indian equities tend to move strongly upward within a short period only to crash violently quickly as well. Since Indian equities are volatile it is wise to learn about past performance of the market. The Indian market has experienced strong bull and markets over the years since 1990.

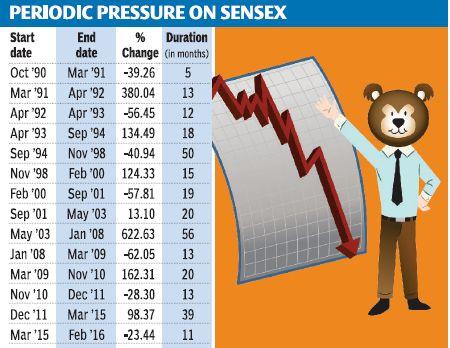

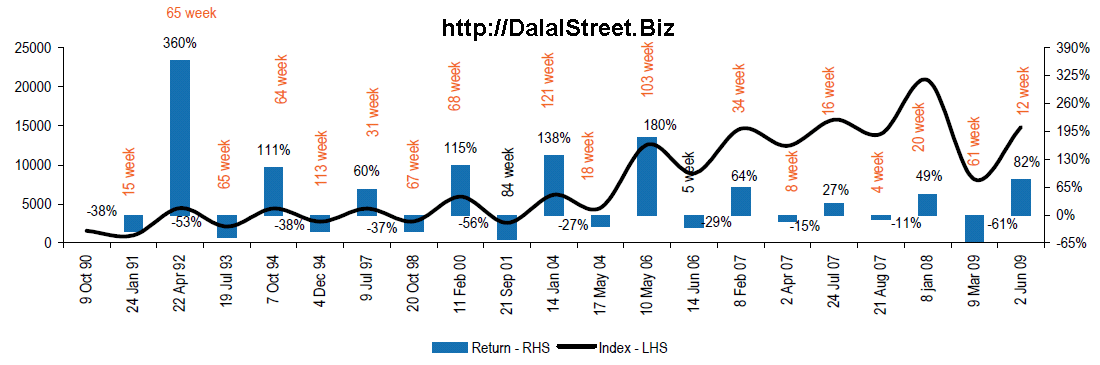

The following chart shows the bull and bear market durations of the Sensex:

Click to enlarge

Source: Is the market caught in an 8-year bear cycle?, The Hindu BusinessLine, Feb 12, 2016

Some fascinating facts about the Indian equity market are listed below:

- Every eighth year the Sensex has declined by more than 50%.

- In 1992, the index fell by 56%.

- When the dot-com bubble popped the Sensex fell by 58%.

- During the global financial crisis of 2008, it crashed by an astonishing 62%.

- Similar to other markets worldwide, the Sensex recovered sharply after the 2008 crisis. The bear market at that time lasted just 13 months.

- Bull markets are also characterized by swift and violent moves in a short time. For example, between March 2009 and November 2010, the index soared by 162%.

Why are Indian stock so volatile?

- While there are an infinite number of reasons that can be attributed to the movement of any market including the Indian equity market, here are a few reasons why Indian equity market is volatile:

- The debt market (bond market) is undeveloped and is very tiny. As a result much of the capital flows into equities driving volatility.

- Foreign institutional investors are some of the major players in the market. Operating from tax heavens such as the Mauritius such investors plough billions of dollars into the market pull them swiftly out at signs of any trouble.

- Retail investor participation in India is still very low. By one estimate it is just 3.3%. As a result, major investors such as institutions, mutual funds, wealthy individuals control the direction of the market.

- Ordinary retail investors are some of the most impatient investors anywhere including India. So when the markets go up they pile up pushing prices higher and higher and run for the hills when markets fall.

- Though there is a lot of hype and hope among investors about India being the best of the BRICs now, plenty of fundamental structural issues remain in the Indian economy.

- Indian companies, including large-caps, traditionally have low dividend yields. The dividend yield has been less than 1.50% for many decades. Due to the low payouts, investors buy stocks hoping for price appreciation rather than yields. So during bull markets investors go rush into stocks driving prices ever higher while during bear markets the low yields on stocks offer not much help to hold on to them or depend on them for a steady stream of income.

Updates (10/1/17):

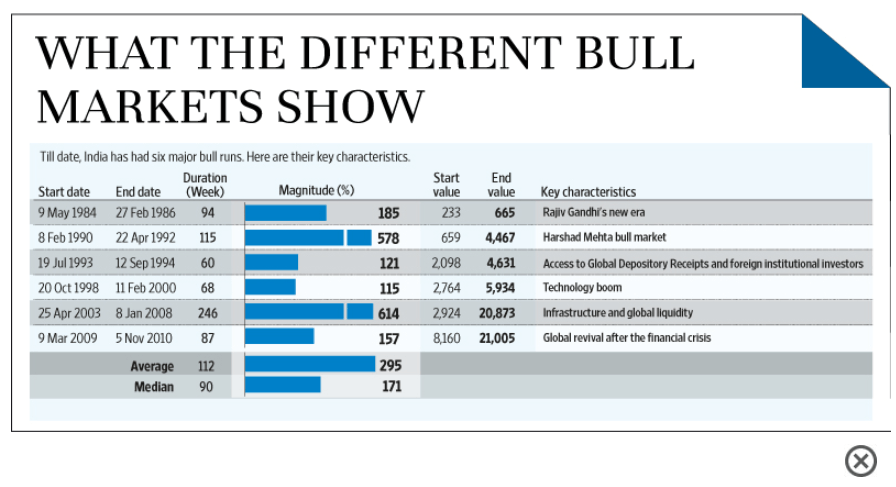

Bull and Bear Markets in India Chart:

