One of the issues that long-term investors may consider is if they should invest in stocks of hi-tech companies. This group includes firms that became public in the past few years , freshly-minted IPOs and well established or mature firms. An example for each of this category can be Facebook(FB), Box Inc(BOX) and Cisco (CSCO).

To answer my title question, the short and simple answer is no. Investing in high tech firms is not a wise strategy especially for the long-term. While the recent spectacular success of few tech stocks such as Apple(AAPL) have kindled investors’ interest towards this sector, they are not suitable for long-term investment. Even for the short-term which can considered as less than five years, tech stocks are not the best bets. Some of the reasons on why investors should ignore these stocks are discussed below. However investors that are purely looking for growth and not income can consider allocate a small portion of their portfolio to tech stocks.

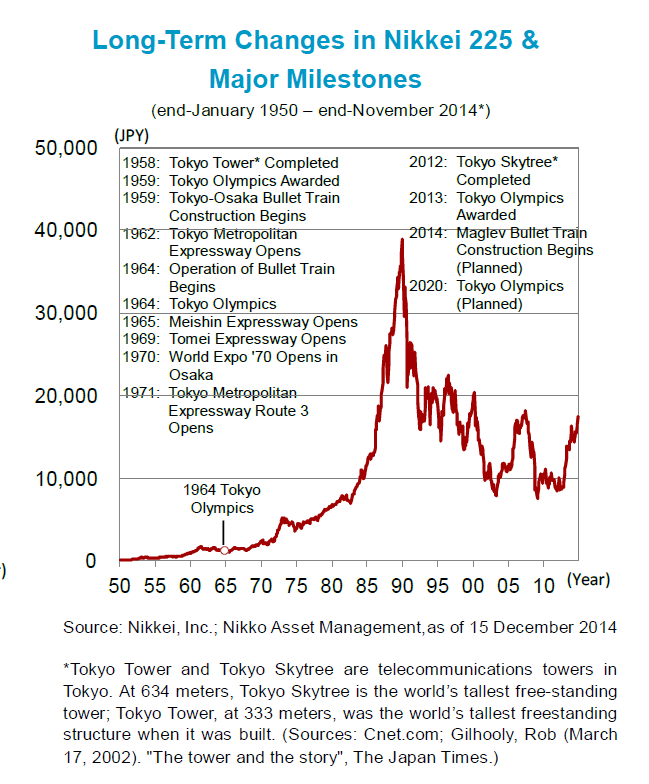

Tech-heavy NASDAQ closed at 4,744 on Friday. This is close to the 5,000 mark that it reached during the dot-com bubble era. As the index has continued to soar in recent years some investors may be tempted to jump back into tech stocks.

I came across an interesting article by Heidi Richardson of Blackrock on the topic of investing in mature tech companies. From that article:

But from an investing standpoint, I am old school. I like mature technology companies—think large established brands like Intel, IBM and Oracle. These companies can use healthy cash balances to unlock shareholder value, are more likely to fare well if the Fed starts raising rates as expected this year and stand to benefit from continued improvement in the U.S. economy.

Cash-fortified, low debt

Some industry-leading companies have been hoarding cash. Consider that four information-age bellwethers―Apple, Microsoft, Google and Cisco―possess a combined $345 billion in cash. And the overall tech sector holds more than half of total corporate cash reserves in the U.S.1

With strong balance sheets, these companies are well-positioned to deliver returns through share repurchases, dividend increases and mergers and acquisitions. In fact, some activist investors have been pushing them in this direction, and share buybacks by S&P 500 tech companies started to accelerate in 2014.

These mature companies have also shown responsibility in taking on debt, so they should be less vulnerable to the anticipated rate hike by the Federal Reserve.

