The U.S. equity market fell sharply today with the Dow down 1.47% and the S&P 500 off by 1.67%. Unlike the dramatic reversal in the markets yesterday, investors simply wanted to dump risky assets such as stocks.

Market participants are spooked by a multitude of fears including Greece, China, potential interest rate increase, global economic slowdown, commodity market collapse, etc. However all these fears are overblown and it is unlikely that a great collapse will occur in equity markets worldwide especially in developed markets. Hence wise investors should use this selloff as an opportunity to add high-quality companies to their portfolios at current levels. Plenty of bargains can be found in the markets of the developed world. Before we can get to the list of potential candidates for additions, let us review some of the reasons that dispel the myth that were heading towards a major equity market disaster.

1. Though the Shanghai Composite Index is off by over 30% so far this year and will fall further, the US and other developed economies will not be highly impacted. Sure there may be short-term declines in stock prices like today but China is not going to kill the economic recovery in North America and Europe. Moreover European indices actually closed green today ignoring the carnage in China.

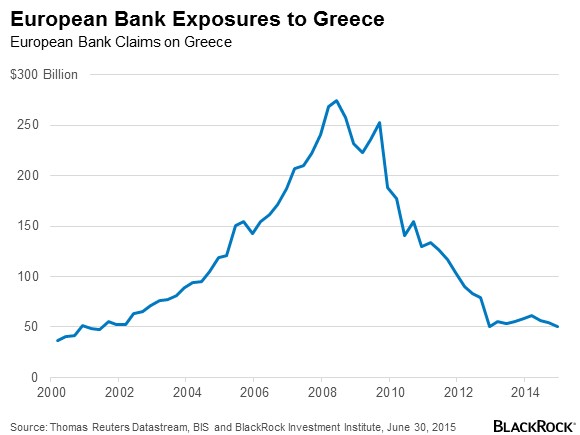

2. The Greek debt drama may prolong for a few more months but Greece is most likely to be part of the EU. In the worst case scenario, the current debt will be restructured by the troika and by this weekend the EU leaders will iron out some form of deal agreeable to all parties.

3. Global commodities have been languishing in a bear market for the fifth year now. So commodity market collapse is not new as China did not all of sudden stop importing commodities in recent weeks. The fact the demand for major commodities have been soft for many years now and equity markets have flourished taking into this consideration.

4. The crash in Chinese equities is not going to push the US and European economies into recession. China is still an emerging market and such boom and busts are features of such markets. So simply because Chinese stocks collapse it does mean US stocks will follow as well. It should noted that during the last market crash, Chinese stocks fell by over 70%.

So from an investment standpoint, all the current chaos in equity markets presents attractive entry points for investors in developed equities. Many sectors such as utilities, railroads, healthcare, consumer goods, etc offer opportunities for long-term investors. For example, there is absolutely no major impact to US utilities from the chaos in China. They do not depend on exports to China and generate most of their revenues from the domestic market.

Ten stocks are listed below with their current dividend for consideration:

1.Company: Southern Company (SO)

Current Dividend Yield: 5.03%

Sector: Electric Utilities

Country: USA

2.Company: Canadian National Railway Co (CNI)

Current Dividend Yield: 1.74%

Sector: Railroads

Country: Canada

3.Company: DTE Energy Company (DTE)

Current Dividend Yield: 3.61%

Sector: Electric Utilities

Country: USA

4.Company: BASF SE (BASFY)

Current Dividend Yield: 3.64%

Sector:Chemicals

Country: Germany

5.Company: Autoliv Inc (ALV)

Current Dividend Yield: 1.97%

Sector: Auto Parts

Country: Sweden

6.Company: Unilever NV (UN)

Current Dividend Yield: 3.39%

Sector: Food Products

Country: The Netherlands

7.Company: Union Pacific Corp (UNP)

Current Dividend Yield: 2.29%

Sector: Railroads

Country: USA

8.Company: Kimberly-Clark Corp (KMB)

Current Dividend Yield: 3.27%

Sector: Household Products

Country: USA

9.Company: Bank of Nova Scotia (BNS)

Current Dividend Yield: 4.29%

Sector: Banking

Country: Canada

10.Company:Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 5.67%

Sector: Electric Utilities

Country: Portugal

Note: Dividend yields noted above are as of July 8, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: BNS, CNI and DTE