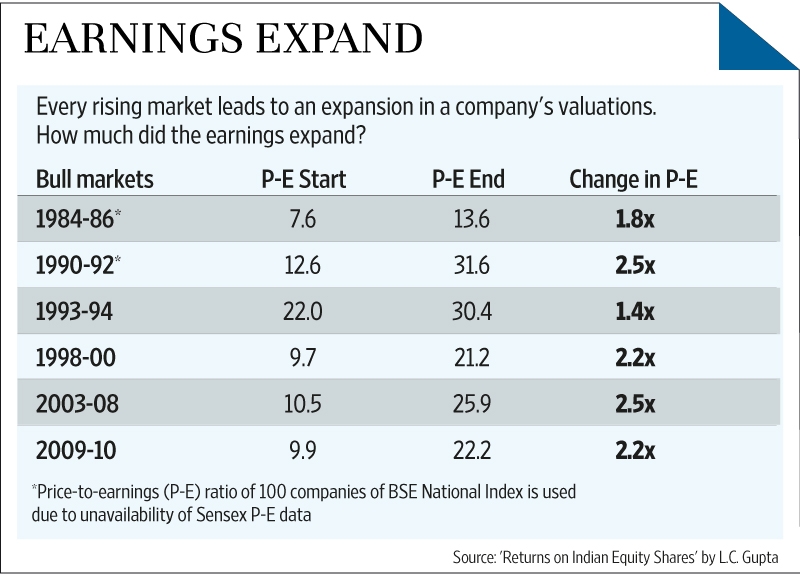

PE Expansion During Bull Markets in India Chart:

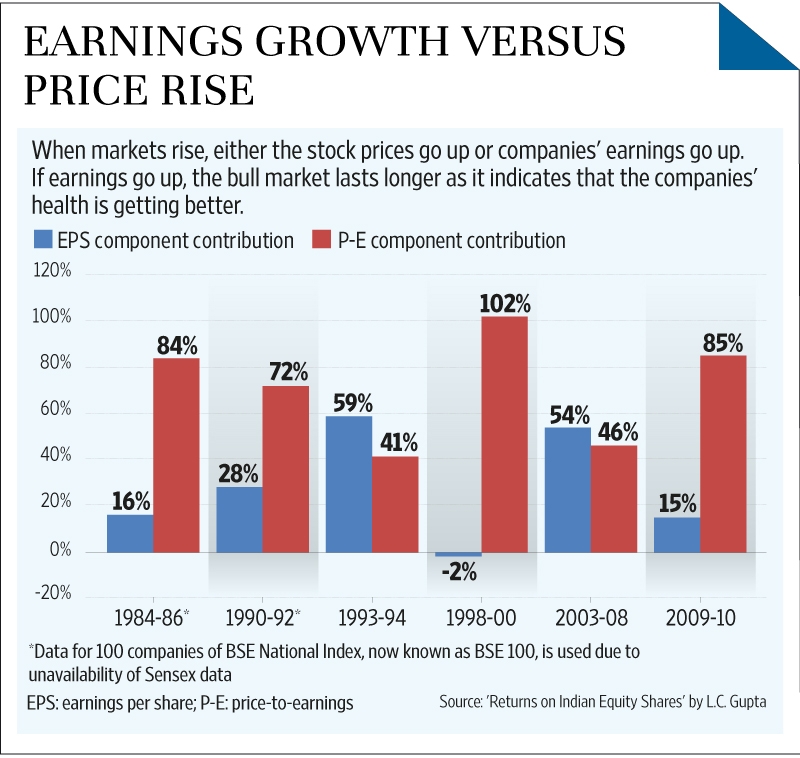

Earnings and PE Contribution in Bull Markets in India:

Source: What the past 6 bull runs tell us about this market, Live Mint

Bull and Bear Market Duration:

Source: Dalal Street

Related ETFs:

- WisdomTree India Earnings ETF (EPI)

- iShares S&P India Nifty 50 Index ETF (INDY)

- PowerShares India ETF (PIN)

Disclosure: No Positions

Related articles:

Also see:

- Duration of Stock Holding Periods Continue to Fall Globally

- Average Stock Holding Period in Asian Emerging Markets

Hi,

I want to know more details about Bear phase and Bull phase in indian stock market, means during the Bear phases which sectors and which stocks had more decline and Bull phase as well.

That’s a good question. Unfortunately I do not have the answers since I haven’t done that type of research. Maybe in the future I will look into writing a post on this. Thanks for your comment.