The OECD released on a report last week discussing rising income equality and poverty since the global financial crisis. The report noted that income inequality based on the gini coefficient actually increased in the past few years in developed countries. This is not surprising as the poor and middle-class suffer more as jobs disappeared and many governments implemented austerity programs to cut down on social welfare. On the other hand, as is usual in such situations, the affluent were to able to take advantage of the crisis and increase their wealth due to favorable tax treatments, buying assets at rock-bottom prices, borrow funds at cheap rates for investment purposes, etc. According to the OECD, income inequality has been rising in the OECD countries since the mid-1980s.

From an article by Brian Keeley in OECD Insights:

‘There’s a lot of little kids going hungry round here,’ explained one friend, who works in a local community centre. Indeed, just the other day she had spoken to a family where the child had been chewing wallpaper at night. ‘He didn’t want to tell his mum because he knew she didn’t have the money for supper,’ she explained.”

That’s not from Dickens or George Orwell’s Down and Out in Paris or London, but from a recent column by Gillian Tett in the Financial Times. And she’s writing not about Lagos or Lahore, but Liverpool, a modern city in one of the world’s wealthiest countries.

Of course, the presence of poverty amid plenty – inequality – is not new. In reality, it’s hard to imagine any society functioning without some sort of wealth gap. But the past few decades have seen inequality rise in much of the world. That’s causing concern, and not just for reasons of social justice: A number of economists, most notably, perhaps, Joe Stiglitz, argue that excessive inequality undermines the foundations of growth by restricting the ability of poorer people to develop their human capital and by encouraging what economists call “rent seeking” – in essence, instead of creating a bigger economic pie, the well-off use their economic and political strength to take a bigger slice of the existing pie.

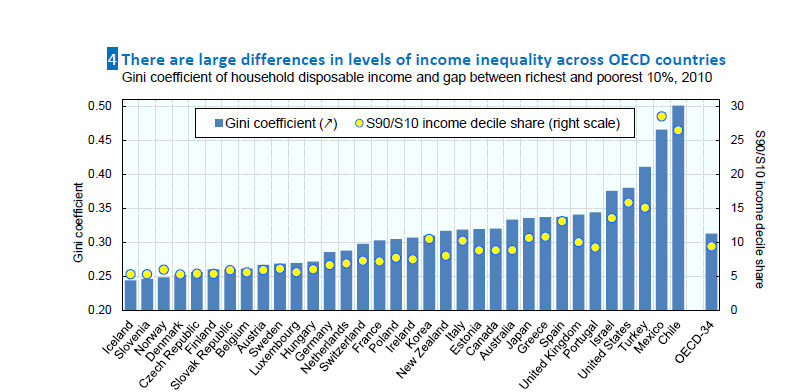

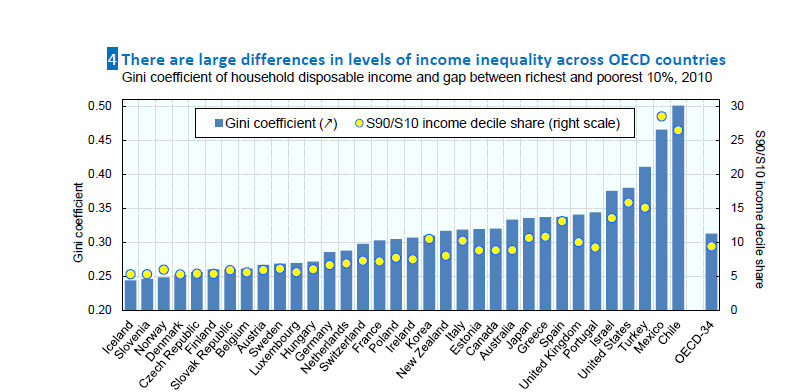

The following chart shows the level of income inequality among OECD countries:

Click to enlarge

Source: Income Distribution and Poverty at the OECD, OECD

From the report:

Income inequality increased especially in Spain, where Gini coefficient increased from 0.31 to 0.34. On the other hand, after having increased since the early 2000s, income inequality fell substantially in Iceland, moving down eleven places on an OECD countries’ inequality ranking to the lowest level (Figure 4).

Consolidation policies appear to have been designed in an overall equalising manner. Disposable income inequality also declined in Portugal and New Zealand, although by a smaller amount.

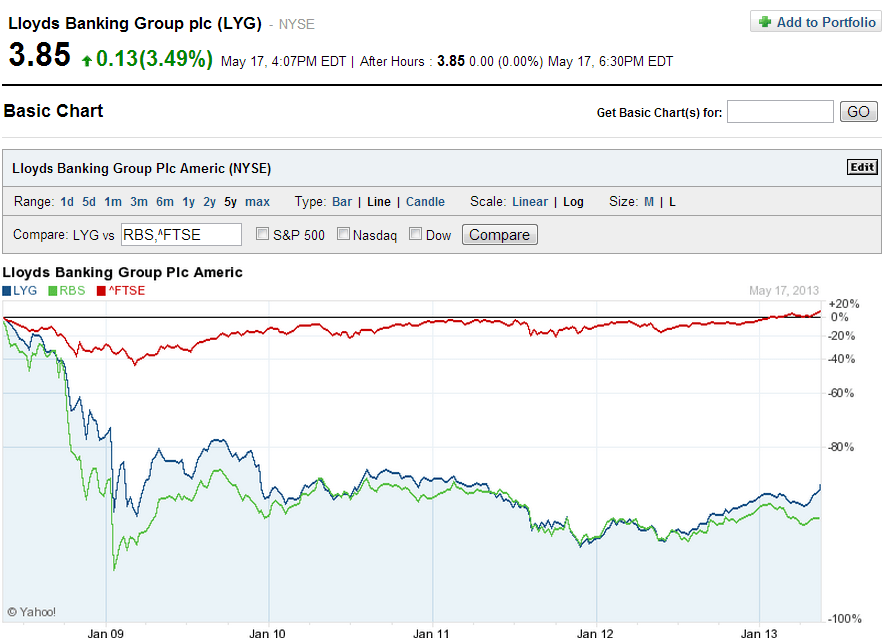

The higher the gini coefficient, the higher the income inequality. Chile has the highest gap between the rich and poor. It is interesting that Iceland has the lowest gini coefficient. The tiny country of Iceland became the basket case of greed and recklessness when some of its banks collapsed and the bankers brought the economy to its knees at the start of the financial crisis. Fortunately unlike other developed countries, Icelandic politicians were smart and actually cared about their country. Iceland implemented some of the boldest policies to rescue the economy and in fact sent some of the crooked bankers to prison in the process. Compared to that, not one banker in the US or UK for example has been sent to prison. As a result ordinary people in these countries continue to pay the price while the bankers and politicians who perpetrated the crisis have moved on with their lives. Or to put it differently they are continuing to enjoy the high life.

No one would be surprised to see the U.S. at the fourth place in the above ranking. Since Turkey, Chile and Mexico are actually emerging countries, in reality the U.S. has the highest income inequality among developed countries. It is interesting that Israel has the next highest income equality though most people would think otherwise. The Scandinavian countries of Denmark, Finland, Norway and Sweden follow extreme form of socialism which leads to some of the lowest income inequality measures among the OECD nations.