The S&P 500 is the widely followed benchmark index of the U.S. equity market. It is generally considered as the barometer of the economy as all the major industries are represented in the index. The DAX Index is the major benchmark index of the German stock market. Similarly to the S&P 500, it contains representative companies from the major sectors of the German economy.

Earlier this year the DAX reached an all-time and the S&P 500 has reached many records in the past few months. In this post let us take a look at some of the differences between the two indices.

The following are some of the differences between the S&P 500 and DAX indices:

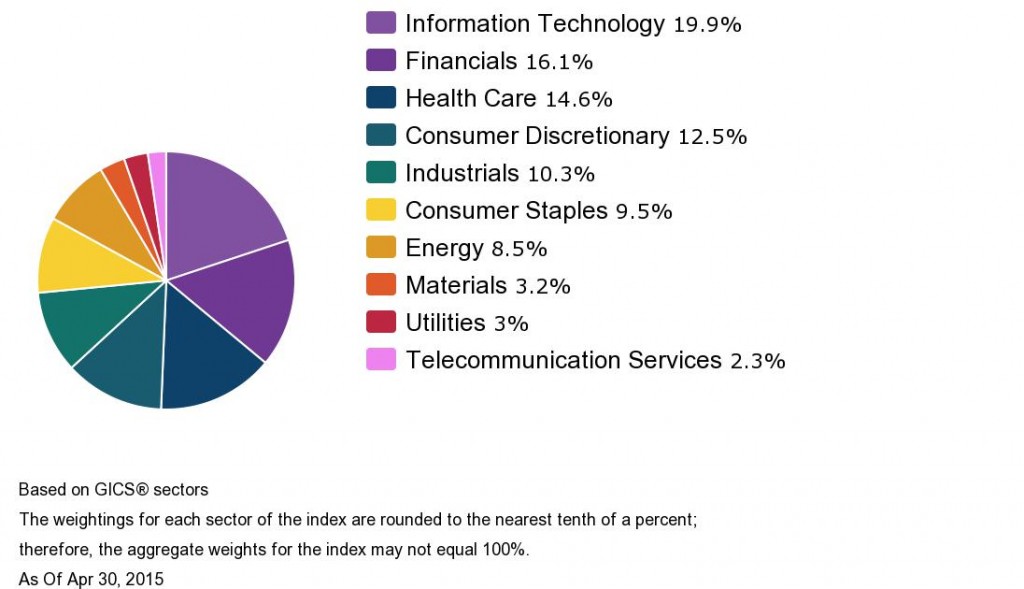

1. IT has the highest weighting in the S&P 500 with a weightage of around 20%. The other two major sectors in the index are financials and healthcare. These three major sectors account for about half of the S&P 500 weightings. As the U.S. is a consumer-driven economy, Industrials have a weightage of just around 10%.

Click to enlarge

S&P 500 Sector Breakdown:

The major sectors in the DAX are shown as of Feb, 2015 in the table below:

| Sector | Weightage |

|---|---|

| Chemicals | 23% |

| Automobiles & Parts | 17% |

| Industrial Goods & Services | 14% |

| Insurance | 11% |

| Technology | 8% |

Unlike the U.S., the German economy is an export-based economy. Germany exports more goods and services than it imports. And the technology industry is very small in the country. The DAX index is dominated by companies in the Chemical sector which account for nearly one-fourth of the index. The second and third largest sectors in the DAX are Automobiles & Parts and Industrial Goods and Services.

2. The S&P 500 is a price-return index meaning dividends are not included in the return calculation. But the DAX is a total-return index. Hence the DAX figure includes dividends reinvested. So even though the DAX reached high this year, in terms of price returns it is actually lower than the previous peak according to an article in The Wall Street Journal. This is also the reason why the DAX attained record highs compared to other major European indices like the FTSE 100, CAC 40, IBEX 35, etc.

3. The S&P 500 is a mix of large cap and small cap companies. The minimum market cap required to be included in the index is just $5.3 billion. On the other hand, the DAX is represented by the largest market cap German companies.Hence the DAX is more similar to the Dow Jones Industrials Average than the S&P 500.

Sources:

What’s in the German stock market?, Barclays

S&P 500, Standard & Poors

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Germany Index Fund (EWG)

- The Components of the DAX Index (TFS)

- Three Differences Between MSCI and FTSE Indices (TFS)

Disclosure: No Positions