Earlier this year I wrote an article discussing the pathetic state of the airline industry in the U.S. due to consolidation of carriers. For travelers it has become a nightmare flying from Point A to Point B. Equity investors have treated most airline stocks like rotten fish that are best avoided at all costs.

A recent journal article noted that years of mergers in the industry is adversely affecting travelers and local economies:

If you’re having trouble finding flights to Memphis, Pittsburgh or a host of other cities, you’re not alone.

A decade of restructuring in the U.S. airline industry has produced a sharp reduction in air service that is curtailing traveler choice and some local economies even as it improves the industry’s health, new research shows.

The study, by Massachusetts Institute of Technology, shows that from 2007 through last year, U.S. airlines cut the number of scheduled domestic flights by 14%. The number of seats offered fell by slightly less, as airlines pushed passengers onto bigger planes, says the study, which was prepared by MIT’s International Center for Air Transportation and is expected to be made public Wednesday.

Source: Leaner Airlines Mean Fewer Routes, Study Shows, The Wall Street Journal, May 7, 2013

Unlike Europe where thriving competition in the industry gives consumers plenty of options at cheap rates, in the U.S. the major carriers hate competition and the state encourages the attitude of these airlines despite the existence of scores of anti-trust laws. The blame can be attributed to all including greedy investors, corrupt politicians, toothless regulators and of course the voting public. While the London underground travelers term the travel experience during peak times as “cattle class”, the U.S. airline industry considers the travelling public as the “Sheeple class” – a combination of sheep and people. As a result fleecing of the public in broad daylight right under the nose of Uncle Sam is common. For example, U.S. airline “collected” a whopping $3.50 billion in 2012 in baggage fees alone according to a report published by not the industry but the government that tracks this figure. The irony of this is incredible to say the least.

The Journal article further added:

Even the nation’s busiest 29 airports lost nearly 9% of their scheduled domestic flights as the major airlines focused on weeding out unprofitable flights and reducing their use of gas-guzzling small jets. Remaining flights also have become more crowded, with the percentage of seats filled—known as the load factor— soaring to a record of nearly 83% in 2012, from not quite 80% in 2007.

Industry executives say that the changes have helped reduce overcapacity and revive the fortunes of the industry after years of losses and bankruptcies, which they say benefits travelers.

But the changes have also affected convenience and cost for fliers. Overall, average domestic round-trip fares have inched up 4% to $374 in 2012 from 2007, adjusted for inflation. Competition on busy routes between big cities and new flights from discount carriers have held some fares down. But at some midsize and smaller airports, the recent service cuts have reduced competition and caused fares to shoot up.

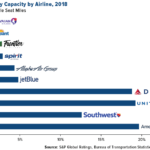

With the proposed merger of American and U.S. Airways, 70% of the U.S. air travel market will be controlled by just four companies: Delta, Southwest, United-Continental and the merged airline according to one study by by Diana L. Moss of American Antitrust Institute. The Journal noted that the four carriers will control 85% of the domestic market.

Related:

Get ready to pay more to fly (MarketWatch, May 20, 2013)