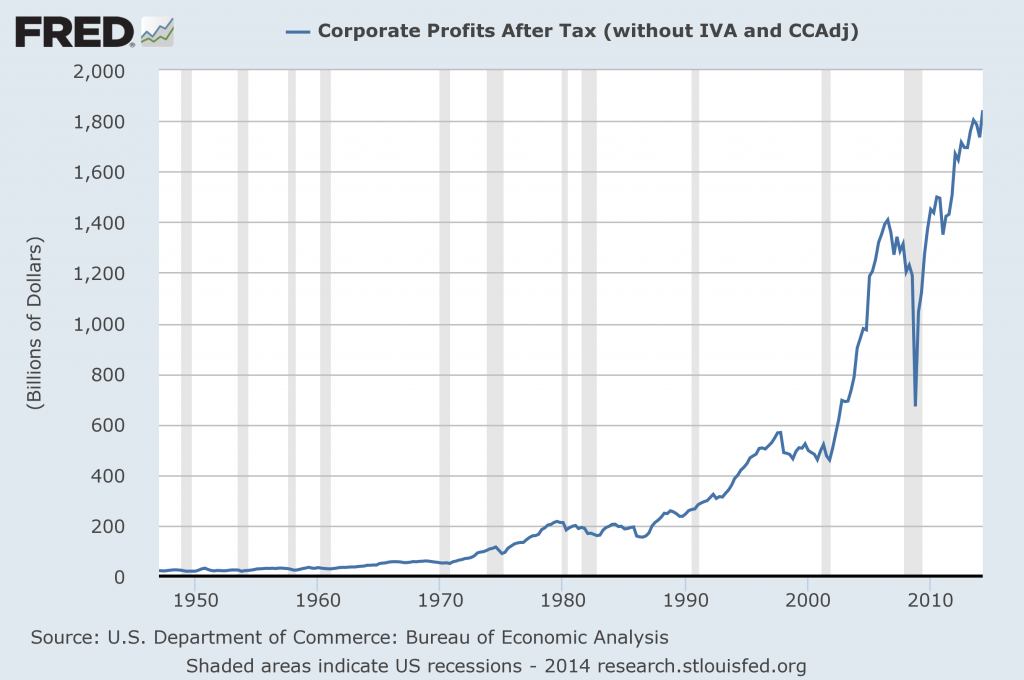

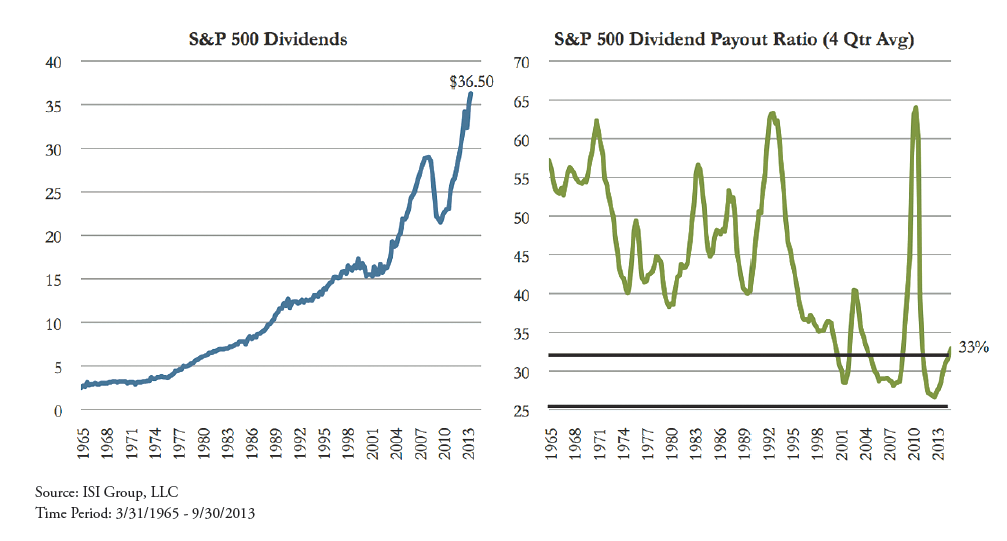

Corporate profits in the U.S. are at a record high.Accordingly earnings returned to shareholders in the form of dividends has also reached record levels. For example, the dividends on the S&P 500 as of September stood at $38.49.

Click to enlarge

Source: Federal Reserve Bank of St. Louis

However as I have discussed before, the payout ratio of U.S. firms has not increased with increase in profits. In fact they have been declining for a few decades now. So even though companies are paying more in dividends but as a share of the total profits earned the amount paid out to investors is still low and they continue to hoard cash as retained earnings.

The chart below shows the rise in S&P 500 dividends and the dividend payout ratio from 1965 thru Sept, 2013:

Click to enlarge

Source: Will the pendulum swing toward a higher payout ratio?, Crawford Investment Counsel, November 2013

The key takeaway from this post is that just because a company earns higher profit it does not mean it will necessarily share that wealth with shareholders. This is especially true for retail investors who do not have the power to make changes in a company’s operations or management’s policies.

Related ETFs:

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard High Dividend Yield ETF (VYM)

Dislosure: No Postions