European equities have fallen heavily in the past few weeks from their 2015 peaks due to the Greek debt crisis. For example, the DAX has declined from 12,390 in April to 10,667 today.

As of July 7 close, the returns of the major indices are listed below:

- S&P 500 Index: 0.5%

- UK’s FTSE 100: -0.50%

- France’s CAC 40: 10.3%

- Germany’s DAX Index: 11.1%

- Spain’s IBEX35 Index: 2.5%

Unlike during the past European sovereign debt crises, this time around many doom and gloom scenarios are being discussed by investors and experts alike. Some of these scenarios include the collapse of Greek banks, collapse of Greece, Grexit, Greece going back to Drachma, Greece aligning itself with Russia, other Eurozone countries like Italy, Spain, etc. quitting the EU, etc. All these are just hype and are unlikely to occur.

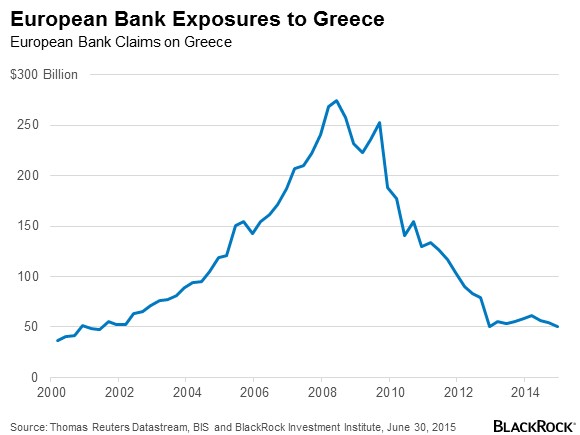

With respect to European banks’ exposure to Greece, it is not a doomsday scenario either. Russ Koesterich, Global Chief Investment Strategist of Blackrock noted this point in a post today. European banks have substaintially reduced their exposure to Greece in the past few years. Most the Greek debt is held by official creditors and not private banks. These major creditors include the troika – the European Central Bank (ECB), IMF and European Commission.

Click to enlarge

Source: Does Greece Pose a Threat to Global Markets?, Blackrock blog

From an investment perspective, investors need not fear holding or investing in European stocks especially banks. Though short-term volatility is normal, European banks are good long-term investments at current levels.