A recent article in the Financial Times discussed about The Shadow Banking System in the U.S. based on a report by the Federal Reserve Bank of New York.

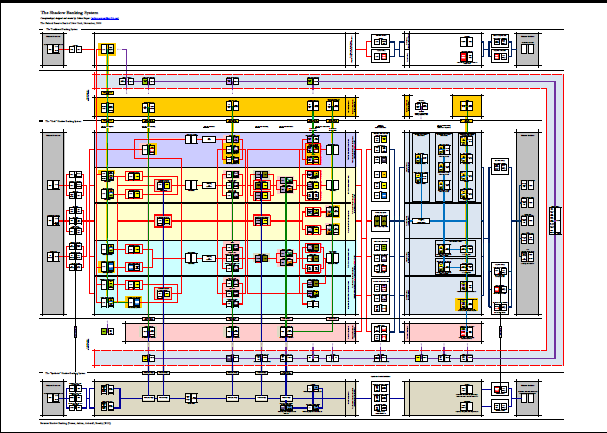

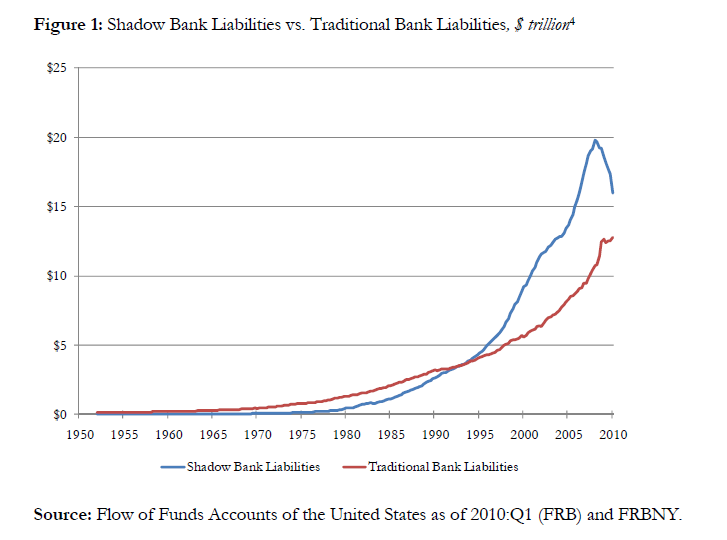

One of the charts in the report depicts the modern day shadow banking system in detail. The author of FT report Gillian Tett notes that the shadow banking system is extremely complex and remains mysterious to regulators, investors and politicians. At $20 Trillions, it is also double the size of the traditional banking system.

The graphic below represents The Shadow Banking System:

Click to enlarge (This is a large size picture)

The Growth of Shadow Banking System:

Source: Shadow Banking, Federal Reserve bank of New York

From the FT article:

“For one thing, this circuit board is a reminder of how clueless most investors, regulators and rating agencies were before 2007 about finance. After all, during the credit boom, there was plenty of research being conducted into the financial world; but I never saw anything remotely comparable to this road map.That was a striking, terrible omission. The Fed now estimates that in early 2008 shadow banking was $20,000bn in size, dwarfing the $11,000bn traditional banking system. And though this shadow system has now shrunk to a “mere†$16,000bn, this remains bigger than traditional banking, at some $13,000bn. Little wonder, then, that so few people immediately appreciated the significance of the seizing up of shadow banking in 2007.

But secondly, this poster is also a reminder that many things about the modern financial system remain mysterious – even today. On the edges of the circuit board, the NY Fed economists list all the government programmes that have supported the system since 2007 (and, in effect, replaced shadow banks when they suffered runs). This “shadow, shadow bank system†– as it might be called – looks complex and baffling too. And in practical terms, the sheer breadth and complexity of that box makes it hard to know what will happen if – or when – government aid disappears.”

It can be argued that one of the causes of the financial crisis is the size and the mind-boggling complexity of this shadow banking system that exists today completely unregulated.