The US equity markets are on a tear this year with the S&P 500 up by over 5.5% year-to-date. Many individual stocks have shot up even more. A few have already doubled or grown by over 50%. And we haven’t completed two months in this year. One of the hot stocks of the AI-driven rally is the US-based chip company Super Micro Computer Inc (SMCI).

Stocks of SMCI crossed over $1,000 a share last week and reached a peak of $1,077 before falling 20% to end Friday at $803.22. Despite the loss, Super Micro has soared by 182% YTD. Currently it has a market cap of about $45.0 billion. Out of about 56 million shares outstanding, 33.5 million shares were traded on Friday.

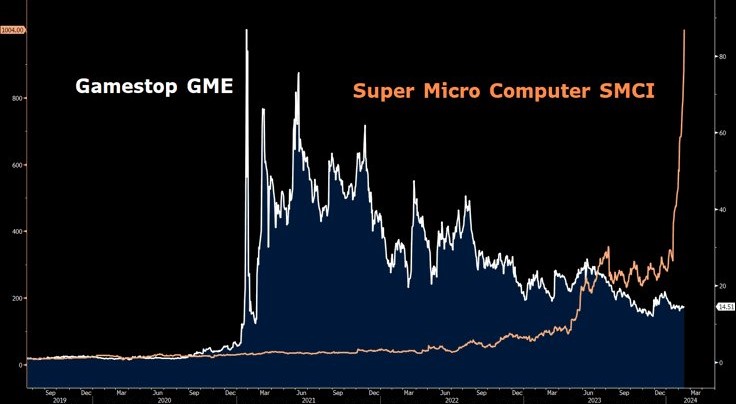

I came across the below chart posted by Kerry of Market Index in The Weekly Wrap:

Click to enlarge

Source: Market Index

The surprising rise of SMCI brings back memory of another hi-flyer of the recent past – GameStop Corp(GME). The brick-and-mortar game store chain soared to astronomical during the covid-pandemic fueled by hype only to fall back to earth dramatically. Though the companies in entirely different industries the charts are indeed striking. It remains to be seen in Super Micro can continue the momentum and stay at elevated levels. One thing that differentiates Super Micro from the GME saga is that there are many other AI-hyped stocks that have shot up as well. However Super Micro is an outlier with outsized gains in a such as short period.

The following chart shows the 5-year return of GameStop vs. Super Micro:

Click to enlarge

Source: Yahoo Finance

Disclosure: No positions