Capex beneficiaries

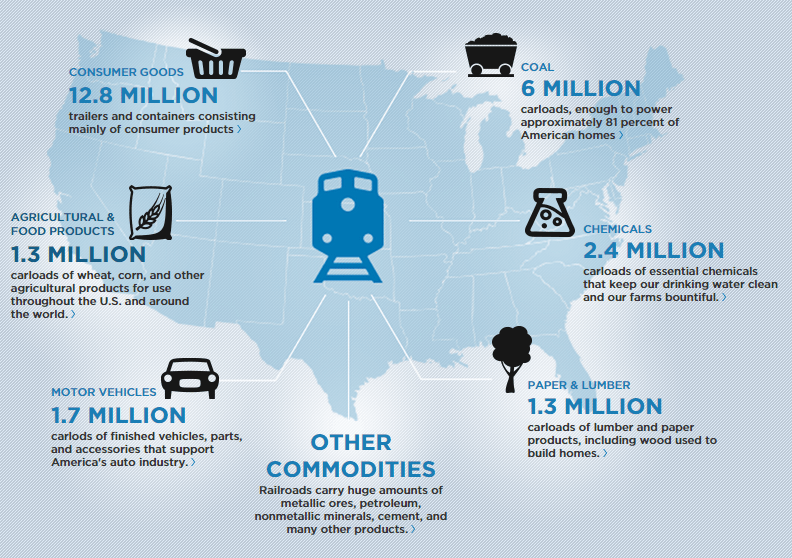

Tech is also poised to reap the benefits of continued economic improvement.Capital expenditures (capex), which is the investment in property and equipment by companies, is expected to increase for U.S. companies across the board. We anticipate that much of this investment will be used to upgrade corporate hardware, software and networking systems. On the consumer side, improving purchasing power, partly due to lower oil prices, may be a boon to companies like Apple.

1 www.dailyfinance.com “Why are U.S. Corporations Still Hoarding $1.5 Trillion in Cash?” Rich Smith. January 16, 2014.

Source: The Wisdom of Investing in Mature Tech Companies, Jan 11, 2015, The Blog, Blackrock

I disagree with Heidi’s arguments for the following reasons:

1. Tech companies are notorious for hoarding cash and not sharing with investors. For example, though Apple, Microsoft, Google and Cisco may have a $345 billion cash pile it does not mean they will use it wisely like paying a substantial dividend to shareholders if they cannot reinvest the cash in the business. Instead they spend on wasteful projects, questionable acquisitions, handing out stock options and more importantly on stock buybacks. IBM has spent billions in the past few years buying back its own stock. Buybacks generally do not benefit investors particularly ordinary retail investors. Similarly Microsoft is another lumbering giant with no meaningful products launched in many years. So the argument that one should invest in mature tech stocks since they have strong balance sheets is built on a shaky foundation.

2. Dividends paid out by mature tech firms are low and dividend increases are not guaranteed. For instance, Intel (INTC) has a dividend yield of 2.88% which may seem great considering the average S&P 500 yield is only about 2%. But there are plenty of companies that pay much higher than 2%. Few months ago Intel failed to increase its dividend payments disappointing many investors. So though cash-rich tech firms can increase dividends they don’t since they don’t have to as any dividend payment or increase is entirely at the discretion of the company.

3.Most of the mergers and acquisitions that tech firms engage in do not pan out. Google’s acquisition of YouTube is one such mergers. Though Cisco has acquired many companies since 2000 it is hard to see any benefits from those costly acquisitions.

4.The tech industry is a prone to disruptions. Though some of the tech firms are mature, it does not mean they will be strong and hold dominant positions forever. Newer players can enter and chip away at their business and even come up with better technologies crushing the established companies. For long-term investors, this inherent risk in the tech industry is not easy to overcome.

5.Investing in tech stocks mainly for share price appreciation either due to growth or due to stock buybacks is highly risky.Companies such as Apple(AAPL) are exceptional cases. Intel and Cisco haven’t reached their peaks attained during the dot com boom. Cisco at point was over $60 back then. It closed at about $27 after all these years. All the M&A activities, buybacks and other corporate actions could not bring the stock back to 60s level.

In summary, simply because mature tech companies have billions in cash or other reasons noted above does not make them attractive for long-term investment. Accordingly investors must be cautious of articles that provide a bullish view of them.

Disclosure: No Positions