In the past few years Gold has become a much-talked about and safe-haven asset class. Investors have been piling into gold due to the credit crisis, collapse of equity markets, Greek debt crisis, continued devaluation of paper currencies and more recently the newly announced QE2 which will depreciate the value of the dollar further. As an example,the SPDR Gold Shares ETF(GLD) has an asset base of about $55 billion.

In the past few years Gold has become a much-talked about and safe-haven asset class. Investors have been piling into gold due to the credit crisis, collapse of equity markets, Greek debt crisis, continued devaluation of paper currencies and more recently the newly announced QE2 which will depreciate the value of the dollar further. As an example,the SPDR Gold Shares ETF(GLD) has an asset base of about $55 billion.

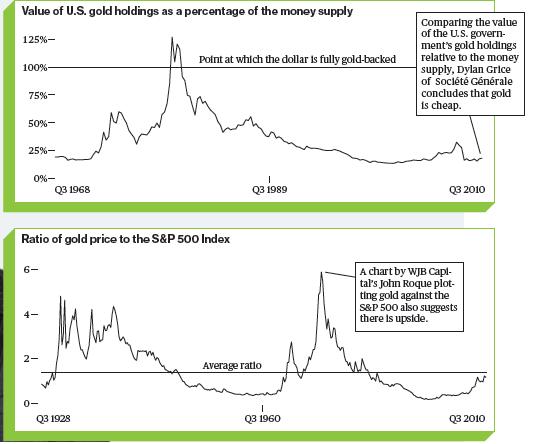

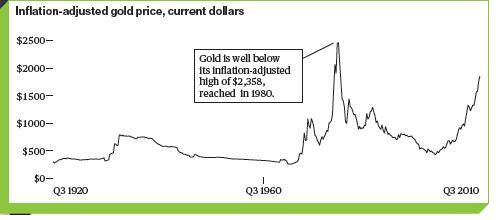

As of last week Gold has gained 28% this year and touched a record $1,398.70 an ounce. Barry Ritholtz, chief executive officer of FusionIQ and the author of the popular “The Big Picture” blog, made the following comment in a recent Bloomberg BusinessWeek article. Barry considers three ways of valuing gold, shown below. “All three of the metrics suggest [gold] has not yet reached its highest potential price,†Ritholtz says. “Slapping a $2,000 target is not unreasonable, and breaching its inflation-adjusted target of $2,358 is also possible.†He adds an important caution: “Gold fever has risen to the point of excess, and gold shouldn’t account for more than 5 percent of your portfolio.”

In a report, William Martin, Senior Vice President, Senior Portfolio Manager of American Century Investments says that unlike stocks and bonds whose returns are dependent on business conditions, gold actually tends to perform better during periods of economic and political uncertainty. He mentions a number of factors supporting investment demand for gold over the next decade.

From the report:

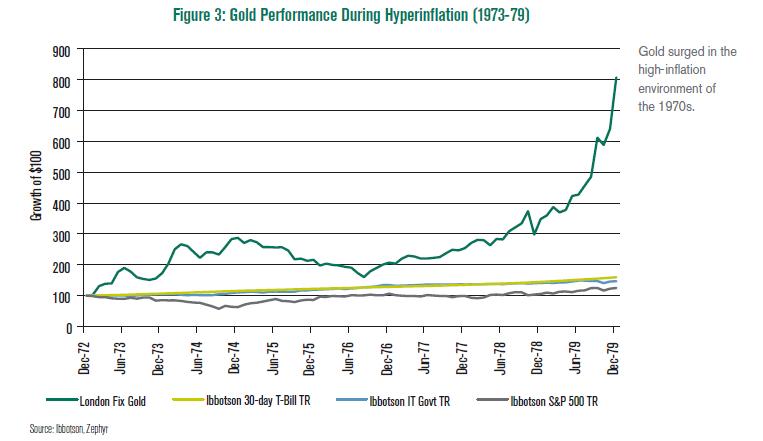

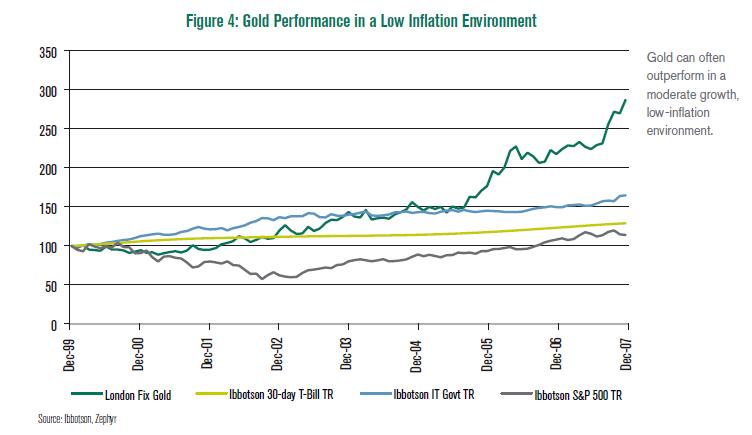

“To see how its unique supply and demand dynamics affect gold in different economic and market environments, we look at the performance of gold relative to U.S. stocks, bonds, and cash under three different historical periods: 1) hyperinflation, 2) low inflation, and 3) financial system crisis. We have intentionally chosen favorable comparisons for gold to illustrate our point that gold has the potential to outperform mainstream assets across diverse environments. ”

a) Gold performance during hyperinflation

The graphic below shows the performance of gold against other asset classes during the hyper-inflationary period of the 1970s. The data used started from December 1972, since before that time the price of gold was pegged to the dollar at $35 an ounce.

Click to enlarge

During inflationary periods such as the one shown above, as prices of goods and services rise, the value of paper currencies decline in purchasing power since their values are not tied to a tangible asset. The value of the dollar has declined sharply since the 1970s relative to gold. Gold, on the other hand, offers some certainty during inflationary periods when paper currencies decline in value. Hence Gold can be used effectively as an inflation-hedging vehicle.

b) Gold performance during low-inflation

During periods of low-inflation gold can also outperform other assets. For example, during the moderate economic growth and low inflation period in the 2000s before the financial crisis, gold performed very well compared to other asset types as shown in the graphic below.:

One of the main factors that contributed to the positive performance of gold in the decade mentioned, is the rise of emerging markets where citizens invested their savings in gold due to cultural and other factors. Many political and economic crises during this time also forced investors to seek the safe-haven of gold.

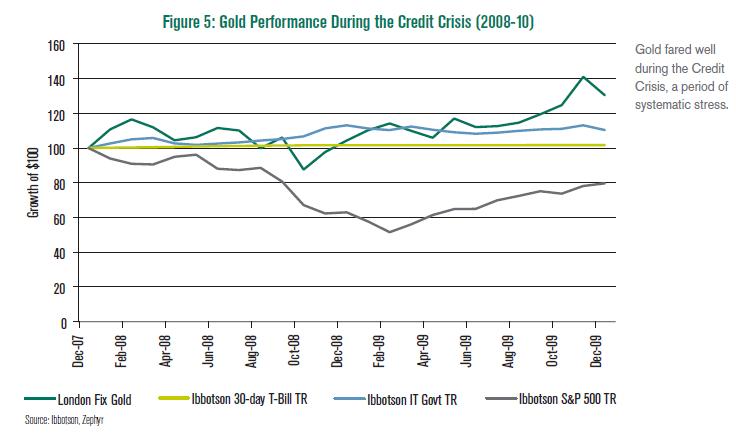

c) Gold performance during crisis

Gold has performed well during periods of stress in the political and financial systems. As shown by the chart below, gold outperformed other asset classes during the credit crisis in 2008 and the European sovereign debt crisis earlier this year. Investors are attracted to gold due to fear of sovereign credit defaults and deflation.

Overall gold is an excellent way to diversify your portfolio due to some of the reasons discussed above. Gold has low and in some cases negative correlations with other financial asset types. Hence allocating a small portion of assets to gold in a well diversified portfolio is a prudent strategy. However, it is not clear if gold is the perfect class for all economic cycles since the above analysis looked at a limited time-series of data. But the study shows that gold is a dependable asset class especially during periods when main-stream assets such as stocks and bonds decline sharply.

Source: Gold and the Decade to Come, William Martin, American Century Investments

Disclosure: No positions