European stocks have been laggards this years relative to the decent performance of U.S. stocks. However moving forward, European stocks have better growth potential compared to their American peers for a variety of reasons two of which are discussed in this post.

1. Currently U.S. stocks are expensive while European equities are relatively cheap based on the P/E ratio. For example, as of Dec 11, the P/E for the US market is 19.5. The P/E ratios of some of the major European markets are lower at 15.8, 9.8, 19.4, 15.5 for Germany, Norway, Spain and the UK respectively. French stocks have a P/E of 19.4.

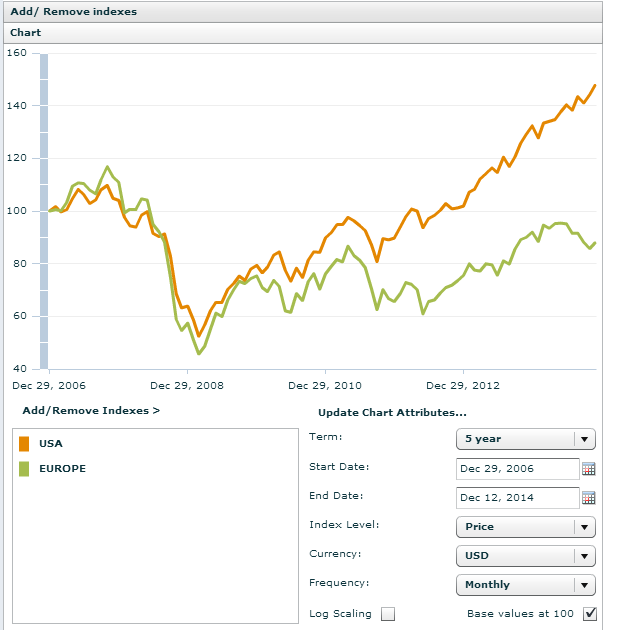

2. European equities as measured by the MSCI Europe Index have under-performed MSCI USA in US dollar terms since the sovereign debt crisis.MSCI Europe performed well in sync with MSCI USA from 2009 thru mud-2011. But since then European stocks have under-performed again.Though European equities have had an upward trend since mid-2012 they still have more room to grow in order to catch up with American stocks as shown in the below chart:

Click to enlarge

Source: MSCI

Ten stocks from the Euro STOXX 50 Index are listed below with their current dividend yields for further research:

1.Company: Sanofi (SNY)

Current Dividend Yield: 4.23%

Sector: Pharmaceuticals

Country: France

2.Company: Danone SA (DANOY)

Current Dividend Yield: 2.98%

Sector:Food Products

Country: France

3.Company: BASF SE (BASFY)

Current Dividend Yield: 4,38%

Sector: Chemicals

Country: Germany

4.Company: Siemens AG (SIEGY)

Current Dividend Yield: 3.62%

Sector:Industrial Conglomerates

Country: Germany

5.Company: Telefonica SA (TEF)

Current Dividend Yield: 3.58%

Sector: Telecom

Country: Spain

6.Company: Volkswagen AG (VLKAY)

Current Dividend Yield: 2.48%

Sector: Auto Manufacturing

Country: Germany

7.Company: AXA Group (AXAHY)

Current Dividend Yield: 4.94%

Sector: Insurance

Country: France

8.Company: Banco Santander SA (SAN)

Current Dividend Yield: 9.68%

Sector: Banking

Country: Spain

9.Company: Eni SpA (E)

Current Dividend : 8.53%

Sector:Oil, Gas & Consumable Fuels

Country: Italy

10.Company:Air Liquide (AIQUY)

Current Dividend Yield: 2.65%

Sector: Chemicals

Country: France

Note: Dividend yields noted above are as of Dec 12, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long AXAHY and SAN