Among the emerging market countries, power consumption in Brazil is projected to rise significantly in the next few years. The population of the country is expected to increase from 192 million to 204 million by 2013. Accordingly electric power consumption is forecast to rise by 10%. The government is also expanding the Luz Para Todos (Light For All) program to provide electricity to more families.By the end of this year , the program would supply electricity to 3.4 million families.

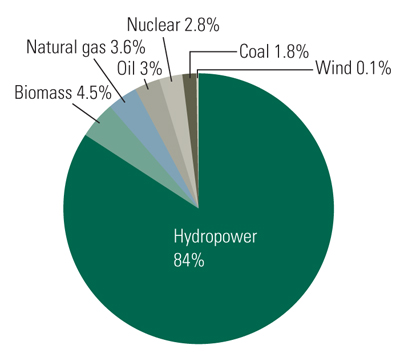

In November 2009, the country’s 26 states experienced a major blackout.Since that time due to rising income levels and low unemployment, power consumption has been increasing steadily. Currently hydro power is the major source of electricity generation in Brazil. Due to drought and other risks, the country may increase its dependence on coal and nuclear power in the future. The world’s second largest dam, Itaipú dam hydroelectric power plant that straddles the border between Brazil and Paraguay supplies 50% of the electricity in Brazil. There are only two nuclear power plants in the country.

Brazil’s Sources of Electricity Generation

Source: www.powermag.com

Electricity Consumption Per Capita in BRIC countries

Current Dividend Yield: 1.90%2. Companhia Energetica de Minas Gerais (CIG)

Current Dividend Yield: 2.43%

3. Aes Tiete SA (OTC:AESAY)

Current Dividend Yield: 13.53%

4. CPFL Energia (CPL)

Current Dividend Yield: 7.85%

In addition to electricity generation and distribution, Companhia Energetica de Minas Gerais (CIG) is also engaged in the distribution of natural gas and has operations in Chile as well.The largest private sector power company CPFL Energia S.A.(CPL) has about 6.6 million customers and it plans to expand its wind energy business.