The Russian economy is the seventh largest in the world with a GDP of $2.55 Trillion (based on purchasing power parity) in 2013 according to data by the CIA’s World Factbook. The petroleum industry is one of the major contributors to the economy with the majority of the industry’s products exported to Europe. The petroleum industry is the largest source of tax revenues for Russia.

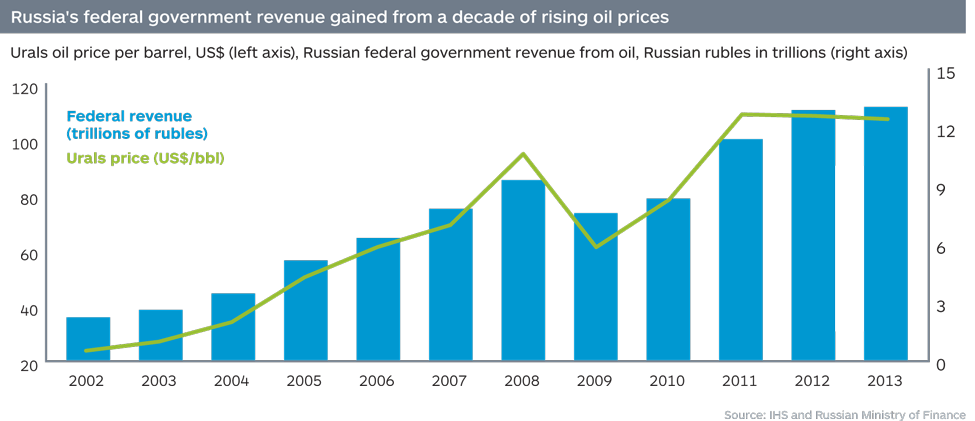

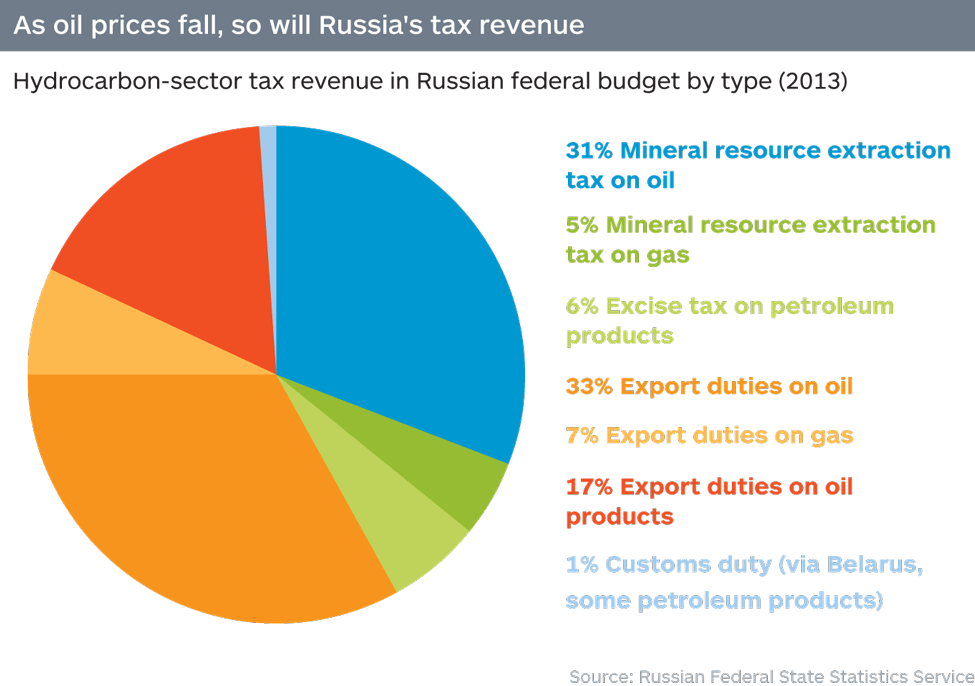

The dramatic decline in the price of crude oil in the past few months has adversely impacted the Federal government’s tax revenues.

Here are a two facts about the importance of oil industry to Russia:

- Oil and gas products accounted for two-thirds of the value of all exports in 2013. Oil and related products accounted for most of this exports.

- The oil and gas industry contributed about 50% of the Russian Federal budget revenues in 2014.

Click to enlarge

Source: Where’s Russia heading?, IHS

According to the IHS report linked above, lower oil prices is likely to pull the Russian economy into recession this year.

From the report:

Of course, Russia’s dependence on oil and gas revenues makes the economy vulnerable to price swings. After a period of 53% oil production growth from 1998 to 2004, the Russian government enacted major changes to its oil taxation regime, ensuring that the bulk of “windfall profits” from rising oil prices at the time were directed to state coffers and the National Wealth Fund, one of two “rainy day funds” set up to absorb oil revenues and help stabilize the economy in times of crisis.

Under the oil taxation regime put in place in 2004, at an oil price above $25 a barrel, incremental taxes—including tax receipts, export duties, import tariffs, and other income—take an estimated 85% of the additional gross revenues, so the state captures virtually all of the upside of higher oil prices. However, this also means that a sharp drop in prices puts the government’s fiscal revenue base in jeopardy. In 2008-09, the collapse of world oil prices forced Russia to dip into these stabilization funds to bail out domestic industries in the midst of the global financial crisis.

Russia’s economy is reliant on oil price escalation to deliver on Putin’s spending priorities, so lower prices will force Russia to curtail its spending plans or operate with a larger budget deficit. Russia’s 2014 budget was based on a Urals blend export crude price of $93 per barrel and a budget deficit of 0.5% of GDP, with escalation to $100 a barrel between 2015 and 2017 generating an even wider deficit of 0.6% of GDP per year.

Some of the top Russian oil companies are Lukoil (LUKOY), Rosneft (OJSCY), Surgutneftegaz (SGPTY), Gazprom Neft(OGZPY)and Tatneft (OAOFY).

Disclosure: No Positions