The MSCI Emerging Market(EM) Index has posted an annualized return of 10.2% over the past 10 years thru the end of 2009. Due to this solid performance and other factors investors are increasingly attracted to EM equities. However many studies have proven that economic growth does not automatically translate into higher stock market returns.

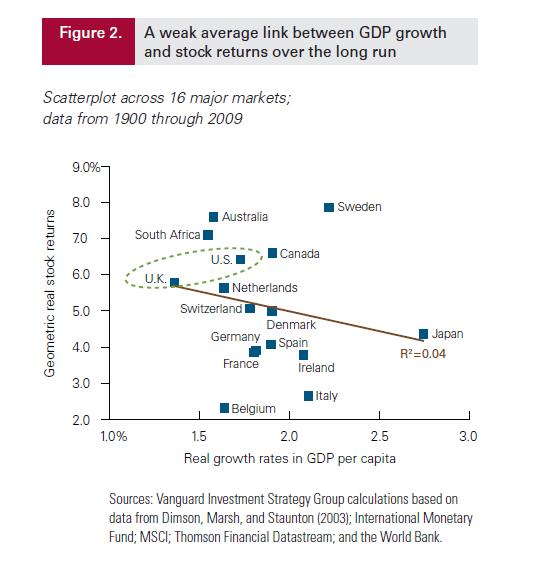

In a study of 16 major markets by the Vanguard group, the correlation between economic growth as measured by GDP per capita and long run stock returns since the 1900 was effectively zero. In the last decade, EM stocks performed well not because of economic growth per se but because of low valuations in early 2000s. Globalization also plays an important factor impacting the relationship between economic growth rates and market returns. For example, U.S. corporate profits from direct investments abroad jumped from 20% in 1999 to 40% in 2008. Hence multinational firms contribute to the economic growth of emerging markets.

From the Vanguard research paper:

“Since 1900, the correlation between long-run economic growth (as measured by real GDP growth per capita, a standard proxy for a country’s productivity growth) and long-run stock returns across 16 major markets has been effectively zero.The slope of the line in Figure 2 is actually slightly negative.” The study observed a similar relationship for emerging markets as well.

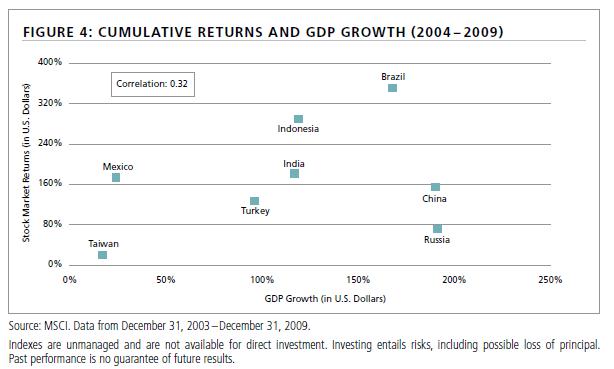

Another study by Neuberger Berman confirms that GDP growth does not necessarily translate to high equity returns. The chart below shows “the disparity between GDP growth rates and five-year cumulative returns for select emerging market countries.

In U.S. dollar terms, the highest nominal GDP growth countries, China and Russia, did not produce the best stock market returns. Mexico, however, outperformed both countries with only about a sixth of their GDP growth. ”

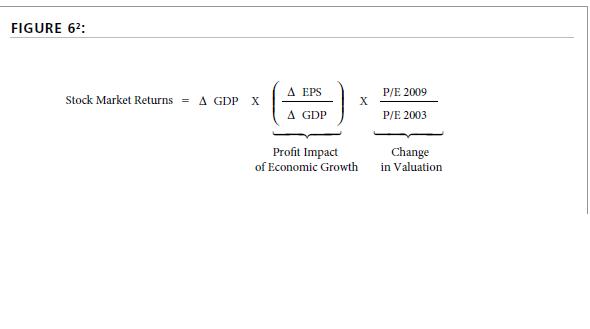

The study further analyzed the MSCI Emerging Markets Index data over a six-year time period from 2003 thru 2009 which coincided with one of the biggest bull markets in emerging markets history. This showed that “the impact of EPS growth (earnings to shareholders) and re-valuation (the price investors are willing to pay) had much larger impact on stock market returns than GDP growth”.

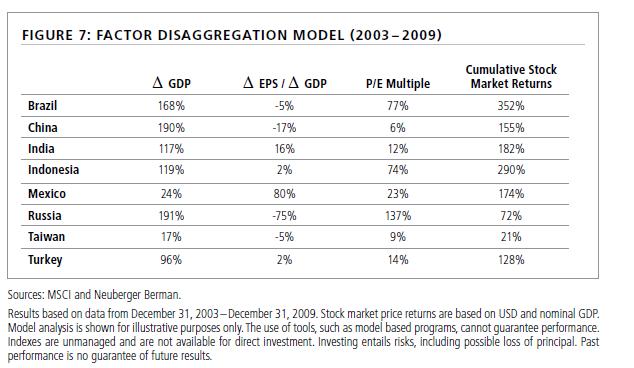

In the above chart, stock market returns was calculated by using the following formula:

Brazil and Indonesia were the best performing markets in the period studied. They achieved this growth by greater P/E expansion than their peers.Part of this P/E expansion can be attributed to the great run experienced by commodities.

China enjoyed a strong GDP growth but the stock market returns were mediocre.On the other hand Mexico had a much lesser economic growth but the stock return was higher. Similarly Russia had a strong GDP growth and P/E expansion but stock returns suffered due to the increased state ownership component within the benchmark. Despite strong economic growth in terms of market returns Russia was an underperformer.

Hence investors must focus on fundamentals of individual firms, profitability, valuation, etc. and follow a bottom-up strategy when investing in emerging markets as opposed to just looking at economic growth.

Related ETFs:

iShares Emerging Markets ETF (EEM)

iShares Brazil ETF (EWZ)

Market Vectors Russia ETF (RSX)

iShares Mexico ETF (EWW)

Sources:

Investing in emerging markets: Evaluating the allure of rapid economic growth, The Vanguard Group

Does Economic Growth in Emerging Markets Drive Equity Returns? , Neuberger Berman

Disclosure: No positions